- United States

- /

- Commercial Services

- /

- NYSE:NL

3 Undiscovered Gems In The US Market With Promising Potential

Reviewed by Simply Wall St

In recent days, the U.S. stock market has experienced volatility amid geopolitical tensions in the Middle East and fluctuating oil prices, with major indices like the Dow Jones Industrial Average and S&P 500 seeing slight declines. Despite these challenges, investors continue to seek opportunities within small-cap stocks that may offer promising potential due to their unique positioning or innovative approaches in a dynamic economic landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Oakworth Capital | 42.08% | 15.43% | 7.31% | ★★★★★★ |

| Morris State Bancshares | 9.62% | 4.26% | 5.10% | ★★★★★★ |

| Metalpha Technology Holding | NA | 81.88% | -4.97% | ★★★★★★ |

| FineMark Holdings | 122.25% | 2.34% | -26.34% | ★★★★★★ |

| FRMO | 0.09% | 44.64% | 49.91% | ★★★★★☆ |

| Gulf Island Fabrication | 19.65% | -2.17% | 42.26% | ★★★★★☆ |

| Pure Cycle | 5.11% | 1.07% | -4.05% | ★★★★★☆ |

| Solesence | 82.42% | 23.41% | -1.04% | ★★★★☆☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

| Vantage | 6.72% | -16.62% | -15.47% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Hingham Institution for Savings (HIFS)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hingham Institution for Savings offers a range of financial products and services to individuals and small businesses in the United States, with a market capitalization of $484.13 million.

Operations: Hingham Institution for Savings generates revenue primarily through its financial services segment, amounting to $67.59 million. The company's market capitalization stands at approximately $484.13 million.

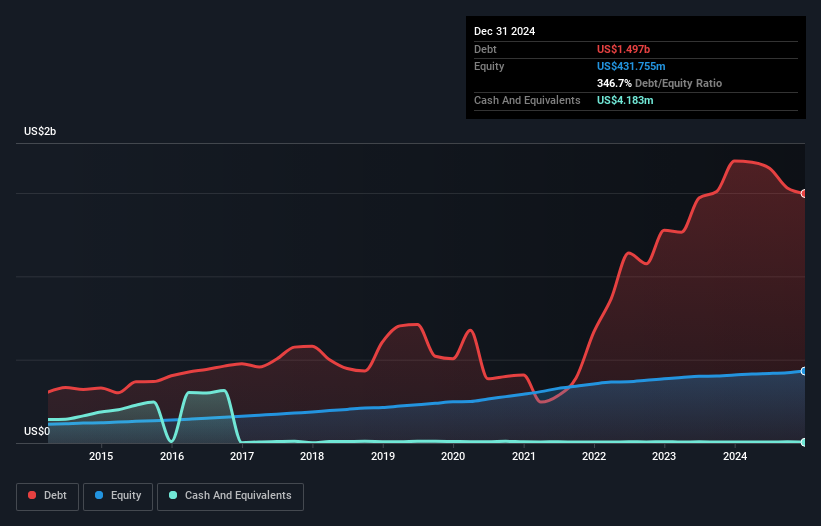

Hingham Institution for Savings, a nimble player in the banking sector, boasts total assets of US$4.5 billion and equity of US$437.6 million, positioning it as a robust entity despite its modest size. With total deposits at US$2.6 billion and loans reaching US$3.9 billion, the bank's operations are underpinned by primarily low-risk funding sources like customer deposits. A net interest margin of 1% reflects its cautious approach to lending, while an allowance for bad loans at 0.05% indicates prudent risk management practices. However, significant insider selling over the past three months could raise some eyebrows among potential investors seeking stability.

Southern First Bancshares (SFST)

Simply Wall St Value Rating: ★★★★★★

Overview: Southern First Bancshares, Inc. is the bank holding company for Southern First Bank, offering commercial, consumer, and mortgage loans across South Carolina, North Carolina, and Georgia with a market cap of $292.12 million.

Operations: Southern First Bancshares generates revenue primarily from its banking operations, amounting to $97.50 million. The company's net profit margin is a key financial metric to consider when evaluating its profitability.

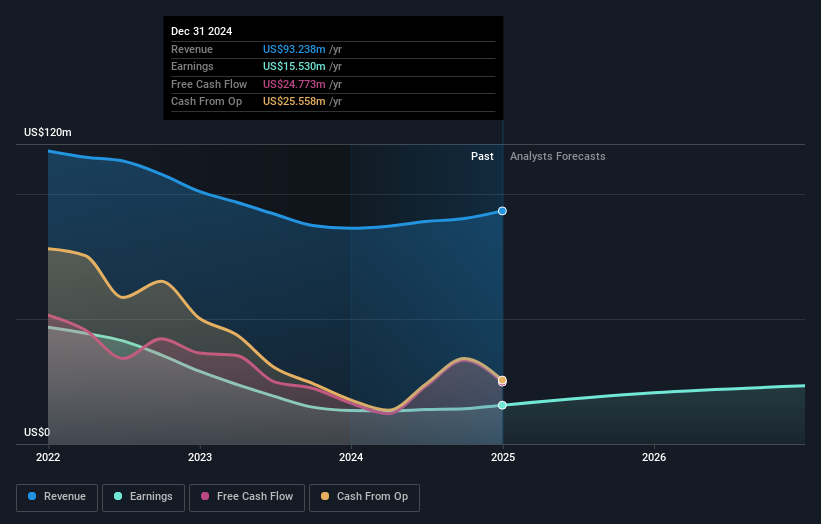

Southern First Bancshares, with assets totaling US$4.3 billion and equity at US$337.6 million, stands out for its robust financial health and growth potential. The bank boasts a strong allowance for bad loans at 378% of non-performing loans, which are just 0.3% of total loans, indicating prudent risk management. Its liabilities are primarily low-risk customer deposits (92%), enhancing stability in turbulent times. Earnings soared by 38% over the past year, surpassing the industry average of 5.3%, while its price-to-earnings ratio is an attractive 16x against the market's 17.7x average, suggesting good value prospects ahead.

NL Industries (NL)

Simply Wall St Value Rating: ★★★★★☆

Overview: NL Industries, Inc. operates in the component products industry through its subsidiaries across Europe, North America, the Asia Pacific, and internationally with a market capitalization of approximately $330.70 million.

Operations: NL Industries generates revenue of $148.20 million from its component products segment.

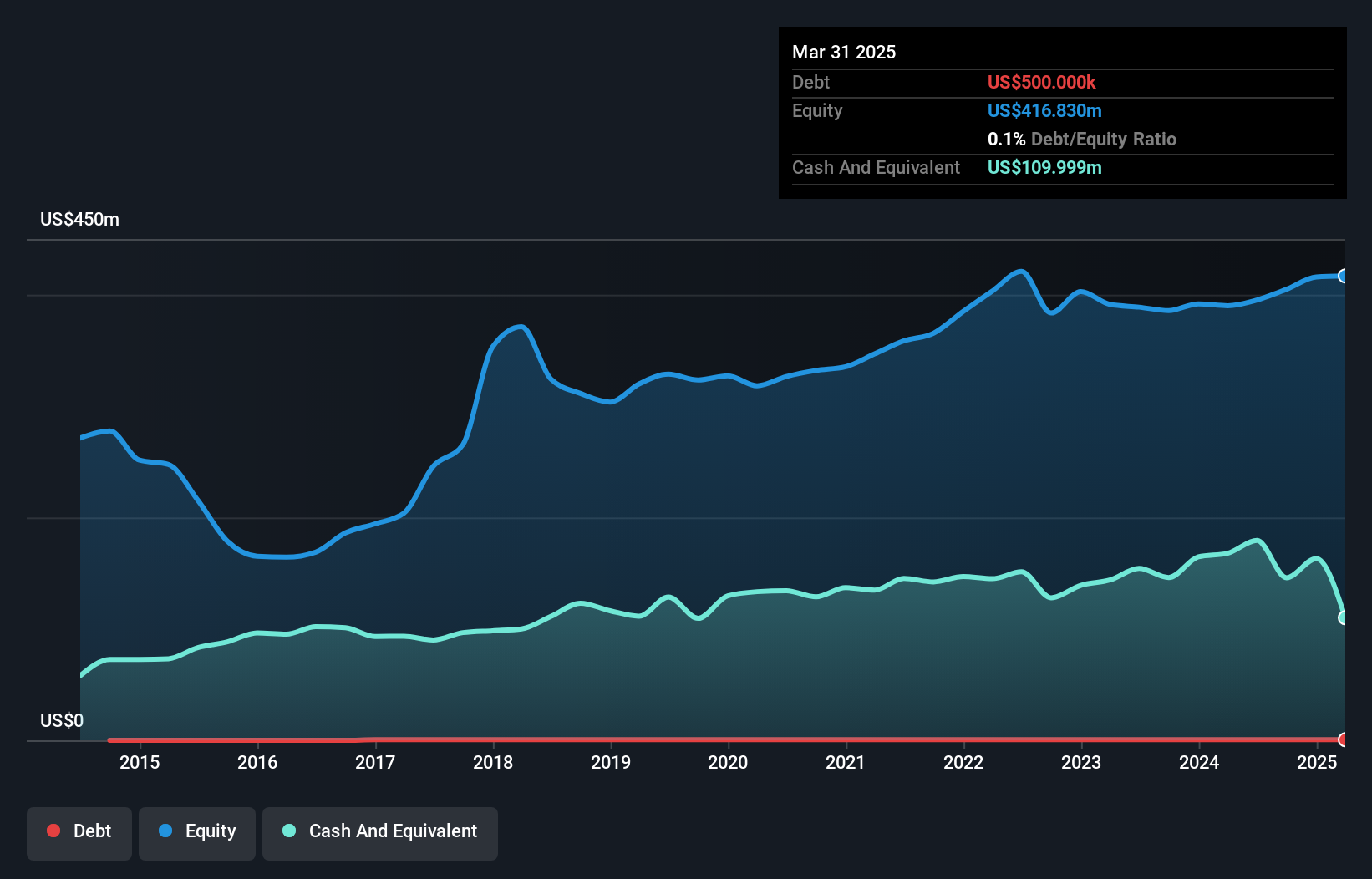

NL Industries, a small player in the commercial services sector, has shown impressive earnings growth of 442.9% over the past year, outpacing the industry average of 7.6%. Despite this surge, its net income for Q1 2025 was US$0.67 million, down from US$6.84 million a year ago. The company is trading at 30.9% below its estimated fair value and maintains more cash than total debt with a reduced debt-to-equity ratio from 0.2% to 0.1% over five years. Recently, NL Industries expanded its board and declared a quarterly dividend of $0.09 per share payable in June 2025.

- Dive into the specifics of NL Industries here with our thorough health report.

Assess NL Industries' past performance with our detailed historical performance reports.

Make It Happen

- Access the full spectrum of 289 US Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NL Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NL

NL Industries

Through its subsidiaries, operates in the component products industry in Europe, North America, the Asia Pacific, and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives