- United States

- /

- Banks

- /

- NasdaqGS:HOPE

How Investors May Respond To Hope Bancorp (HOPE) Amid Sector-Wide Loan Quality Concerns

Reviewed by Sasha Jovanovic

- In the past week, investor jitters spread across the regional banking sector after Zions Bancorp disclosed a US$50 million loan charge-off and Western Alliance Bancorp reported collateral issues tied to a borrower. These reports heightened anxiety about potential loan quality deterioration and possible ripple effects for other banks.

- This wave of caution impacted sector peers, as market participants reassessed risk exposure and profitability outlooks across regional lenders even without company-specific news at Hope Bancorp.

- We'll examine how renewed sector-wide concerns about loan quality may influence Hope Bancorp's investment narrative and perceived future risks.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Hope Bancorp Investment Narrative Recap

To be a shareholder in Hope Bancorp, you need to believe in the company's ability to leverage its expanded footprint and focus on growing Asian-American communities while managing risks from commercial real estate concentration. The recent industry news on loan charge-offs may sharpen investor focus on credit risk and near-term profitability, but so far, there has been no material company-specific development changing Hope Bancorp’s immediate catalysts or primary risk profile.

The upcoming Q3 2025 earnings announcement on October 28 is particularly relevant right now, as it will provide a fresh look at asset quality metrics and management’s outlook in light of broader sector anxiety. Investors will be monitoring these results for any signs of loan quality deterioration or management commentary on credit risk controls, especially amid the heightened market caution seen in recent days.

However, investors should also be aware that, despite recent sector-related pressures, Hope Bancorp’s heavy concentration in commercial real estate lending remains a central risk that could...

Read the full narrative on Hope Bancorp (it's free!)

Hope Bancorp's narrative projects $828.8 million in revenue and $392.4 million in earnings by 2028. This requires 26.2% yearly revenue growth and a $350.7 million earnings increase from the current $41.7 million.

Uncover how Hope Bancorp's forecasts yield a $12.25 fair value, a 16% upside to its current price.

Exploring Other Perspectives

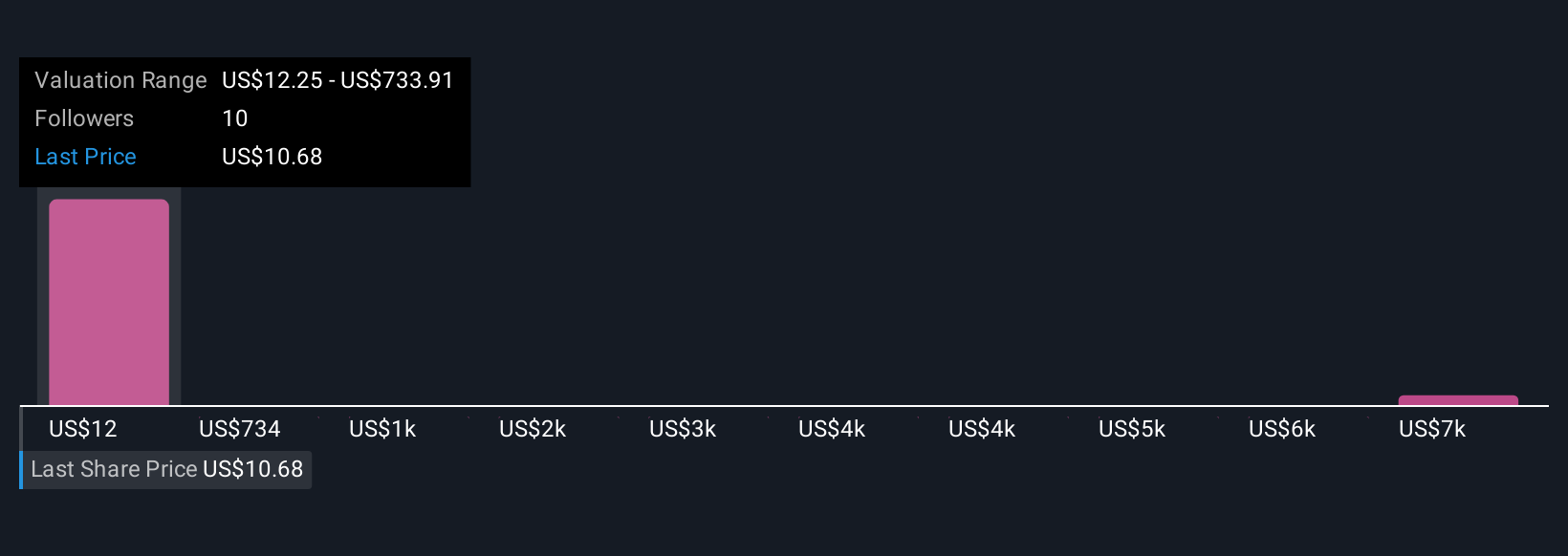

Private investors in the Simply Wall St Community have set fair value estimates for Hope Bancorp anywhere between US$12.25 and US$7,228.80 across four submissions. These widely differing opinions highlight the importance of current concerns around loan quality and credit risk for anyone weighing the company’s future earnings strength and stability.

Explore 4 other fair value estimates on Hope Bancorp - why the stock might be worth just $12.25!

Build Your Own Hope Bancorp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hope Bancorp research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Hope Bancorp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hope Bancorp's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hope Bancorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HOPE

Hope Bancorp

Operates as the bank holding company for Bank of Hope that provides retail and commercial banking services for businesses and individuals in the United States.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives