- United States

- /

- Banks

- /

- NasdaqGM:HMNF

Here's Why HMN Financial, Inc.'s (NASDAQ:HMNF) CEO Compensation Is The Least Of Shareholders' Concerns

Performance at HMN Financial, Inc. (NASDAQ:HMNF) has been reasonably good and CEO Brad Krehbiel has done a decent job of steering the company in the right direction. As shareholders go into the upcoming AGM on 27 April 2021, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. Here is our take on why we think the CEO compensation looks appropriate.

See our latest analysis for HMN Financial

How Does Total Compensation For Brad Krehbiel Compare With Other Companies In The Industry?

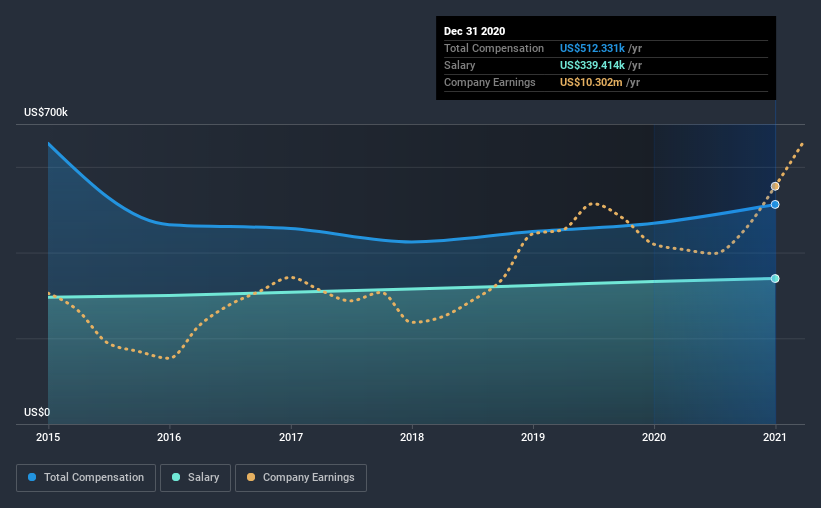

At the time of writing, our data shows that HMN Financial, Inc. has a market capitalization of US$97m, and reported total annual CEO compensation of US$512k for the year to December 2020. Notably, that's an increase of 9.4% over the year before. We note that the salary portion, which stands at US$339.4k constitutes the majority of total compensation received by the CEO.

In comparison with other companies in the industry with market capitalizations under US$200m, the reported median total CEO compensation was US$523k. This suggests that HMN Financial remunerates its CEO largely in line with the industry average. Moreover, Brad Krehbiel also holds US$3.0m worth of HMN Financial stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$339k | US$333k | 66% |

| Other | US$173k | US$136k | 34% |

| Total Compensation | US$512k | US$468k | 100% |

Talking in terms of the industry, salary represented approximately 51% of total compensation out of all the companies we analyzed, while other remuneration made up 49% of the pie. HMN Financial is paying a higher share of its remuneration through a salary in comparison to the overall industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at HMN Financial, Inc.'s Growth Numbers

HMN Financial, Inc.'s earnings per share (EPS) grew 35% per year over the last three years. It achieved revenue growth of 13% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. It's a real positive to see this sort of revenue growth in a single year. That suggests a healthy and growing business. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has HMN Financial, Inc. Been A Good Investment?

HMN Financial, Inc. has generated a total shareholder return of 8.5% over three years, so most shareholders wouldn't be too disappointed. Although, there's always room to improve. As a result, investors in the company might be reluctant about agreeing to increase CEO pay in the future, before seeing an improvement on their returns.

To Conclude...

Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. However, we still think that any proposed increase in CEO compensation will be examined closely to make sure the compensation is appropriate and linked to performance.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 3 warning signs for HMN Financial that you should be aware of before investing.

Switching gears from HMN Financial, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you decide to trade HMN Financial, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade HMN Financial, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if HMN Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGM:HMNF

HMN Financial

Operates as a bank holding company for Home Federal Savings Bank that provides various retail banking products and services.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives