- United States

- /

- Banks

- /

- NasdaqGS:IBOC

Is International Bancshares Corporation (NASDAQ:IBOC) Over-Exposed To Risk?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

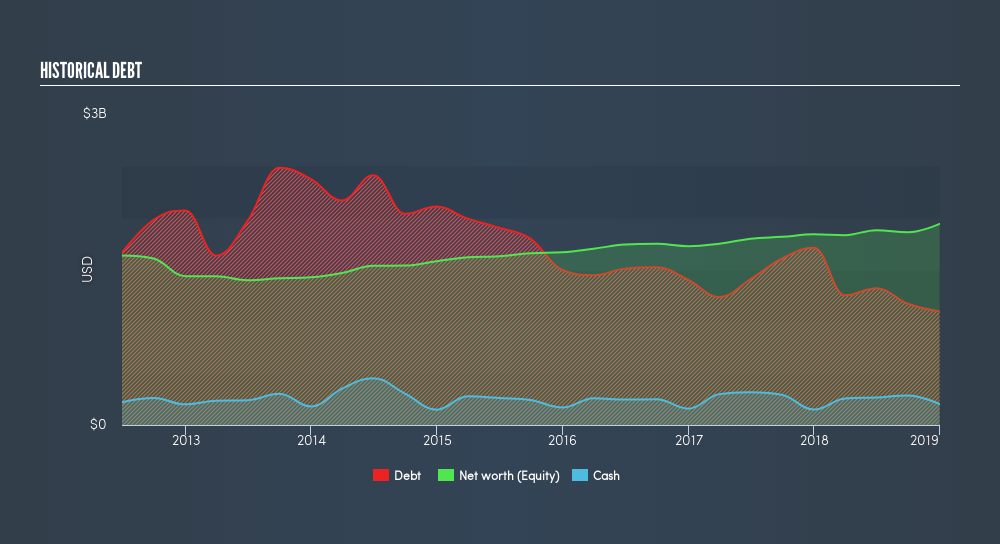

Post-GFC recovery has led to improving credit quality and a strong growth environment for the banking sector. As a small-cap bank with a market capitalisation of US$2.7b, International Bancshares Corporation’s (NASDAQ:IBOC) profit and value are directly affected by economic growth. This is because borrowers’ demand for, and ability to repay, their loans depend on the stability of their salaries and interest rates. Risk associated with repayment is measured by bad debt which is written off as an expense, impacting International Bancshares’s bottom line. Today I will take you through some bad debt and liability measures to analyse the level of risky assets held by the bank. Looking through a risk-lens is a useful way to assess the attractiveness of International Bancshares's a stock investment.

See our latest analysis for International Bancshares

Does International Bancshares Understand Its Own Risks?

International Bancshares’s ability to forecast and provision for its bad loans indicates it has a good understanding of the level of risk it is taking on. If the level of provisioning covers 100% or more of the actual bad debt expense the bank writes off, then the bank may be relatively accurate and prudent in its bad debt provisioning. Given its large non-performing loan allowance to non-performing loan ratio of 388.73%, International Bancshares over-provisioned by 288.73% above the minimum, indicating the bank may perhaps be too cautious with their expectation of bad debt.

How Much Risk Is Too Much?

If International Bancshares does not engage in overly risky lending practices, it is considered to be in relatively better financial shape. Loans that cannot be recuperated by the bank, also known as bad loans, should typically form less than 3% of its total loans. When these loans are not repaid, they are written off as expenses which comes out directly from International Bancshares’s profit. The bank's bad debt only makes up a very small 0.24% to total debt which suggests the bank either has strict risk management - or its loans haven't started going bad yet.Is There Enough Safe Form Of Borrowing?

International Bancshares operates by lending out its various forms of borrowings. Customers’ deposits tend to carry the smallest risk given the relatively stable interest rate and amount available. As a rule, a bank is considered less risky if it holds a higher level of deposits. Since International Bancshares’s total deposit to total liabilities is very high at 88% which is well-above the prudent level of 50% for banks, International Bancshares may be too cautious with its level of deposits and has plenty of headroom to take on risker forms of liability.

International Bancshares operates by lending out its various forms of borrowings. Customers’ deposits tend to carry the smallest risk given the relatively stable interest rate and amount available. As a rule, a bank is considered less risky if it holds a higher level of deposits. Since International Bancshares’s total deposit to total liabilities is very high at 88% which is well-above the prudent level of 50% for banks, International Bancshares may be too cautious with its level of deposits and has plenty of headroom to take on risker forms of liability. Next Steps:

The recent acquisition is expected to bring more opportunities for IBOC, which in turn should lead to stronger growth. I would stay up-to-date on how this decision will affect the future of the business in terms of earnings growth and financial health. Below, I've listed three fundamental areas on Simply Wall St's dashboard for a quick visualization on current trends for IBOC. I've also used this site as a source of data for my article.

- Future Outlook: What are well-informed industry analysts predicting for IBOC’s future growth? Take a look at our free research report of analyst consensus for IBOC’s outlook.

- Valuation: What is IBOC worth today? Has the future growth potential already been factored into the price? The intrinsic value infographic in our free research report helps visualize whether IBOC is currently mispriced by the market.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:IBOC

International Bancshares

A multibank financial holding company, provides a range of commercial and retail banking services in Texas and the State of Oklahoma.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives