- United States

- /

- Banks

- /

- NasdaqGS:IBOC

How Sustained Net Income Growth and No Buybacks This Quarter Could Shape International Bancshares' (IBOC) Story

Reviewed by Sasha Jovanovic

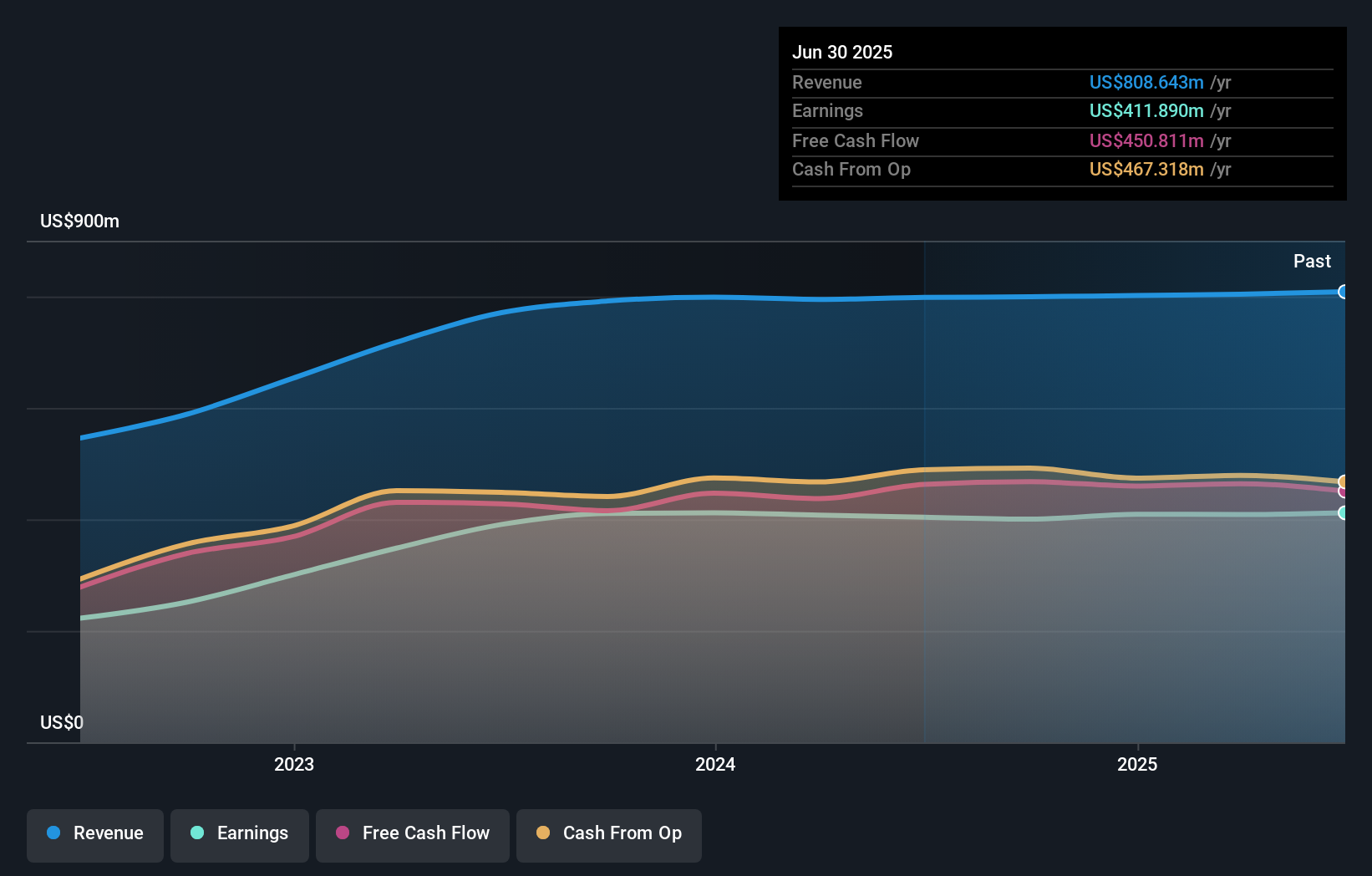

- International Bancshares Corporation recently reported third quarter and nine-month earnings, with net interest income reaching US$172.23 million and net income rising to US$108.38 million for the quarter ending September 30, 2025.

- Consistent growth in both quarterly and year-to-date earnings per share underscored improving profitability, while no shares were repurchased during the latest buyback tranche.

- We'll explore how the sustained year-over-year growth in net income shapes International Bancshares' current investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is International Bancshares' Investment Narrative?

To feel confident as a shareholder in International Bancshares, you need to believe in the company’s ability to maintain steady earnings growth and pay attractive dividends while navigating the headwinds facing regional banks. The latest quarterly results show net income and net interest income both ticking higher year over year, pointing to stable profitability and an intact value proposition for income-focused investors. However, the absence of share repurchases in the most recent tranche, despite an ongoing buyback program, may shift attention to management’s capital deployment priorities or suggest increasing caution. Meanwhile, slow board refreshment and recent insider selling remain relevant risks, particularly in a sector where governance and alignment with shareholders matter. This latest news doesn’t appear to fundamentally alter the biggest short-term catalysts or risks, but it reinforces that incremental progress and management’s actions are in focus as investors decide what’s next.

On the other hand, the board’s lack of new appointments could signal a need for fresh perspectives. Despite retreating, International Bancshares' shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 2 other fair value estimates on International Bancshares - why the stock might be worth over 2x more than the current price!

Build Your Own International Bancshares Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your International Bancshares research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free International Bancshares research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate International Bancshares' overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IBOC

International Bancshares

A multibank financial holding company, provides a range of commercial and retail banking services in Texas and the State of Oklahoma.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives