- United States

- /

- Banks

- /

- NasdaqGM:HIFS

Hingham Institution for Savings (HIFS) Margin Jump Challenges Cautious Narrative on Long-Term Earnings

Reviewed by Simply Wall St

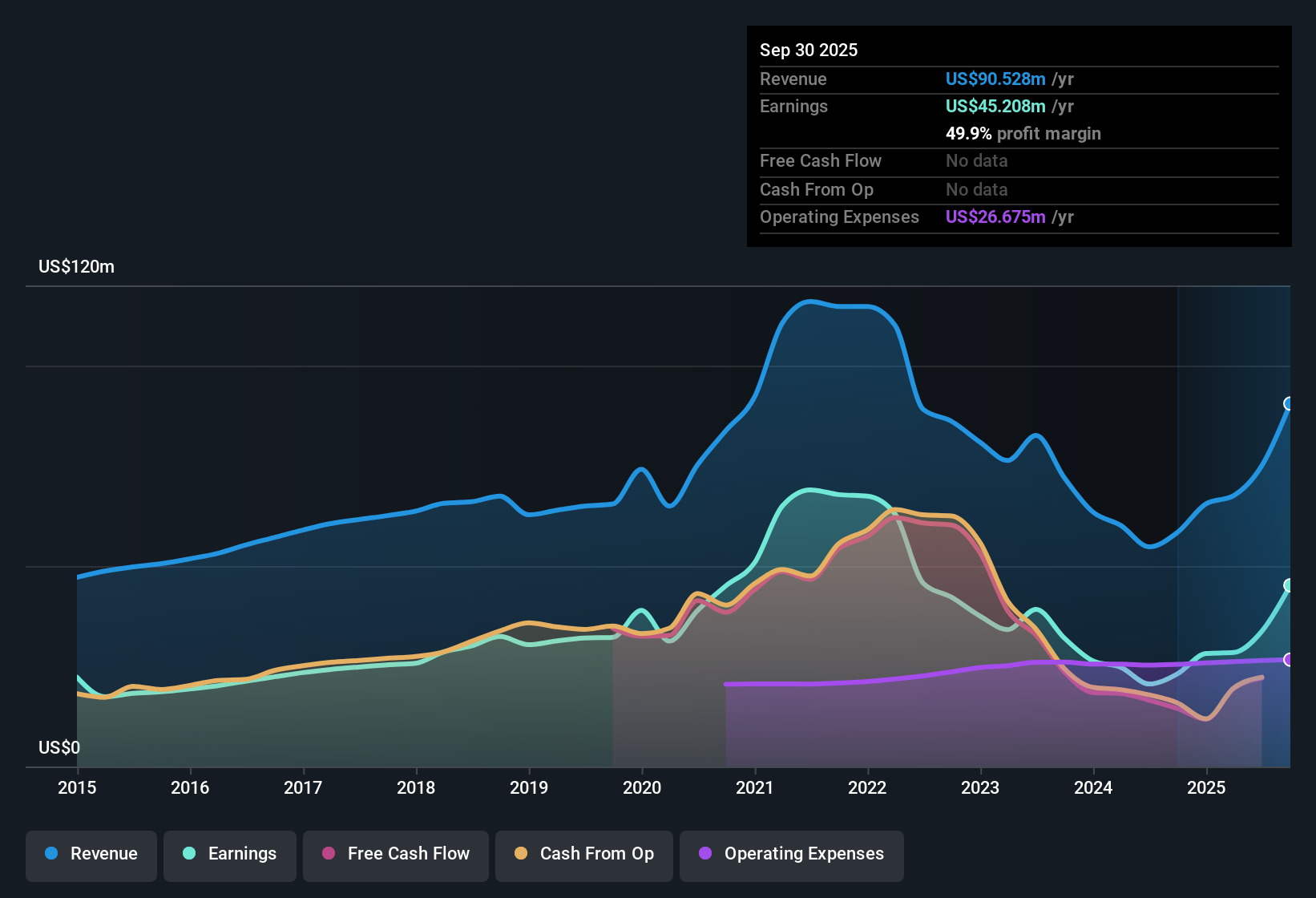

Hingham Institution for Savings (HIFS) posted net profit margins of 49.9% for the year, a marked jump from 39.6% twelve months ago, with EPS-powered earnings growing 95.4%. Despite this impressive surge, the company’s five-year record shows earnings declined by an average of 17.9% per year. Shares are trading at $272.18, representing a Price-to-Earnings ratio of 13.1x, notably above both the US Banks industry average (11.3x) and its peers (12.1x), and well over the fair value estimate of $135.38. The quality of these earnings is high, but investors are weighing recent momentum against a premium price and mixed long-term trends.

See our full analysis for Hingham Institution for Savings.Now, let's see how these results stack up against the most widely followed narratives, and where the numbers might challenge the current market story.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margin Expansion Outpaces Five-Year Decline

- Net profit margin reached 49.9% this year, topping last year’s 39.6%. This outcome stands in stark contrast to an average annual earnings decline of 17.9% over the past five years.

- The recent margin surge strongly supports the view that Hingham’s operational model remains resilient during market stress. What is striking is that this performance followed a period of persistent earnings contraction.

- Bulls may point to the margin rebound as evidence of effective cost control and a quality-focused loan book. Critics, however, highlight that a single strong year does not yet indicate a new trend given the negative five-year track record.

- The high quality of reported earnings, as emphasized in the filing, further bolsters advocates for the bank’s steady approach. Yet, the overall trajectory makes some investors cautious about assuming the margin improvement can continue.

Premium Valuation Raises Fresh Doubts

- Shares trade at a Price-to-Earnings ratio of 13.1x, which is higher than both the US Banks industry average of 11.3x and the peer average of 12.1x. The $272.18 share price also exceeds the DCF fair value of $135.38.

- The prevailing market view acknowledges that reliable, high-quality banks often earn valuation premiums. However, the current gap with industry norms creates tension between short-term confidence and ongoing skepticism about sustainability.

- Supporters of Hingham’s approach may argue that the premium reflects investor appreciation for the recent margin turnaround and perceived safety. The sizable difference versus fair value, though, leaves little room for disappointment if performance declines.

- Onlookers watching sector trends see Hingham as benefiting from a flight to quality among risk-averse investors. At the same time, some warn that the market could quickly re-rate the stock if growth prospects remain muted.

High Quality Earnings, Mixed Trajectory

- The company’s annual earnings growth of 95.4% comes alongside high-quality, well-documented profits but does not erase the negative 17.9% per year five-year trend.

- The prevailing market view emphasizes Hingham’s conservative lending and focus on stability. This approach resonates with investors seeking lower-risk exposure, even as growth-oriented buyers remain cautious.

- This year’s exceptional profit growth and margin expansion highlight the payoff from a disciplined, traditional model, which appeals to those looking for safety after recent banking sector volatility.

- However, the mixed growth trajectory over multiple years dampens broader enthusiasm and limits the stock’s momentum among aggressive buyers, especially while other banks pursue higher growth or digital initiatives.

Confidence in the turnaround story is building, but investors are weighing whether a strong year signals a durable new era or a brief high point.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Hingham Institution for Savings's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite an impressive earnings rebound this year, Hingham’s inconsistent long-term growth and premium valuation may concern investors seeking more reliable performance.

If steady results matter to you, check out our stable growth stocks screener to discover companies with a track record of consistent expansion and dependable fundamentals beyond just one strong year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hingham Institution for Savings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:HIFS

Hingham Institution for Savings

Provides various financial services to individuals and small businesses in the United States.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.