- United States

- /

- Banks

- /

- NasdaqGS:FITB

Fifth Third Bancorp (NASDAQ:FITB) Ticks All The Boxes When It Comes To Earnings Growth

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Fifth Third Bancorp (NASDAQ:FITB). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Fifth Third Bancorp with the means to add long-term value to shareholders.

View our latest analysis for Fifth Third Bancorp

Fifth Third Bancorp's Earnings Per Share Are Growing

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That makes EPS growth an attractive quality for any company. It certainly is nice to see that Fifth Third Bancorp has managed to grow EPS by 21% per year over three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

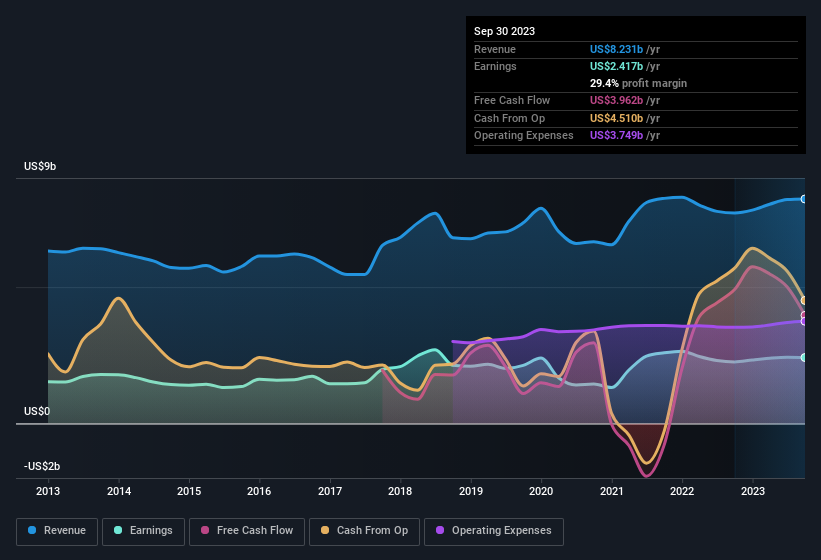

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Our analysis has highlighted that Fifth Third Bancorp's revenue from operations did not account for all of their revenue in the previous 12 months, so our analysis of its margins might not accurately reflect the underlying business. EBIT margins for Fifth Third Bancorp remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 6.6% to US$8.2b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Fifth Third Bancorp's future profits.

Are Fifth Third Bancorp Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

The US$73k worth of shares that insiders sold during the last 12 months pales in comparison to the US$2.9m they spent on acquiring shares in the company. This adds to the interest in Fifth Third Bancorp because it suggests that those who understand the company best, are optimistic. It is also worth noting that it was company insider Charles Daniels who made the biggest single purchase, worth US$1.5m, paying US$23.31 per share.

Along with the insider buying, another encouraging sign for Fifth Third Bancorp is that insiders, as a group, have a considerable shareholding. Given insiders own a significant chunk of shares, currently valued at US$79m, they have plenty of motivation to push the business to succeed. This would indicate that the goals of shareholders and management are one and the same.

Shareholders have more to smile about than just insiders adding more shares to their already sizeable holdings. That's because on our analysis the CEO, Tim Spence, is paid less than the median for similar sized companies. For companies with market capitalisations over US$8.0b, like Fifth Third Bancorp, the median CEO pay is around US$12m.

Fifth Third Bancorp offered total compensation worth US$8.1m to its CEO in the year to December 2022. That comes in below the average for similar sized companies and seems pretty reasonable. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Is Fifth Third Bancorp Worth Keeping An Eye On?

For growth investors, Fifth Third Bancorp's raw rate of earnings growth is a beacon in the night. On top of that, insiders own a significant stake in the company and have been buying more shares. Astute investors will want to keep this stock on watch. You should always think about risks though. Case in point, we've spotted 1 warning sign for Fifth Third Bancorp you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Fifth Third Bancorp, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:FITB

Fifth Third Bancorp

Operates as the bank holding company for Fifth Third Bank, National Association that engages in the provision of a range of financial products and services in the United States.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives