- United States

- /

- Banks

- /

- NasdaqGS:INBK

First Internet Bank (INBK): Forecasts Call for 186% Annual Earnings Growth, Challenging Bearish Outlooks

Reviewed by Simply Wall St

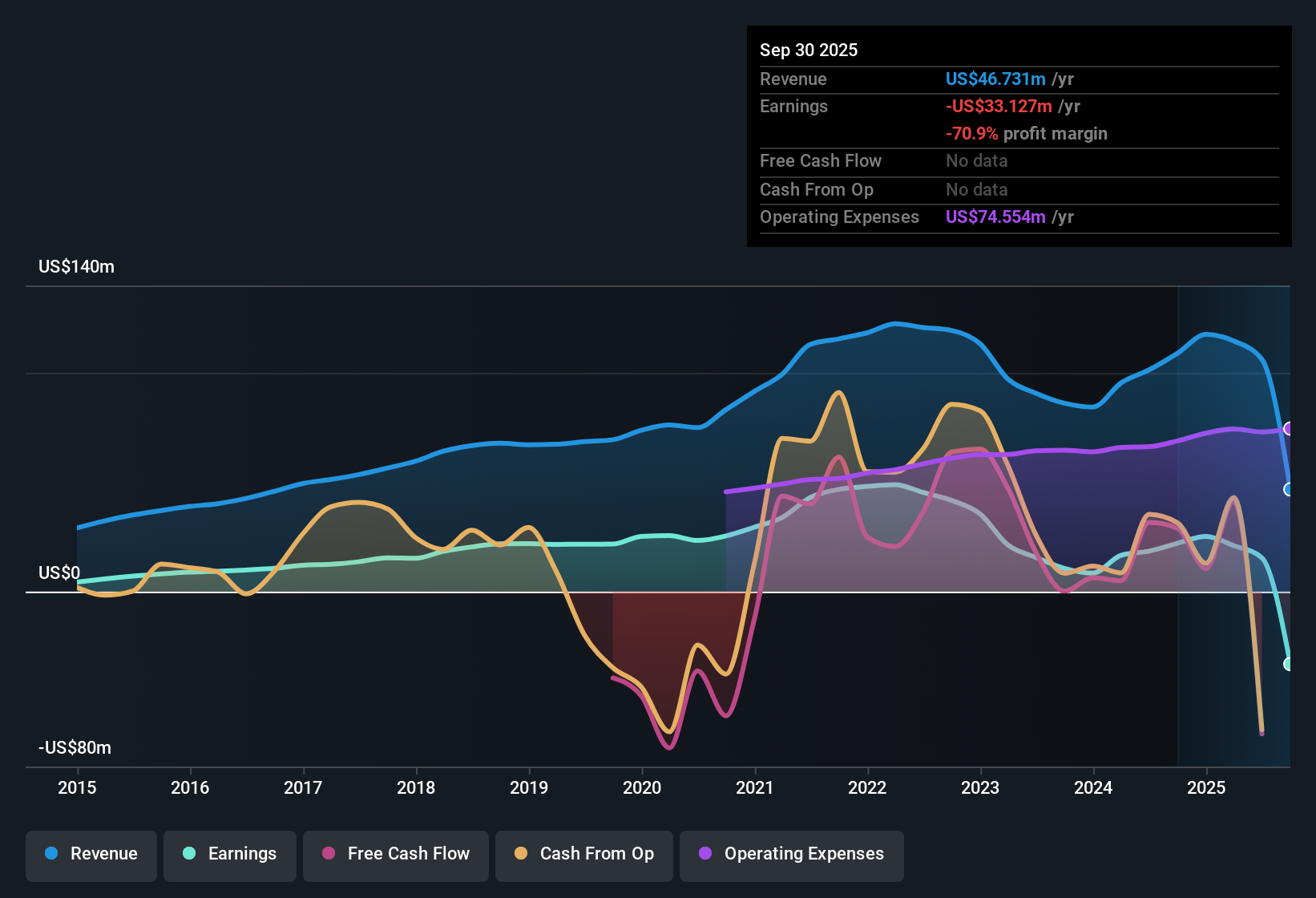

First Internet Bancorp (INBK) is currently unprofitable, with losses deepening at a rate of 28% per year over the past five years. However, analysts project a sharp turnaround, forecasting earnings growth of 186.19% per year and a return to profitability within the next three years. Revenue is expected to surge at 62.9% per year, outpacing the broader US market’s 10% growth. Investors appear focused on these powerful growth catalysts, as well as the company’s attractive Price-To-Book Ratio of 0.5x, though the share price at $19.79 does sit above one discounted cash flow estimate of $17.68.

See our full analysis for First Internet Bancorp.The next section puts these headline results in context, comparing them head-to-head with the most widely followed market narratives to see where expectations are met and where perspectives might shift.

See what the community is saying about First Internet Bancorp

Profit Margins Set to Triple

- Analysts forecast profit margins will rise from 14.6% to 42.3% in just three years, a dramatic expansion supporting future earnings durability and higher returns on capital.

- According to the analysts' consensus view, margin expansion is largely driven by the company's move to a fully branchless, digital-first operating model and stricter underwriting. This is expected to:

- Lower overall expense growth relative to revenue, with tech and compliance spending balanced by higher fee and loan volumes.

- Reduce credit costs as credit quality improves in SBA and franchise finance lending portfolios, directly boosting net income if credit normalization holds up as predicted.

- If sustained, these margin gains would outpace most US banks, underlining analysts' confidence in future profitability.

See how analysts' shift in profit margin expectations is shaping the balanced outlook on First Internet Bancorp's path ahead. 📊 Read the full First Internet Bancorp Consensus Narrative.

Digital Model Keeps Costs in Check

- The company's branchless and automated structure enables expense growth to remain below revenue growth, allowing positive operating leverage unlike many peers weighed down by physical branch costs.

- Analysts' consensus notes this scalable model is poised to:

- Deliver operating leverage as deposits and loans scale without the need for new branches, supporting higher net interest margins.

- Leverage enhanced marketing and proprietary technology to attract younger, digital-native customers, expanding the addressable market and revenue potential.

Valuation Discount vs. Peers

- First Internet Bancorp trades at a Price-To-Book ratio of 0.5x, well below the industry average of 1x and peer average of 0.9x, highlighting a steep discount among US banks.

- Despite the low valuation, analysts' consensus narrative points out that the current share price of $19.79 still sits above the DCF fair value estimate of $17.68, creating tension for value investors eager for a clear margin of safety.

- With no material risks flagged, sentiment may stay optimistic. Yet until profitability becomes consistent, this valuation gap is likely to remain under close watch.

- Consensus price target of $28.30 implies potential upside if earnings targets are met, but divergence from fair value estimates invites careful scrutiny from both bulls and bears.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for First Internet Bancorp on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the latest results? In just a few minutes, you can capture your perspective and shape your own story. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding First Internet Bancorp.

See What Else Is Out There

While First Internet Bancorp offers compelling growth, current profitability is not yet consistent and the share price sits above some fair value estimates.

If a discounted price and stronger margin of safety are your priority, use these 876 undervalued stocks based on cash flows to discover companies trading below their intrinsic value right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INBK

First Internet Bancorp

Operates as the bank holding company for First Internet Bank of Indiana that provides various commercial, small business, consumer, and municipal banking products and services to individuals and commercial customers in the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives