- United States

- /

- Banks

- /

- NasdaqCM:FSFG

With EPS Growth And More, First Savings Financial Group (NASDAQ:FSFG) Is Interesting

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In contrast to all that, I prefer to spend time on companies like First Savings Financial Group (NASDAQ:FSFG), which has not only revenues, but also profits. Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for First Savings Financial Group

How Fast Is First Savings Financial Group Growing?

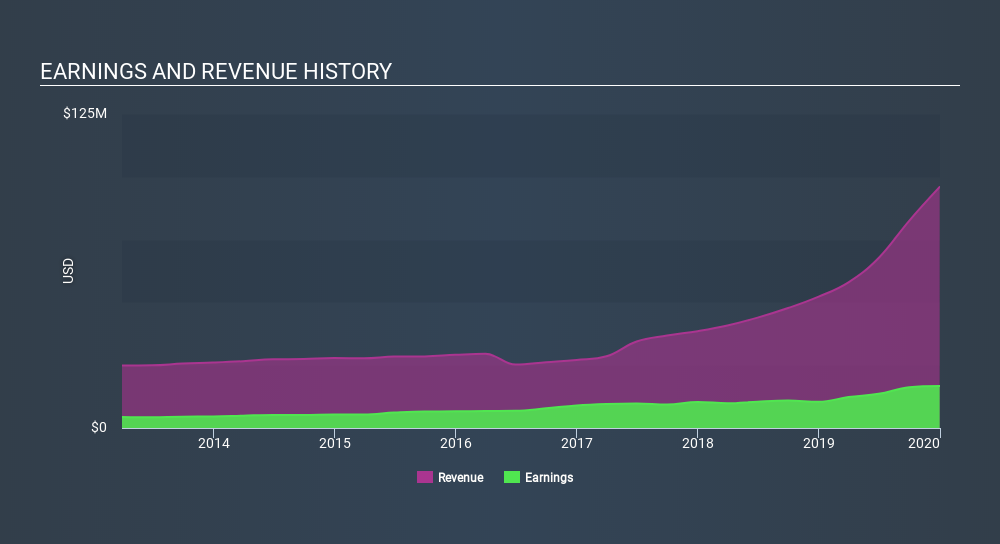

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). That makes EPS growth an attractive quality for any company. It certainly is nice to see that First Savings Financial Group has managed to grow EPS by 21% per year over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). I note that First Savings Financial Group's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. While we note First Savings Financial Group's EBIT margins were flat over the last year, revenue grew by a solid 83% to US$96m. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Since First Savings Financial Group is no giant, with a market capitalization of US$148m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are First Savings Financial Group Insiders Aligned With All Shareholders?

It makes me feel more secure owning shares in a company if insiders also own shares, thusly more closely aligning our interests. So it is good to see that First Savings Financial Group insiders have a significant amount of capital invested in the stock. Indeed, they hold US$29m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. Those holdings account for over 19% of the company; visible skin in the game.

Is First Savings Financial Group Worth Keeping An Eye On?

For growth investors like me, First Savings Financial Group's raw rate of earnings growth is a beacon in the night. I think that EPS growth is something to boast of, and it doesn't surprise me that insiders are holding on to a considerable chunk of shares. Fast growth and confident insiders should be enough to warrant further research. So the answer is that I do think this is a good stock to follow along with. What about risks? Every company has them, and we've spotted 2 warning signs for First Savings Financial Group (of which 1 can't be ignored!) you should know about.

Although First Savings Financial Group certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqCM:FSFG

First Savings Financial Group

Operates as the bank holding company for First Savings Bank that provides various financial services to consumers and businesses in southern Indiana.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives