- United States

- /

- Banks

- /

- NasdaqGS:FITB

Does Q2 Earnings Growth Change The Bull Case For Fifth Third Bancorp (FITB)?

Reviewed by Simply Wall St

- Fifth Third Bancorp announced its second-quarter results, reporting net interest income of US$1.50 billion and net income of US$628 million, both higher than the same period last year.

- This marks continued year-over-year growth for both earnings and interest income, underscoring the company’s ongoing focus on core banking profitability.

- We’ll examine how the improvement in net interest income could reshape Fifth Third Bancorp’s investment narrative and outlook going forward.

Find companies with promising cash flow potential yet trading below their fair value.

Fifth Third Bancorp Investment Narrative Recap

To own shares in Fifth Third Bancorp, an investor should have confidence in its ability to deliver steady net interest income growth while maintaining credit quality and effective cost controls. The recent quarterly report showed a positive year-over-year increase in net interest income and earnings, but this improvement does not materially alter the biggest near-term risk: ongoing unpredictability in monetary policy and interest rate movements that could pressure profit margins and earnings targets.

The recent announcement of a new share repurchase program, with authorization to buy back up to 100 million shares, stands out as particularly relevant. If executed alongside ongoing core earnings growth, such buybacks could further support per-share metrics and potentially act as a cushion during periods of market volatility, helping to offset headwinds from rising deposit costs or market-driven risks.

By contrast, investors should also be aware that persistent unpredictability in interest rate policy could affect how sustainable these recent improvements in net interest income really are, especially if…

Read the full narrative on Fifth Third Bancorp (it's free!)

Fifth Third Bancorp's outlook anticipates $10.3 billion in revenue and $2.7 billion in earnings by 2028. This scenario assumes a 9.2% annual revenue growth and a $0.5 billion increase in earnings from the current $2.2 billion.

Exploring Other Perspectives

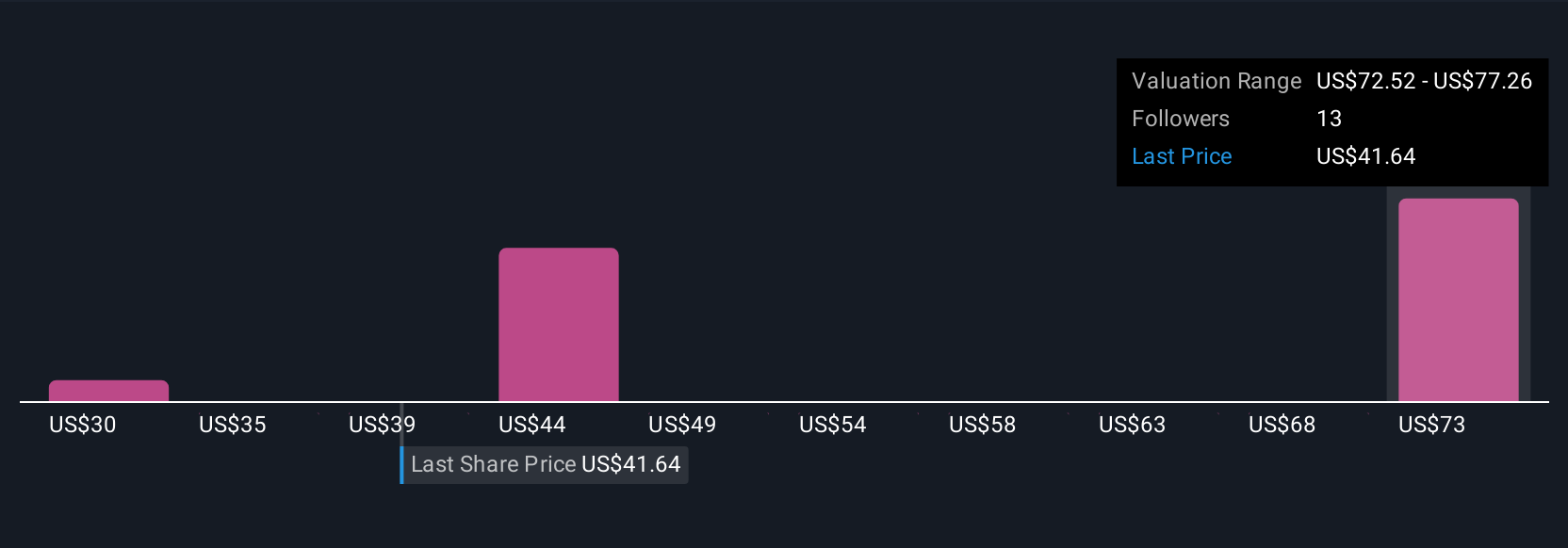

Private investors in the Simply Wall St Community place Fifth Third Bancorp’s fair value anywhere from US$29.85 to US$85.84, based on four unique estimates. With the market still weighing the durability of recent net interest income gains, these differing views offer several alternative insights into the company’s prospects.

Build Your Own Fifth Third Bancorp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fifth Third Bancorp research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Fifth Third Bancorp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fifth Third Bancorp's overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover 17 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

- This technology could replace computers: discover the 26 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FITB

Fifth Third Bancorp

Operates as the bank holding company for Fifth Third Bank, National Association that engages in the provision of a range of financial products and services in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives