- United States

- /

- Banks

- /

- NYSE:GNTY

Shareholders Would Not Be Objecting To Guaranty Bancshares, Inc.'s (NASDAQ:GNTY) CEO Compensation And Here's Why

It would be hard to discount the role that CEO Ty Abston has played in delivering the impressive results at Guaranty Bancshares, Inc. (NASDAQ:GNTY) recently. Shareholders will have this at the front of their minds in the upcoming AGM on 19 May 2021. The focus will probably be on the future company strategy as shareholders cast their votes on resolutions such as executive remuneration and other matters. We think the CEO has done a pretty decent job and we discuss why the CEO compensation is appropriate.

View our latest analysis for Guaranty Bancshares

How Does Total Compensation For Ty Abston Compare With Other Companies In The Industry?

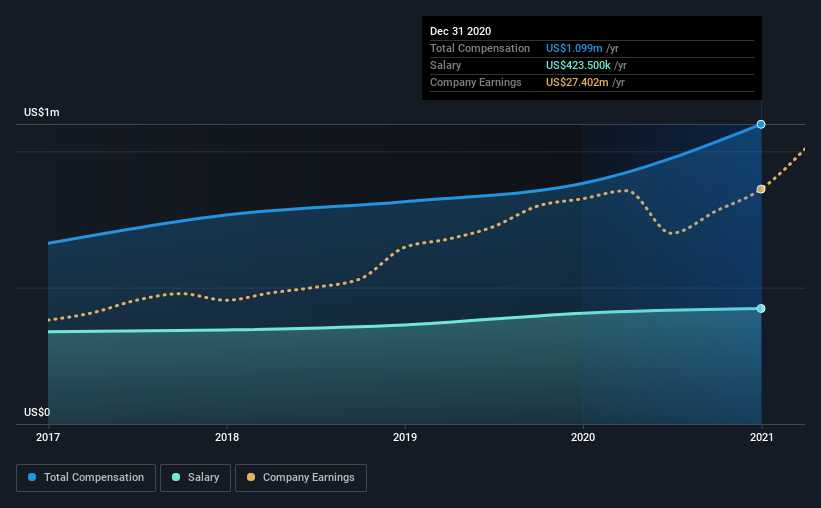

Our data indicates that Guaranty Bancshares, Inc. has a market capitalization of US$461m, and total annual CEO compensation was reported as US$1.1m for the year to December 2020. That's a notable increase of 25% on last year. We think total compensation is more important but our data shows that the CEO salary is lower, at US$424k.

On comparing similar companies from the same industry with market caps ranging from US$200m to US$800m, we found that the median CEO total compensation was US$1.1m. This suggests that Guaranty Bancshares remunerates its CEO largely in line with the industry average. Moreover, Ty Abston also holds US$5.9m worth of Guaranty Bancshares stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$424k | US$406k | 39% |

| Other | US$675k | US$475k | 61% |

| Total Compensation | US$1.1m | US$882k | 100% |

On an industry level, around 42% of total compensation represents salary and 58% is other remuneration. Guaranty Bancshares is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

A Look at Guaranty Bancshares, Inc.'s Growth Numbers

Guaranty Bancshares, Inc.'s earnings per share (EPS) grew 27% per year over the last three years. It achieved revenue growth of 9.6% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's nice to see revenue heading northwards, as this is consistent with healthy business conditions. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Guaranty Bancshares, Inc. Been A Good Investment?

We think that the total shareholder return of 37%, over three years, would leave most Guaranty Bancshares, Inc. shareholders smiling. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

Seeing that the company has put in a relatively good performance, the CEO remuneration policy may not be the focus at the AGM. In fact, strategic decisions that could impact the future of the business might be a far more interesting topic for investors as it would help them set their longer-term expectations.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We identified 3 warning signs for Guaranty Bancshares (1 is a bit concerning!) that you should be aware of before investing here.

Important note: Guaranty Bancshares is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

When trading Guaranty Bancshares or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:GNTY

Guaranty Bancshares

Operates as the bank holding company for Guaranty Bank & Trust, N.A.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives