- United States

- /

- Banks

- /

- NasdaqGS:FRME

First Merchants (FRME) Profit Margin Rises to 35.6%, Reinforcing Bullish Community Narratives

Reviewed by Simply Wall St

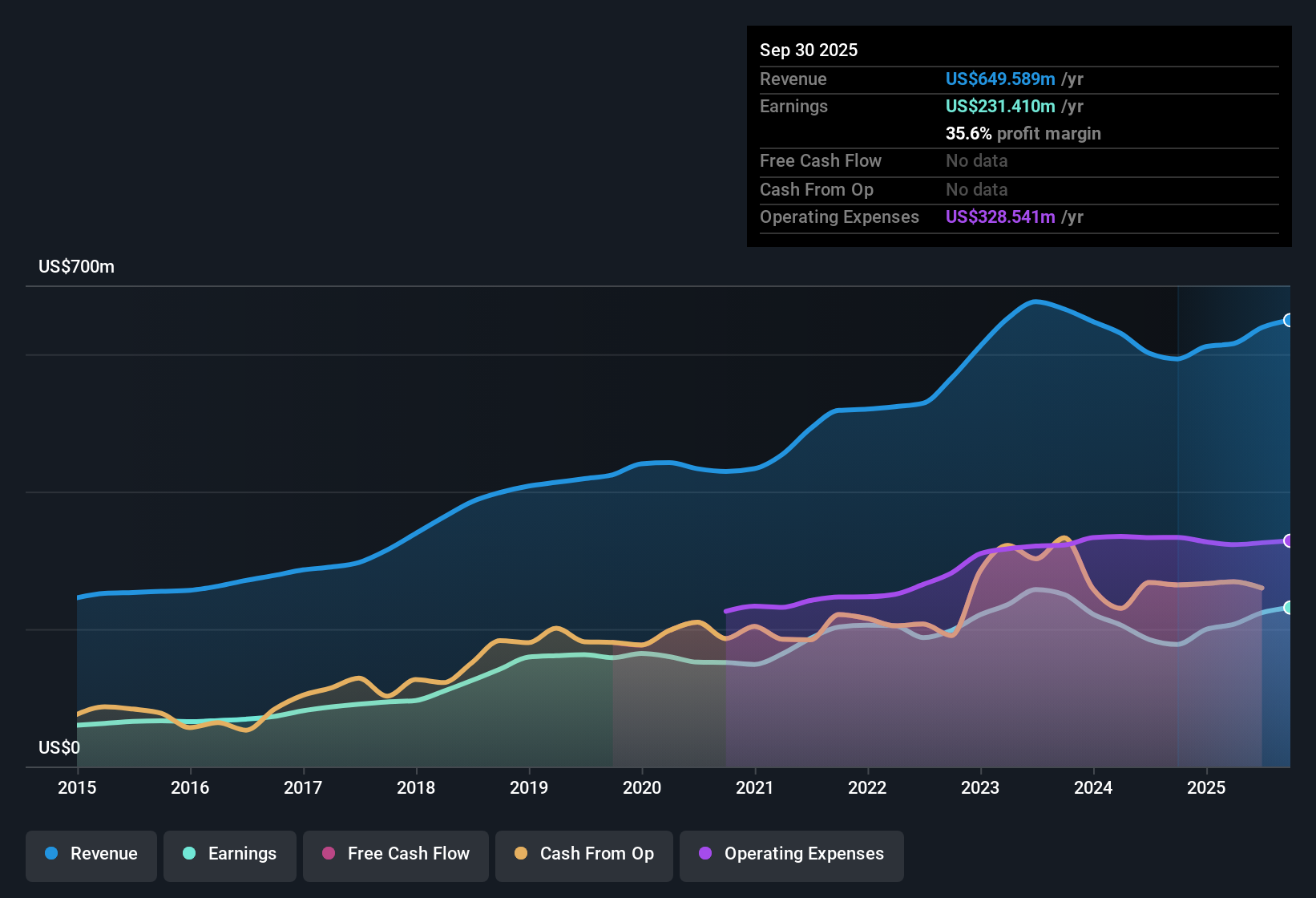

First Merchants (FRME) posted a strong set of headline numbers, with revenue projected to grow 11.9% per year and net profit margins climbing to 35.6% from 30% a year earlier. Earnings are forecast to rise by 10.29% annually, and the company’s recent 30.3% one-year earnings growth far outpaced its historical five-year average of 4.9% per year. With no flagged risks, a price-to-earnings ratio well below industry peers, and a share price of $36.42 trading at a significant discount to its estimated fair value, investors have plenty to weigh entering earnings season.

See our full analysis for First Merchants.Next, we’re setting these results in the context of Simply Wall St’s most-followed market narratives to see which stories hold up and where new perspectives might emerge.

See what the community is saying about First Merchants

Profit Margin Expands to 35.6%

- Net profit margin rose to 35.6%, up from 30% last year. This outpaced analyst projections for US regional banks and set First Merchants apart from many peers who are struggling to hold margins in a rising rate environment.

- Analysts’ consensus view highlights that heavy regional business activity and population growth are fueling strong loan and deposit demand.

- Operational investments in digital platforms and talent have reduced expenses while increasing revenue streams. These efforts are supporting high profitability alongside aggressive growth in key Midwest markets.

- Consistent margin expansion is considered a key driver for sustained organic growth and improved shareholder returns in the consensus narrative.

- Positive consensus forecasts and robust margin performance have analysts watching for further upside, as these trends reinforce confidence in First Merchants' strategy.

📊 Read the full First Merchants Consensus Narrative.

Analyst Price Target Sits 28% Above Market

- The current share price of $36.42 trades at a 28% discount to the latest analyst price target of $46.60. This indicates that investors have not yet fully priced in the company's ongoing profitability and growth outlook.

- According to the consensus narrative, the gap between market price and expectations is underpinned by forecasts of $221.9 million in earnings and a PE ratio of 14.2x by 2028.

- This forecasted rerating would lift the valuation above current US bank averages. The consensus sees continued core deposit and fee income growth as the engines behind the price target.

- Analysts caution that reaching the target assumes robust Midwest economy trends and strong execution on digital and commercial banking initiatives.

Profitability Stands Out Versus Peers

- First Merchants’ price-to-earnings ratio of 9.1x is well below both the US banks’ industry average of 11.3x and its peer group’s 17x. This gives the stock a clear value edge amid solid underlying performance.

- Analysts’ consensus view points to earnings reliability, high-quality revenues, and tangible book value per share growth as supporting the company’s premium assignment in forward-looking models.

- The attractive dividend and management’s disciplined capital deployment are highlighted as key pillars underpinning analysts’ confidence in ongoing value creation.

- This relative undervaluation, paired with a strong risk/reward profile and no apparent flagged risks, stands as a central point in the consensus narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for First Merchants on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a fresh take on the results? Add your own perspective and shape your personal narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 6 key rewards investors are optimistic about regarding First Merchants.

See What Else Is Out There

While First Merchants’ growth outlook is positive, the company’s profitability relies on favorable Midwest economic trends and seamless execution in digital and commercial banking. This reliance introduces uncertainty.

If you want more consistent performance regardless of economic shifts, use our stable growth stocks screener (2090 results) to zero in on companies delivering reliably steady earnings and revenue growth year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FRME

First Merchants

Operates as the financial holding company for First Merchants Bank that provides commercial and consumer banking services.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives