- United States

- /

- Banks

- /

- NasdaqCM:GCBC

Greene County Bancorp (GCBC): Margin Expansion to 42.4% Reinforces Bullish Community Narrative

Reviewed by Simply Wall St

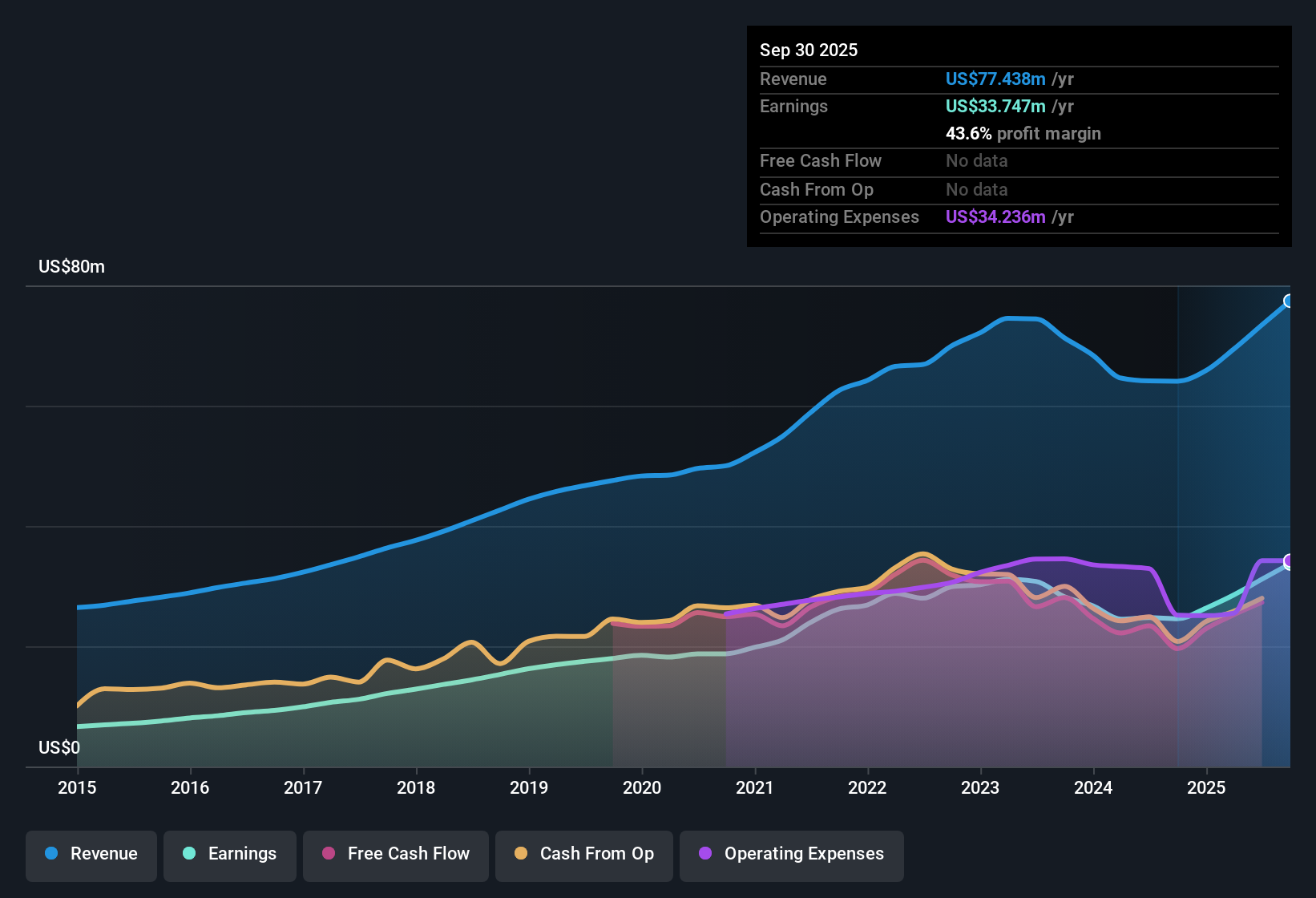

Greene County Bancorp (GCBC) delivered robust results in its most recent earnings, with net income growing by 25.7% over the last year and an annualized growth rate of 4.8% over the past five years. Profit margins expanded to 42.4%, up from 38.6% a year ago, reflecting stronger operational efficiency and profitability. As investors assess these figures, the company’s valuation metrics, attractive dividend, and consistent growth profile come into focus, setting the stage for a balanced but optimistic outlook.

See our full analysis for Greene County Bancorp.Next up, we will see how these latest numbers measure up against the community narrative and broader market expectations, and where the key themes may get reinforced or rewritten.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Outpace Peers with 42.4%

- Greene County Bancorp reported net profit margins of 42.4%, surpassing last year’s 38.6% and illustrating a meaningful lift in operational efficiency that is not matched by many competitors in the US Banks category.

- High margin performance strongly supports the case for the company’s resilience. Even as sector volatility tests regional banks, robust cost controls and a local focus can drive above-average profitability.

- With annual earnings growth averaging 4.8% over five years and a jump to 25.7% in the latest period, profitability is building on itself, not just holding steady.

- This margin expansion supports the narrative that smaller, community-focused banks can offer a defensive hedge in an industry pressured by regulatory and macroeconomic challenges.

Valuation Premium Balanced by DCF Discount

- The stock’s Price-to-Earnings Ratio of 12.1x currently sits above the US Banks industry average (11.3x) and its peer average (10.8x). However, shares at $22.19 trade below the DCF fair value of $35.44, highlighting a gap between market pricing and intrinsic worth.

- Despite the premium to sector and peer multiples, the prevailing view is that the current discount to DCF fair value offers room for upside if profitability holds. Sentiment may remain cautious unless new growth drivers emerge.

- Value investors may be interested in the fair value gap but may also view the premium multiples as a sign that some optimism is already reflected in the price.

- Realized returns will depend not just on market re-rating, but on whether strong operational execution can be sustained in the face of sector risks.

Dividend and Profit Growth Remain Steady

- No risks were cited in the statements, and ongoing profit and revenue momentum combine with the bank’s established dividend payments to reinforce the case for operational stability.

- Investors are especially drawn to the combination of attractive value metrics and consistent performance, as ongoing dividend payments and elevated margins create the perception that Greene County Bancorp can withstand industry storms.

- While greater sector volatility could still affect the stock price, the company’s historical rate of earnings growth and dividend policy are important differentiators among regional banks.

- This blend of risk-mitigating fundamentals and above-industry profitability positions the stock as a stable option for cautious investors.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Greene County Bancorp's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While Greene County Bancorp’s earnings and margin growth are impressive, the stock’s valuation premium means some future upside may already be priced in.

If you’re seeking companies with greater upside based on intrinsic worth, check out these 871 undervalued stocks based on cash flows for stocks currently trading at a better discount to fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:GCBC

Greene County Bancorp

Operates as a holding company for The Bank of Greene County that provides various financial services in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives