- United States

- /

- Banks

- /

- NasdaqCM:FVCB

FVCBankcorp (FVCB) Profit Margin Surges to 32.5%, Challenging Expectations of Ongoing Weakness

Reviewed by Simply Wall St

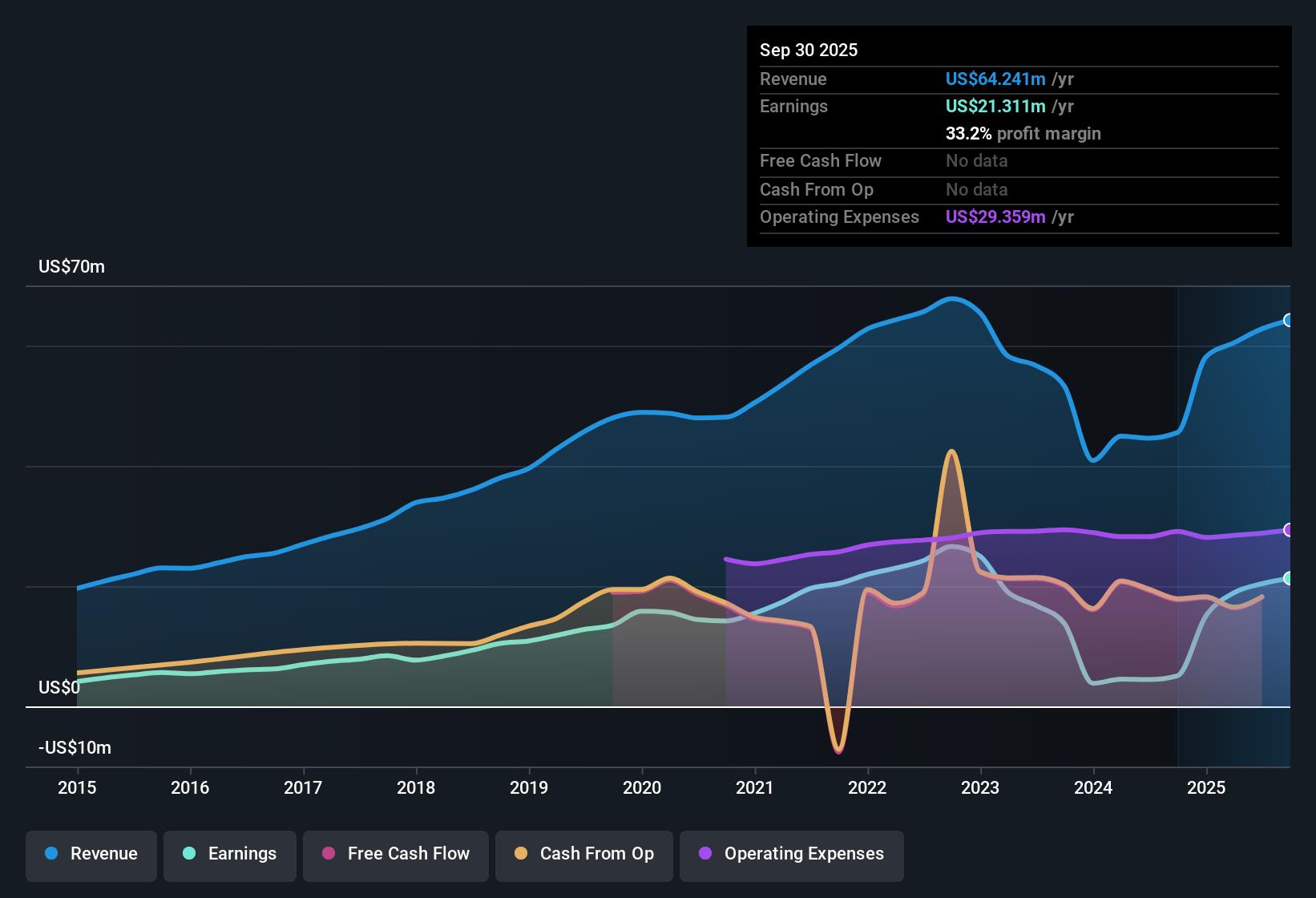

FVCBankcorp (FVCB) reported a striking turnaround in its latest results, posting a net profit margin of 32.5%, significantly above last year's 10%. Earnings soared 357.1% year-over-year, far outpacing the five-year trend where annual earnings declined by 11% on average. Despite a history of declines, the company’s recent margin expansion signals an impressive improvement in the quality of its earnings.

See our full analysis for FVCBankcorp.Now let’s see how these headline results stack up against the current community narratives and market expectations. Some long-held views may get reinforced, while others could be due for a rethink.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margin Expansion Defies Five-Year Decline

- Net profit margin now stands at 32.5%, a stark reversal given the previous five-year annual earnings average declined by 11%.

- What is surprising is how recent margin improvement supports the view that FVCBankcorp offers defensive resilience. However, the ongoing risk that revenue and earnings are not expected to grow complicates that optimism.

- The dramatic move from a five-year downtrend in earnings to high current profit margins strongly supports the narrative that strong discipline and prudent lending are at play here.

- At the same time, concerns remain as sustained upside may be pressured if growth fails to materialize, despite current efficiency gains.

Trading Below DCF Fair Value Benchmarks

- Shares trade at $12.57, which is below the DCF fair value of $16.48 and also comes at a discount versus the peer group average price-to-earnings ratio (11.1x vs 14.5x).

- The prevailing analysis suggests this valuation gap could appeal to value-oriented investors, with the peer discount highlighting perceived quality. The market appears cautious about assigning a premium without clearer prospects for future growth.

- Despite attractive relative valuation, FVCBankcorp is priced close to the industry average (P/E 11.2x), which tempers expectations for rapid multiple expansion.

- A market re-rating may depend on evidence that improved profitability can be maintained, not just achieved in a single cycle.

Growth Uncertainty Persists Despite Turnaround

- Even with a 357% increase in earnings this year, both revenue and profit are projected to remain flat going forward. This stands out as the most significant ongoing risk.

- Some may highlight the turnaround as a fresh start, but muted growth expectations still create tension for investors weighing short-term improvements against long-term stability.

- The risk that recent performance might not translate into sustained expansion is reflected by the lack of forecasted top-line or bottom-line increases from filings.

- Investors focused on long-term compounding may remain on the sidelines until there is more visibility on future growth avenues.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on FVCBankcorp's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite FVCBankcorp’s dramatic earnings rebound, its lack of expected revenue and profit growth leaves questions about long-term stability and reliable upside.

If steady performance is your goal, check out stable growth stocks screener (2091 results) to find companies that consistently deliver reliable growth through every market cycle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:FVCB

FVCBankcorp

Operates as the bank holding company for FVCbank provides various banking products and services for small and medium-sized businesses, professionals, non-profit organizations and associations, and investors.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives