- United States

- /

- Banks

- /

- NasdaqGS:FSUN

FirstSun Capital Bancorp (FSUN): Is Strong Growth Fueling an Undervalued Opportunity?

Reviewed by Kshitija Bhandaru

FirstSun Capital Bancorp (FSUN) has recently seen a wave of attention after reports spotlighted its strong net interest income growth, improved operational efficiency, and substantial tangible book value gains.

See our latest analysis for FirstSun Capital Bancorp.

While the boost in net interest income and improved efficiency have made headlines, FirstSun Capital Bancorp’s recent share price hasn’t reflected a major shift. However, its three-year total shareholder return of 28% suggests long-term investors have still fared well. Market momentum appears steady rather than dramatic, but ongoing operational gains could set the stage for future moves.

If you’re watching for quality companies with solid management and insider confidence, use this moment to discover fast growing stocks with high insider ownership.

With shares still trading below analyst price targets and a sizable intrinsic discount, the question now becomes whether FirstSun Capital Bancorp is undervalued or if the market has already factored in its future growth prospects. Is there a buying opportunity here?

Most Popular Narrative: 9% Undervalued

With FirstSun Capital Bancorp’s most widely followed narrative placing fair value at $43.25 and shares last closing at $39.37, there is a clear gap that has analysts’ attention. This difference is rooted in a forward-looking view on both growth and profitability as the bank expands across its Southwestern and California footprint.

FirstSun's robust deposit growth across both consumer and business segments, especially in high-growth Southwestern and newly entered California markets, positions the bank to capitalize on urban migration trends and expanding local economies. This supports future revenue and net interest income expansion.

Want to know the growth blueprint behind this high valuation? The key element of this narrative is double-digit expansion in both top and bottom lines, alongside a profit multiple that sets bold expectations. Find out which surprising profit and revenue forecasts make up the backbone of this fair value argument by diving into the full narrative.

Result: Fair Value of $43.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent deposit volatility or asset quality concerns could challenge the bullish case and result in more cautious analyst sentiment going forward.

Find out about the key risks to this FirstSun Capital Bancorp narrative.

Another View: Market Ratios Tell a Different Story

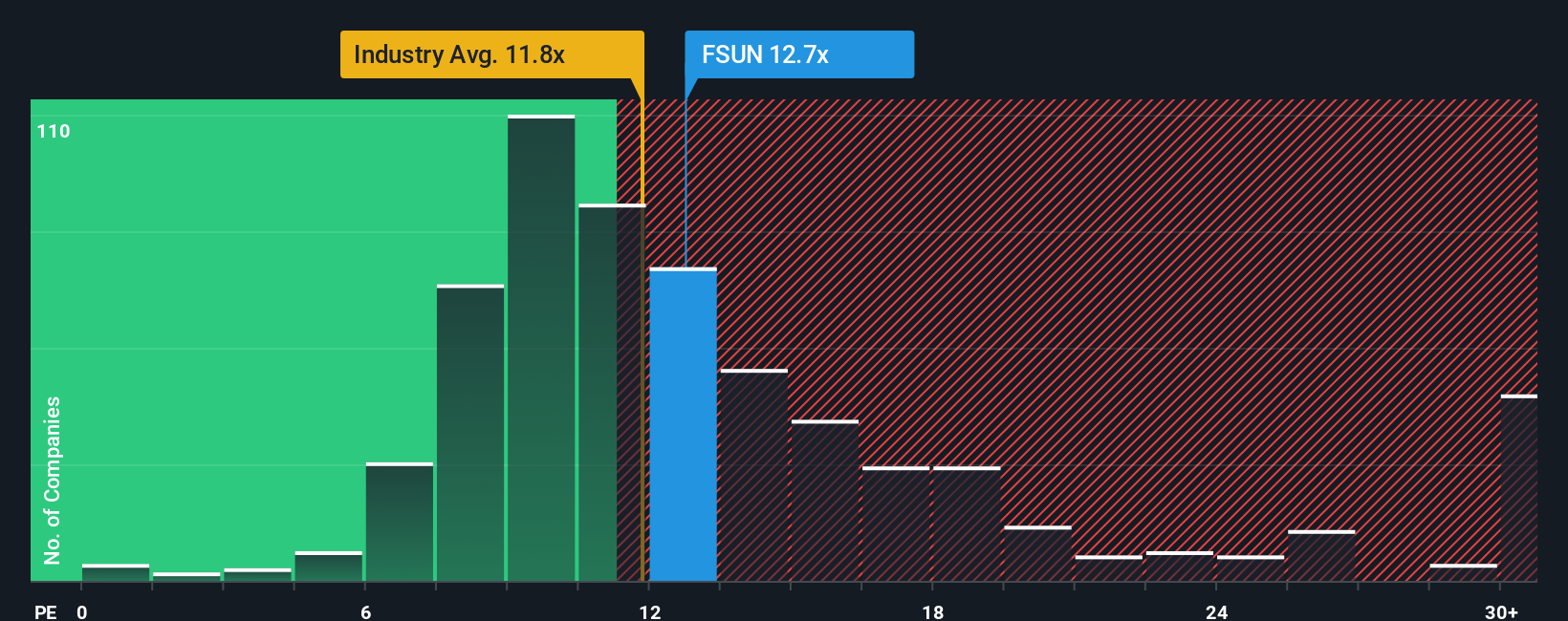

Looking through the lens of market pricing, FirstSun Capital Bancorp trades at 12.4 times earnings, which makes it pricier than both its industry average (11.8x) and direct peers (11.2x). Even the fair ratio for this bank comes in lower at 11.4x. This premium may suggest investors expect strong future growth, but it also adds valuation risk if the company fails to deliver. Is the market’s optimism justified or are expectations running ahead of reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own FirstSun Capital Bancorp Narrative

Not convinced by these viewpoints, or want to dig deeper into the numbers yourself? You can shape your own take in under three minutes by clicking here: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding FirstSun Capital Bancorp.

Looking for More Investment Ideas?

Don’t let an exciting opportunity pass you by. Uncover stocks that match your ambitions using the Simply Wall Street Screener. There’s always another smart move to make.

- Capitalize on innovation in medicine when you browse these 32 healthcare AI stocks. These companies are changing the future of healthcare with advanced diagnostics and AI-driven therapies.

- Zero in on outstanding returns by tapping into these 19 dividend stocks with yields > 3%. These selections offer strong yields and dependable cash flows for income-focused investors.

- Ride the wave of technology disruption by checking out these 24 AI penny stocks. These stocks are powering breakthroughs in artificial intelligence across diverse industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FSUN

FirstSun Capital Bancorp

Operates as the bank holding company for Sunflower Bank, National Association that provides commercial and consumer banking and financial services to small and medium-sized companies in Texas, Kansas, Colorado, New Mexico, Arizona, California, and Washington.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives