- United States

- /

- Banks

- /

- NasdaqGM:FGBI

First Guaranty Bancshares (NASDAQ:FGBI) Has Announced A Dividend Of $0.16

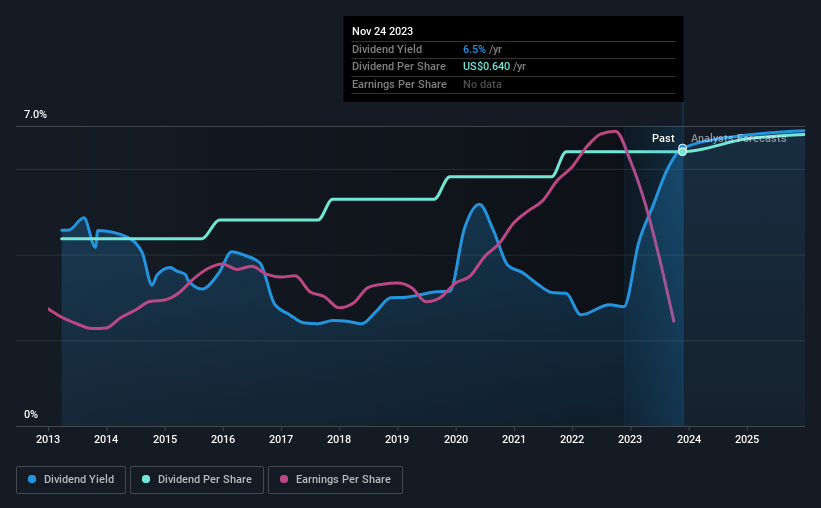

The board of First Guaranty Bancshares, Inc. (NASDAQ:FGBI) has announced that it will pay a dividend on the 29th of December, with investors receiving $0.16 per share. The dividend yield will be 6.5% based on this payment which is still above the industry average.

View our latest analysis for First Guaranty Bancshares

First Guaranty Bancshares' Payment Expected To Have Solid Earnings Coverage

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained.

First Guaranty Bancshares has established itself as a dividend paying company with over 10 years history of distributing earnings to shareholders. Based on First Guaranty Bancshares' last earnings report, the payout ratio is at a decent 65%, meaning that the company is able to pay out its dividend with a bit of room to spare.

Looking forward, earnings per share is forecast to fall by 16.0% over the next 3 years. However, analysts forecast that the future payout ratio could reach 92% over the same time period. This is definitely on the higher side of what we consider sustainable.

First Guaranty Bancshares Has A Solid Track Record

The company has been paying a dividend for a long time, and it has been quite stable which gives us confidence in the future dividend potential. The annual payment during the last 10 years was $0.437 in 2013, and the most recent fiscal year payment was $0.64. This means that it has been growing its distributions at 3.9% per annum over that time. Although we can't deny that the dividend has been remarkably stable in the past, the growth has been pretty muted.

Dividend Growth May Be Hard To Come By

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. Let's not jump to conclusions as things might not be as good as they appear on the surface. Over the past five years, it looks as though First Guaranty Bancshares' EPS has declined at around 6.7% a year. Declining earnings will inevitably lead to the company paying a lower dividend in line with lower profits.

In Summary

In summary, while it's good to see that the dividend hasn't been cut, we are a bit cautious about First Guaranty Bancshares' payments, as there could be some issues with sustaining them into the future. The company hasn't been paying a very consistent dividend over time, despite only paying out a small portion of earnings. We would probably look elsewhere for an income investment.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Case in point: We've spotted 4 warning signs for First Guaranty Bancshares (of which 1 makes us a bit uncomfortable!) you should know about. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:FGBI

First Guaranty Bancshares

Operates as the holding company for First Guaranty Bank that provides commercial banking services in Louisiana and Texas.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives