- United States

- /

- Banks

- /

- NasdaqGS:FFIN

First Financial Bankshares (FFIN): Assessing Valuation Following Spike in Credit Losses and Leadership Changes

Reviewed by Simply Wall St

First Financial Bankshares (FFIN) recently disclosed a sharp increase in net charge-offs tied to fraudulent activity by a commercial borrower. This development weighed on its third-quarter financial results and quickly caught the attention of investors.

See our latest analysis for First Financial Bankshares.

After these surprises, including a spike in credit losses, a dip in quarterly net income, and the appointment of a new Chief Information Officer, First Financial Bankshares’ share price momentum has faded, with a 1-year total shareholder return of -14.9% and a year-to-date share price decline of nearly 14%. Overall, the stock’s recent weakness reflects both operational headwinds and shifting investor sentiment as the company focuses on restoring confidence and stability.

If you’re curious where else opportunity might be building, now’s a smart time to broaden your search and discover fast growing stocks with high insider ownership

With shares recently under pressure and analyst targets suggesting some room for upside, the question now is whether First Financial Bankshares’ challenges are fully reflected in the price or if there is a genuine buying opportunity ahead.

Price-to-Earnings of 18x: Is it justified?

First Financial Bankshares currently trades at a price-to-earnings (P/E) ratio of 18x, which stands well above the average for its peers in the US banking sector. With a recent closing price of $30.65, the stock appears expensive compared to both its industry rivals and its estimated fair value multiple.

The P/E ratio measures how much investors are willing to pay for each dollar of a company’s earnings. In the banking sector, this is a widely used metric because it reflects the market’s expectations for future profitability and overall business stability. A higher P/E typically signals that investors anticipate stronger growth or superior business quality. However, it can also indicate over-optimism, especially if fundamentals do not support the premium.

Compared to the US Banks industry average P/E of 11x and a peer average of 12.7x, First Financial Bankshares is priced at a hefty premium. Even when compared to the estimated fair P/E ratio of 11.9x, there is a notable gap, suggesting the stock could be overvalued unless the company delivers outsized growth or operational improvements.

Explore the SWS fair ratio for First Financial Bankshares

Result: Price-to-Earnings of 18x (OVERVALUED)

However, slower revenue growth and ongoing investor skepticism could limit any rebound and continue to put pressure on First Financial Bankshares’ valuation going forward.

Find out about the key risks to this First Financial Bankshares narrative.

Another View: Discounted Cash Flow Model

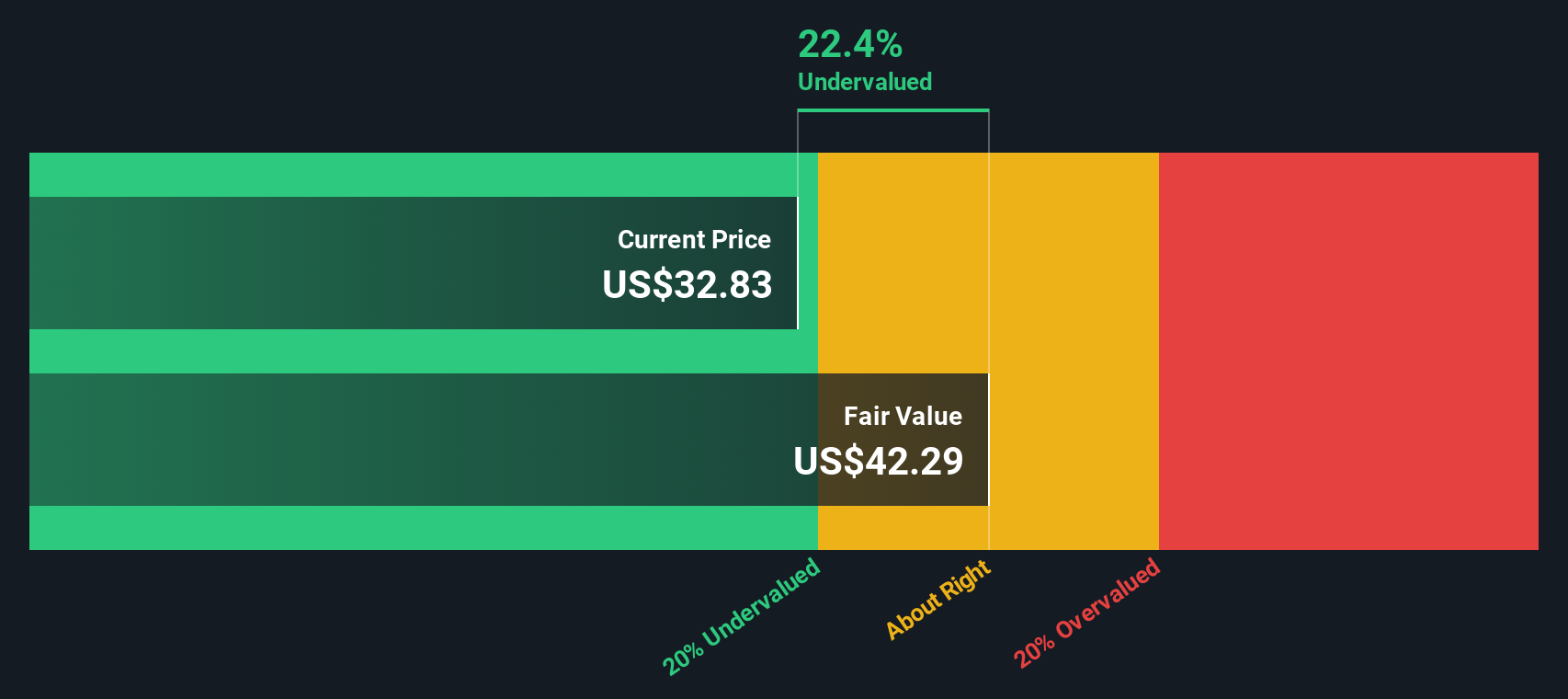

While First Financial Bankshares looks overvalued based on its price-to-earnings ratio, our DCF model gives a different perspective. According to this approach, the current share price of $30.65 is actually trading about 28% below its estimated fair value of $42.52. This raises the possibility that the stock could be undervalued if these cash flow assumptions prove accurate. Which valuation method better reflects reality?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out First Financial Bankshares for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 840 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own First Financial Bankshares Narrative

If you see things differently or want to dig deeper, you can easily analyze the numbers and shape your own view in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding First Financial Bankshares.

Looking for more investment ideas?

Don’t let great opportunities pass you by. The market often rewards those willing to act early. Use these powerful tools to find your next winning stock today:

- Grow your portfolio’s income by tapping into these 20 dividend stocks with yields > 3% with attractive yields exceeding 3% and proven stability for investors seeking reliable returns.

- Capitalize on the booming tech revolution with access to these 26 AI penny stocks, where artificial intelligence leaders are transforming industries and delivering significant upside potential.

- Position yourself ahead of Wall Street by checking out these 840 undervalued stocks based on cash flows driven by strong cash flows, and uncover stocks the market may be overlooking right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FFIN

First Financial Bankshares

Through its subsidiaries, provides banking services in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives