- United States

- /

- Banks

- /

- NasdaqGS:FSUN

How FirstSun Capital's Strong Q2 Earnings Beat May Shape the Investment Outlook for FSUN Investors

Reviewed by Simply Wall St

- FirstSun Capital Bancorp recently reported second quarter 2025 earnings, with net interest income of US$78.5 million and net income of US$26.39 million, both increasing from the prior year, and diluted earnings per share reaching US$0.93.

- The company surpassed analyst forecasts in both revenue and profitability, reflecting the strength of its relationship-focused business model and ability to maintain stable margins despite higher credit costs.

- We’ll assess how the strong deposit growth and earnings outperformance reported this past quarter may impact FirstSun’s investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

FirstSun Capital Bancorp Investment Narrative Recap

To be a shareholder of FirstSun Capital Bancorp, you are essentially betting on the continued strength of its high-growth southwestern and western U.S. markets, stable net interest margin, and disciplined credit administration. The recent earnings beat and robust deposit growth reinforce the short-term catalyst of expanding top-line revenue, but higher credit costs due to challenges in some commercial and industrial loans remain the most important risk and were only partly offset by this quarter’s results.

Among recent announcements, FirstSun’s inclusion in multiple Russell indices in late June could boost investor awareness and potentially increase share liquidity, adding a tailwind to the positive momentum seen after this strong quarter. However, this exposure also coincides with rising credit costs and heightened sensitivity to regional economic headwinds in their core lending markets.

By contrast, the risk around elevated loan growth in specific regions could present challenges if local economic conditions shift, so investors should remain aware of...

Read the full narrative on FirstSun Capital Bancorp (it's free!)

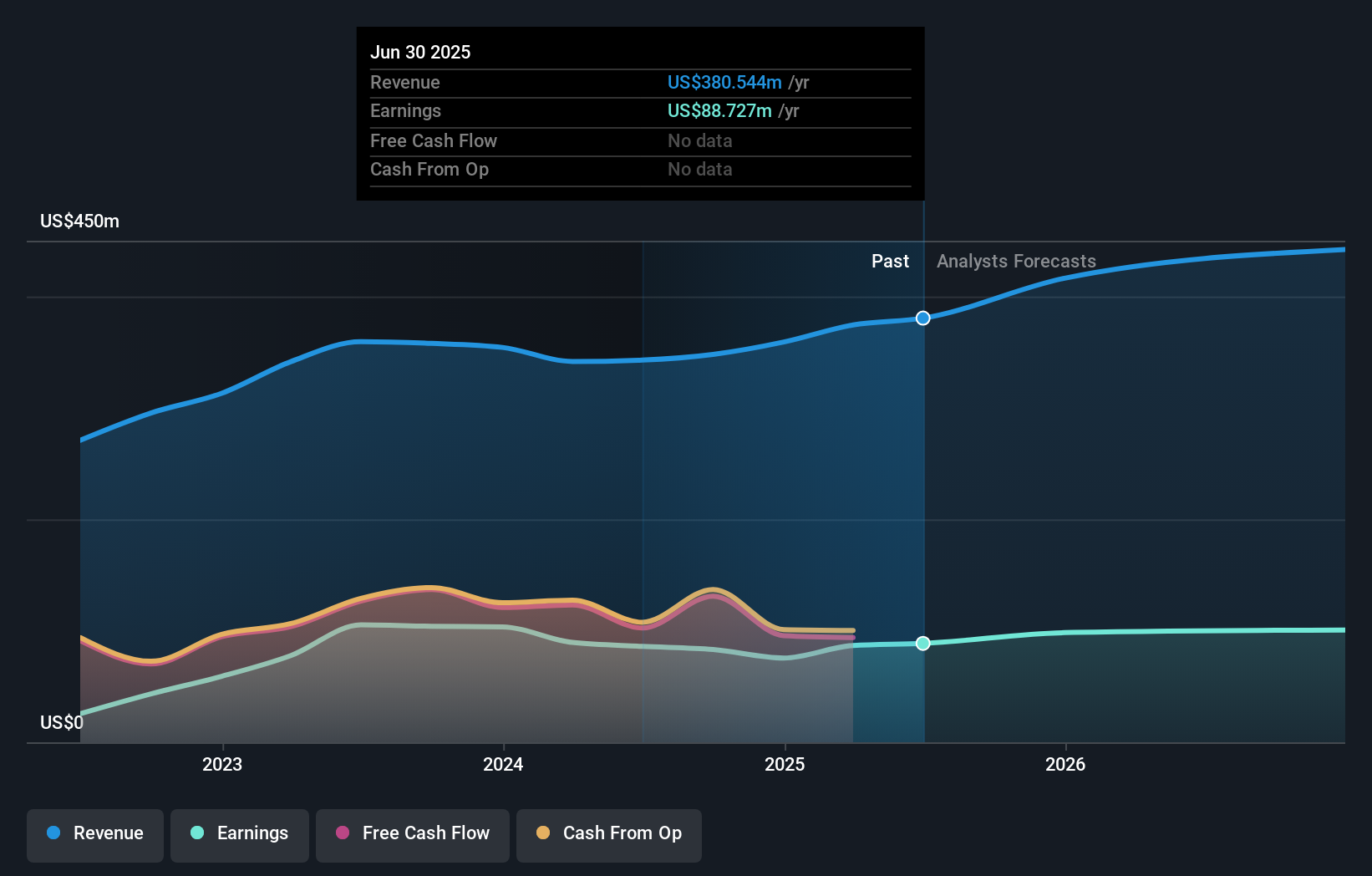

FirstSun Capital Bancorp's narrative projects $504.2 million revenue and $121.0 million earnings by 2028. This requires 10.4% yearly revenue growth and a $34.1 million earnings increase from the current earnings of $86.9 million.

Uncover how FirstSun Capital Bancorp's forecasts yield a $43.25 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Community members on Simply Wall St valued FirstSun shares at a single consensus of US$75.92, well above the recent price. Despite this, growing credit costs highlight potential volatility and remind you to consider a range of opinions.

Explore another fair value estimate on FirstSun Capital Bancorp - why the stock might be worth just $75.92!

Build Your Own FirstSun Capital Bancorp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your FirstSun Capital Bancorp research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free FirstSun Capital Bancorp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate FirstSun Capital Bancorp's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FSUN

FirstSun Capital Bancorp

Operates as the bank holding company for Sunflower Bank, National Association that provides commercial and consumer banking and financial services to small and medium-sized companies in Texas, Kansas, Colorado, New Mexico, Arizona, California, and Washington.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives