- United States

- /

- Banks

- /

- NasdaqGM:FNWB

I Ran A Stock Scan For Earnings Growth And First Northwest Bancorp (NASDAQ:FNWB) Passed With Ease

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like First Northwest Bancorp (NASDAQ:FNWB). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for First Northwest Bancorp

First Northwest Bancorp's Earnings Per Share Are Growing.

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. As a tree reaches steadily for the sky, First Northwest Bancorp's EPS has grown 34% each year, compound, over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

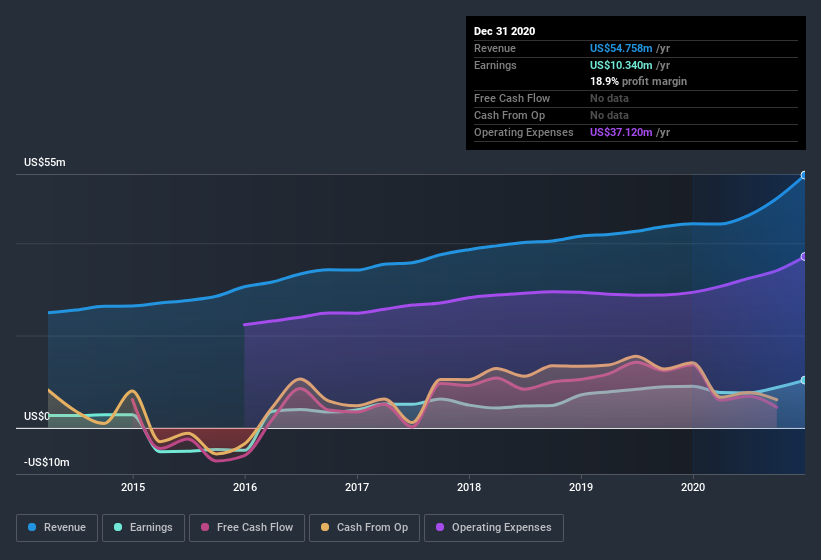

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Not all of First Northwest Bancorp's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. While we note First Northwest Bancorp's EBIT margins were flat over the last year, revenue grew by a solid 24% to US$55m. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

First Northwest Bancorp isn't a huge company, given its market capitalization of US$173m. That makes it extra important to check on its balance sheet strength.

Are First Northwest Bancorp Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

While First Northwest Bancorp insiders did net -US$66k selling stock over the last year, they invested US$373k, a much higher figure. You could argue that level of buying implies genuine confidence in the business. Zooming in, we can see that the biggest insider purchase was by President Matthew Deines for US$58k worth of shares, at about US$11.55 per share.

It's reassuring that First Northwest Bancorp insiders are buying the stock, but that's not the only reason to think management are fair to shareholders. I refer to the very reasonable level of CEO pay. I discovered that the median total compensation for the CEOs of companies like First Northwest Bancorp with market caps between US$100m and US$400m is about US$877k.

The First Northwest Bancorp CEO received US$650k in compensation for the year ending . That comes in below the average for similar sized companies, and seems pretty reasonable to me. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Is First Northwest Bancorp Worth Keeping An Eye On?

For growth investors like me, First Northwest Bancorp's raw rate of earnings growth is a beacon in the night. And that's not the only positive, either. We have both insider buying and reasonable and remuneration to consider. The message I'd take from this quick rundown is that, yes, this stock is worth investigating further. Before you take the next step you should know about the 1 warning sign for First Northwest Bancorp that we have uncovered.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of First Northwest Bancorp, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading First Northwest Bancorp or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGM:FNWB

First Northwest Bancorp

Operates as a bank holding company for First Fed Bank that provides commercial and consumer banking services to individuals, businesses, and nonprofit organizations in western Washington, the United States.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives