- United States

- /

- Banks

- /

- NasdaqGS:FSUN

FirstSun Capital Bancorp (FSUN): Evaluating Valuation Following Fed Rate Cut and Renewed Investor Optimism

Reviewed by Kshitija Bhandaru

FirstSun Capital Bancorp (FSUN) just caught the attention of investors after the Federal Reserve lowered its benchmark interest rate by 25 basis points and suggested there could be more cuts before year-end. Regional banks like FSUN tend to thrive in environments where borrowing costs drop, as it can stimulate loan demand and support margins. The Fed’s signal of further easing, driven by a softer labor market, sparked a surge in bank stocks as investors weighed the potential benefits of a more supportive rate backdrop.

This policy shift has reinvigorated momentum in FSUN’s shares, which jumped in response to the news alongside other regional lenders. Over the past month, FSUN’s stock has climbed more than 5%, and it is up nearly 17% in the past 3 months, recapturing ground after lagging most of the year. Even so, the stock is still down roughly 7% over the past twelve months, which highlights just how much recent sentiment has changed as the interest rate outlook evolves.

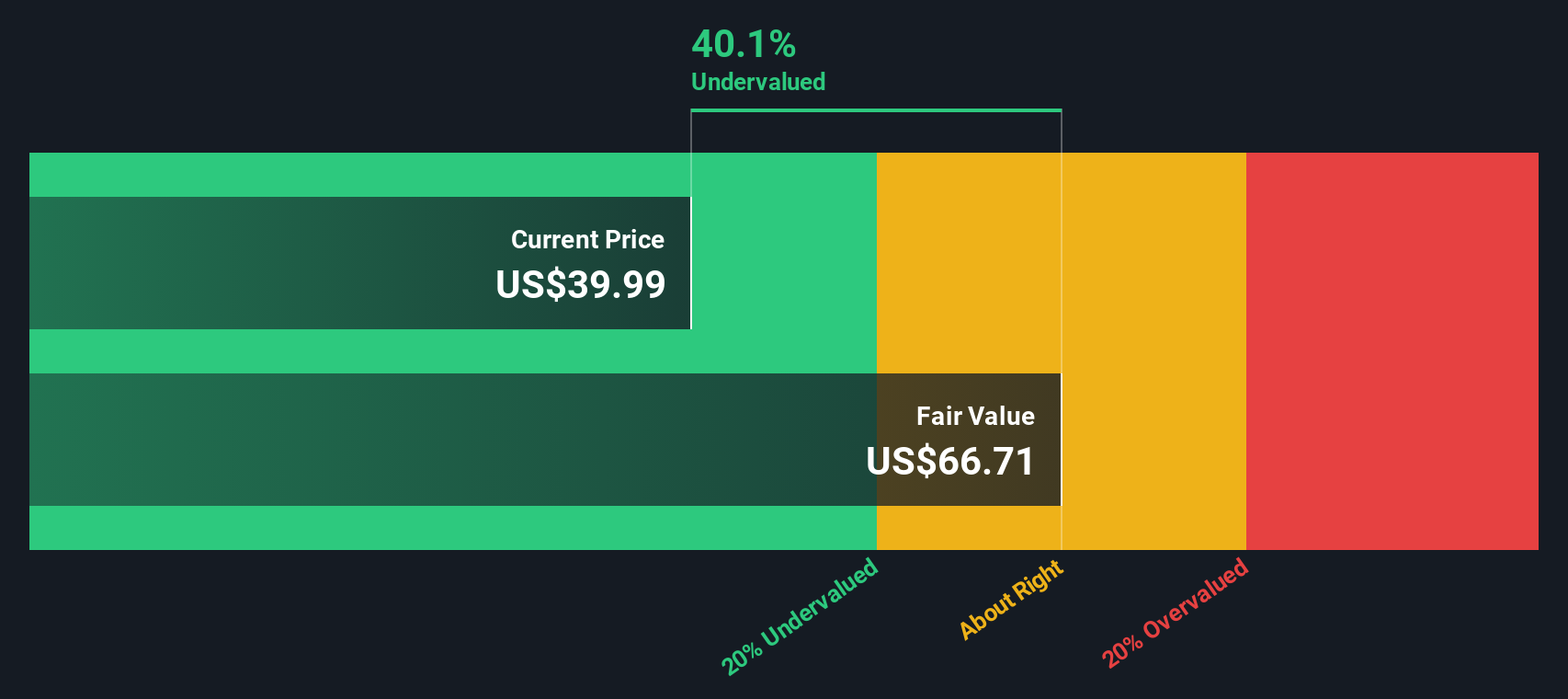

The rally brings up the crucial question: has FSUN’s price fully adjusted for these more upbeat expectations, or does the stock still offer an entry point for investors who believe growth is yet to be realized?

Most Popular Narrative: 8% Undervalued

The prevailing narrative contends that FirstSun Capital Bancorp remains undervalued, with analysts expecting upside based on its business momentum and future growth.

The bank's commitment to a relationship-driven business model and ongoing enhancement of fee-based service offerings (with fee income now exceeding 25% of total revenues) enables FirstSun to leverage rising demand among younger demographics for innovative, convenient banking solutions. This supports higher non-interest income and improved net margins.

Want to know what’s powering that bullish outlook? This narrative hints at a formula involving rising earnings, expanding revenue streams, and a profit multiple typically reserved for industry leaders. Curious about the bold assumptions and where analysts see the greatest value opportunity? Dive deeper to uncover the projections and rationale behind this valuation perspective.

Result: Fair Value of $43.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing volatility in deposit flows and the competitive push from fintechs remain key risks that could challenge FirstSun’s optimistic outlook.

Find out about the key risks to this FirstSun Capital Bancorp narrative.Another View: What Does Our DCF Model Say?

Taking a different approach, the SWS DCF model also suggests the shares are undervalued and reinforces the earlier outlook. But does this model account for all the challenges and market variables facing FSUN? Could the true value story still be untold?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own FirstSun Capital Bancorp Narrative

If you see the story differently or want to dig into the numbers on your own, it takes just a few minutes to shape your own perspective. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding FirstSun Capital Bancorp.

Looking for more investment opportunities?

Smart investors stay ahead by hunting for tomorrow’s leaders before the crowd catches on. Jump into these unique stock ideas and upgrade your portfolio game right now.

- Uncover high-potential tech disruptors transforming industries by checking out AI penny stocks.

- Boost your income plan with companies offering generous payouts through dividend stocks with yields > 3%.

- Tap into overlooked bargains that could deliver strong returns by exploring undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FSUN

FirstSun Capital Bancorp

Operates as the bank holding company for Sunflower Bank, National Association that provides commercial and consumer banking and financial services to small and medium-sized companies in Texas, Kansas, Colorado, New Mexico, Arizona, California, and Washington.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives