- United States

- /

- Banks

- /

- NasdaqGS:FFBC

Does Recent Banking Sector Volatility Reveal Opportunity in First Financial Bancorp Stock for 2025?

Reviewed by Bailey Pemberton

- Ever wondered if First Financial Bancorp’s current share price is a bargain or simply fair value? You are not alone, as plenty of investors are taking a closer look right now.

- After a slight dip of 2.8% in the past week and a 7.5% fall over the last month, the stock is down 11.5% year-to-date. However, it remains up an impressive 104.4% over five years.

- Market attention has sharpened as recent banking sector volatility and shifts in regional growth forecasts have put companies like First Financial Bancorp under the spotlight. Headlines referencing regulatory changes and sector consolidation have added another layer of complexity to how investors view risk and opportunity in financial stocks.

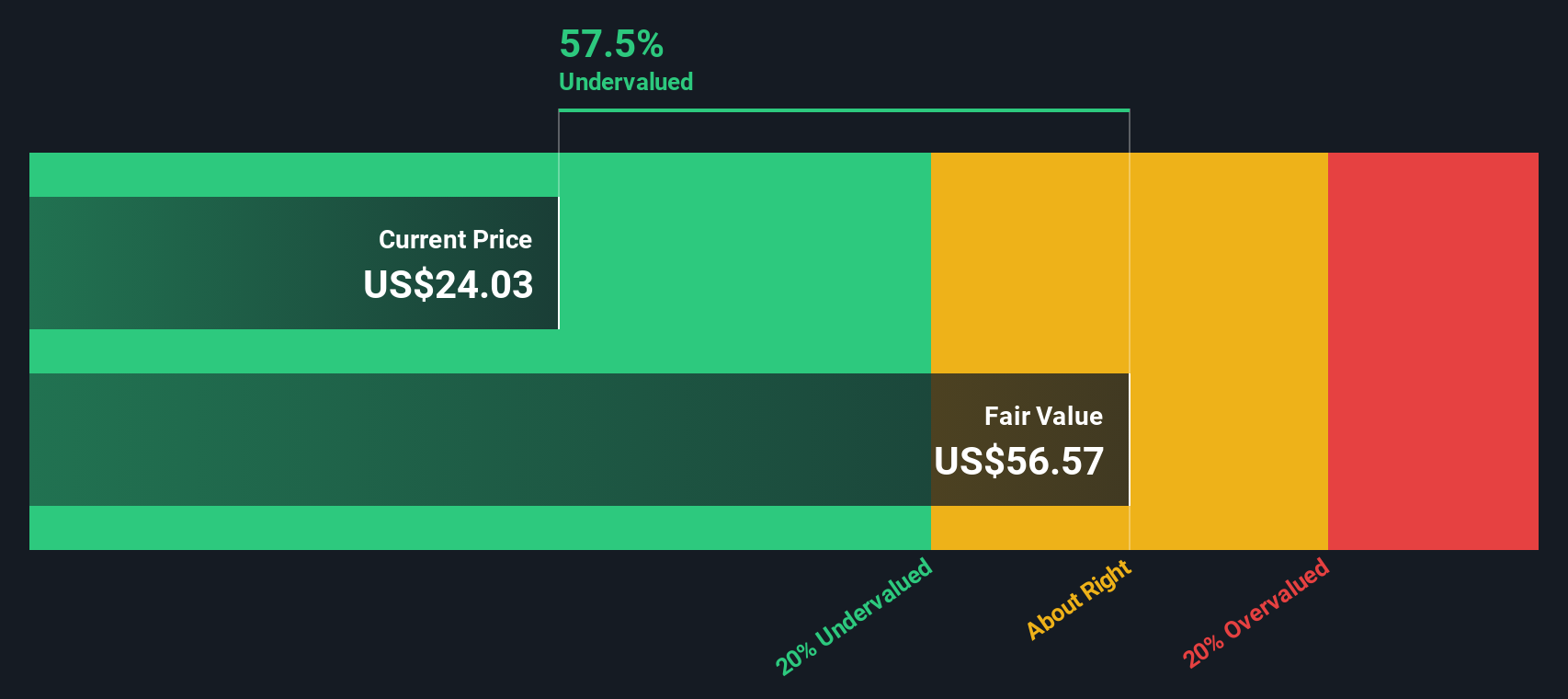

- On the pure numbers, First Financial Bancorp scores a perfect 6 out of 6 in our valuation checks, suggesting it is undervalued across the board. We will break down the standard approaches to value a bank stock below, but stick with us for a perspective that goes beyond the usual metrics.

Find out why First Financial Bancorp's -5.4% return over the last year is lagging behind its peers.

Approach 1: First Financial Bancorp Excess Returns Analysis

The Excess Returns valuation approach considers how effectively a bank puts its capital to work compared to the cost of that capital. In other words, it measures the value created when a company’s return on equity exceeds its cost of equity, rather than simply looking at its earnings or cash flows.

For First Financial Bancorp, the model breaks down as follows:

- Book Value: $27.48 per share

- Stable EPS: $3.11 per share (Source: Weighted future Return on Equity estimates from 6 analysts.)

- Cost of Equity: $2.00 per share

- Excess Return: $1.12 per share

- Average Return on Equity: 10.58%

- Stable Book Value: $29.45 per share (Source: Weighted future Book Value estimates from 6 analysts.)

Applying this method, Simply Wall St estimates the intrinsic value at $59.56 per share. Compared to current market pricing, this implies the stock is trading at a 60.7% discount. This suggests First Financial Bancorp is undervalued based on its ability to generate returns above its cost of equity. For investors seeking value in bank stocks with consistently positive excess returns, this result is a strong positive signal.

Result: UNDERVALUED

Our Excess Returns analysis suggests First Financial Bancorp is undervalued by 60.7%. Track this in your watchlist or portfolio, or discover 832 more undervalued stocks based on cash flows.

Approach 2: First Financial Bancorp Price vs Earnings

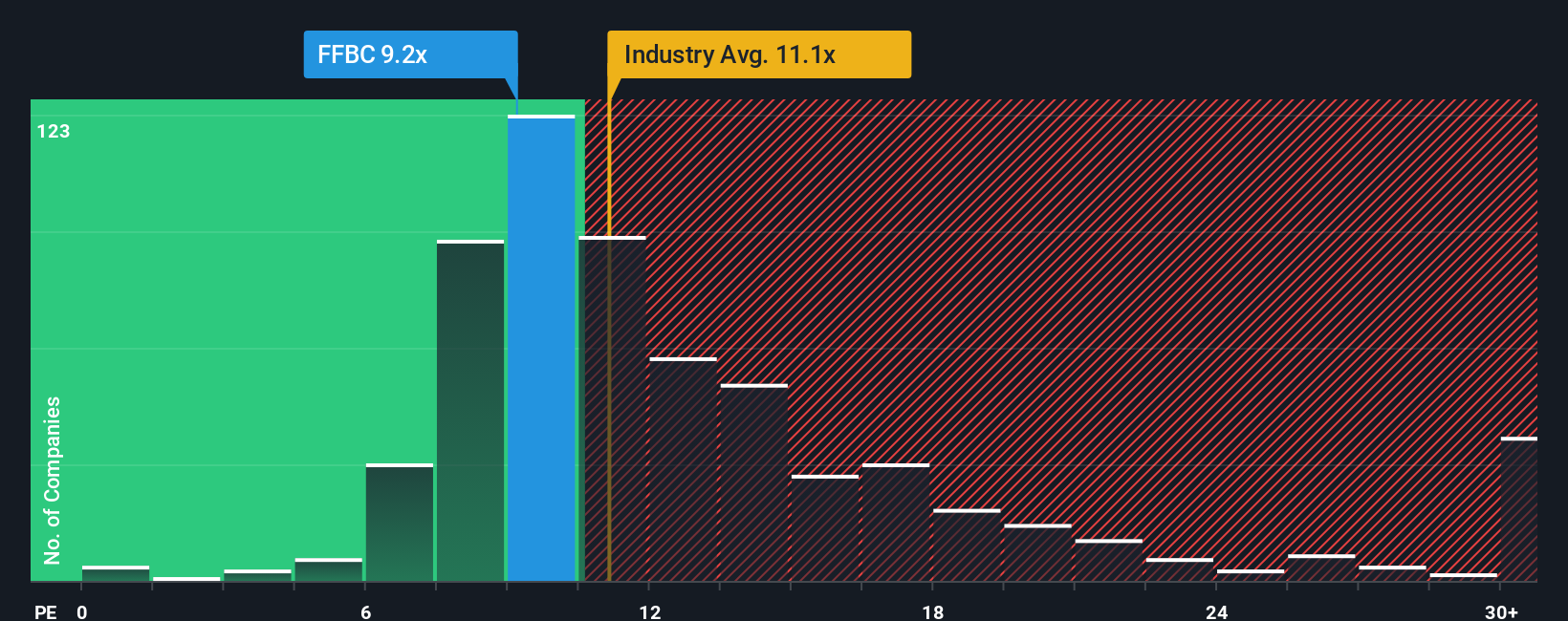

For profitable companies like First Financial Bancorp, the Price-to-Earnings (PE) ratio is a widely used valuation measure. It allows investors to quickly gauge how much they are paying for each dollar of earnings, making it useful for comparing against historical ranges, industry peers, and market expectations.

The PE ratio, however, is not static. Higher growth prospects, lower risk, or greater profitability tend to justify a higher PE. In contrast, slower growth or greater risks warrant a lower one. This dynamic means what counts as a “fair” PE can vary significantly between companies, even within the same industry.

First Financial Bancorp currently trades at a PE ratio of 8.7x. This sits below both the industry average of 11.1x and notably under the average of peer companies at 18.2x. At first glance, this suggests the stock could be undervalued relative to the sector and its competitors.

Simply Wall St’s “Fair Ratio” for First Financial Bancorp is calculated at 13.6x. This is a more tailored benchmark that, unlike a simple industry or peer comparison, incorporates the company’s specific growth outlook, risk profile, profit margins, market capitalization, and industry characteristics. For investors, this makes the Fair Ratio a smarter and more individualized measure of value.

Since First Financial Bancorp’s current PE ratio is well below its Fair Ratio, the analysis suggests the stock is undervalued by this metric as well.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your First Financial Bancorp Narrative

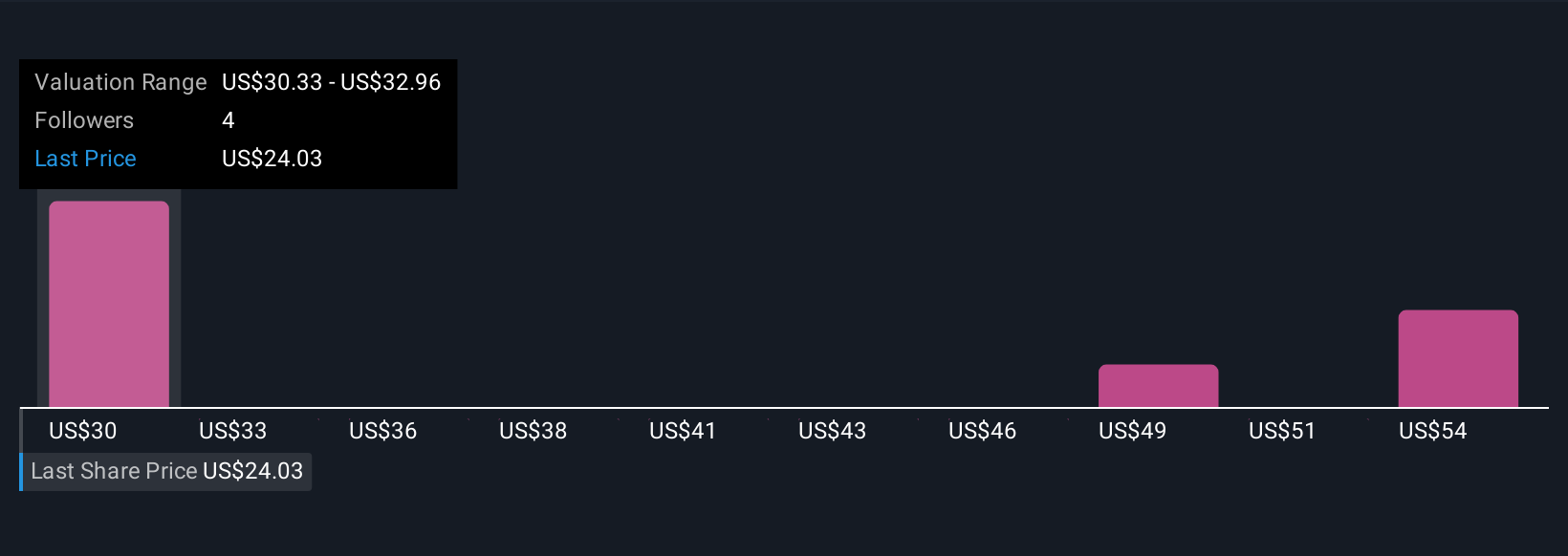

Earlier, we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal story or thesis about First Financial Bancorp. It is how you turn numbers into meaning by outlining what you believe will drive the company’s future, and then linking those assumptions to a clear financial forecast and a fair value estimate.

This approach lets you go beyond static ratios and analyst targets. You can craft your own perspective, set your forecast for revenue, earnings, and margins, and instantly see what fair value those assumptions imply. Narratives are easy to create and update directly within Simply Wall St’s Community page, where millions of investors share, refine, and compare their unique views.

With Narratives, you can quickly spot when your fair value is above or below the current market price, helping you decide when to buy, hold, or sell. These forecasts update automatically as new information and news are released.

For example, one investor might build a Narrative expecting aggressive digital transformation and new fee-based services to push First Financial Bancorp's fair value up to $30.33 per share. Another could hold a more cautious view, seeing risks from commercial real estate and competition as reasons for a lower fair value. Narratives help you make smarter, conviction-based investment decisions that stay relevant as circumstances change.

Do you think there's more to the story for First Financial Bancorp? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FFBC

First Financial Bancorp

Operates as the bank holding company for First Financial Bank that provides commercial banking and related services to individuals and businesses in Ohio, Indiana, Kentucky, and Illinois.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives