- United States

- /

- Banks

- /

- NasdaqGS:FHB

What First Hawaiian (FHB)'s Rate Cut Buzz Means for Shareholders

Reviewed by Sasha Jovanovic

- Following comments from New York Federal Reserve President John Williams about a potential interest rate cut, investor sentiment strengthened and regional banks such as First Hawaiian saw increased market attention.

- This signaled that broader monetary policy expectations can quickly shift the outlook for regional financial institutions, given their sensitivity to lending rates and funding costs.

- We'll explore how renewed speculation about Federal Reserve rate cuts could influence First Hawaiian's investment narrative and future prospects.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

First Hawaiian Investment Narrative Recap

To be comfortable owning First Hawaiian stock, an investor generally needs to believe in the resilience of the bank’s local deposit base and its ability to capture Hawaii’s steady tourism and population trends. The recent uptick in shares after speculation of a Federal Reserve rate cut highlights how quickly sentiment can shift, but the most important short-term catalyst, stabilizing core deposit levels, remains unchanged, while risks from broader funding pressures and regional economic concentration still outweigh the impact of this news event.

Among recent company announcements, First Hawaiian’s Q3 2025 results showed year-over-year growth in net interest income and net income, even as management signaled caution on future loan growth. These results tie directly to the core catalyst of stable noninterest-bearing deposits and support cautious optimism, though any early benefits from rate policy shifts may be short-lived if underlying deposit trends do not improve.

Yet, despite renewed optimism, investors should be aware that persistent outflows in commercial and retail deposits could...

Read the full narrative on First Hawaiian (it's free!)

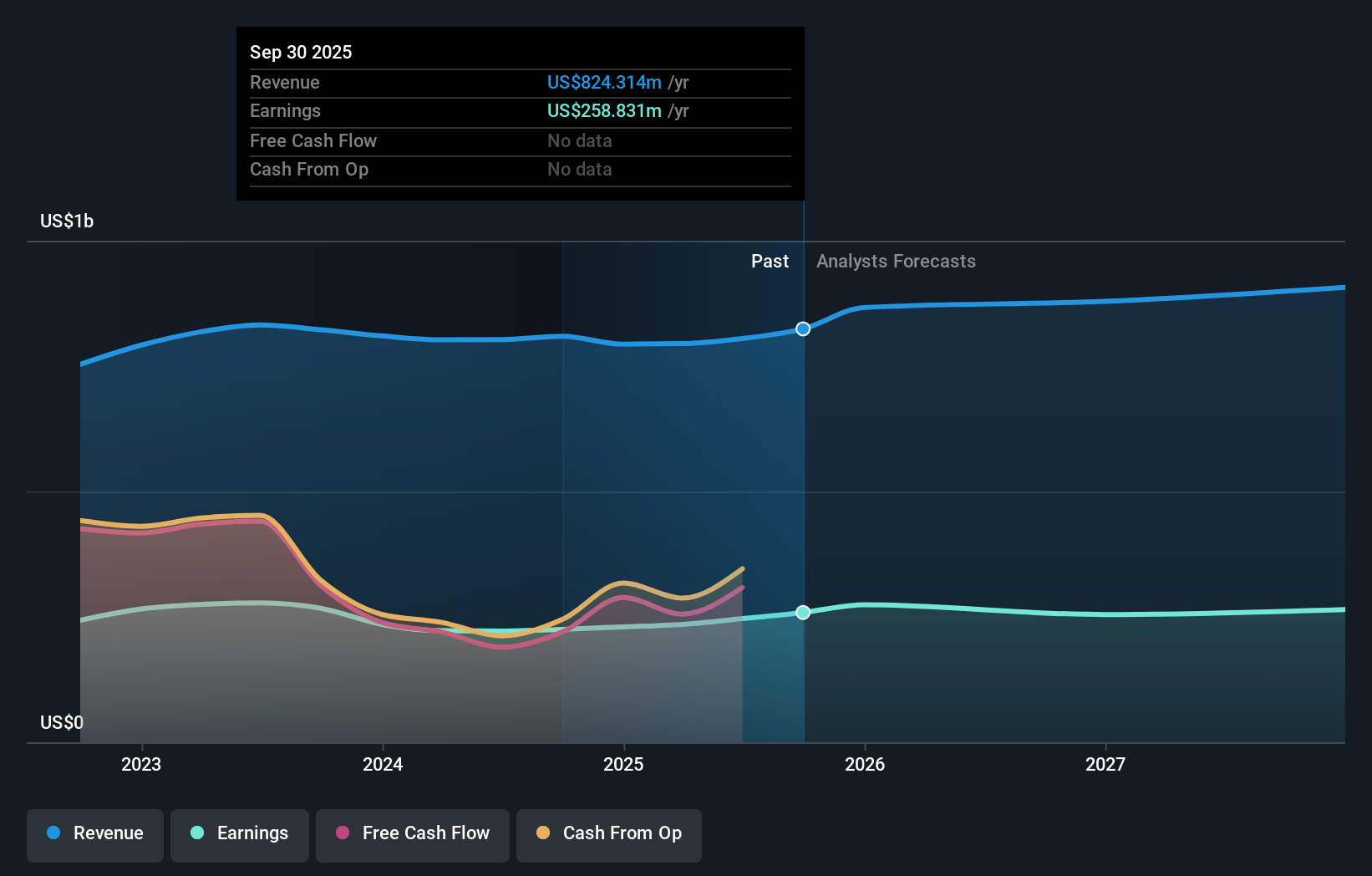

First Hawaiian's outlook projects $952.3 million in revenue and $263.9 million in earnings by 2028. This assumes a 5.8% annual revenue growth rate and a $17.4 million earnings increase from current earnings of $246.5 million.

Uncover how First Hawaiian's forecasts yield a $27.33 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community participants have set fair value targets for First Hawaiian as low as US$27.33 and as high as US$49.48, based on two distinct approaches. With ongoing questions about deposit growth and funding stability, you’ll find plenty of alternative viewpoints to consider.

Explore 2 other fair value estimates on First Hawaiian - why the stock might be worth just $27.33!

Build Your Own First Hawaiian Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your First Hawaiian research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free First Hawaiian research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate First Hawaiian's overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FHB

First Hawaiian

Operates as a bank holding company for First Hawaiian Bank that provides a range of banking products and services to consumer and commercial customers in the United States.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives