- United States

- /

- Banks

- /

- NasdaqGS:FCNC.A

Will First Citizens BancShares' (FCNC.A) New Initiatives Reshape Its Competitive Edge in Wealth Management?

Reviewed by Sasha Jovanovic

- Earlier this month, First Citizens BancShares announced a new fixed-income offering and named Lee Erby as region head of wealth management for Northern California, while Dynapac North America LLC and First Citizens Bank Equipment Finance unveiled a vendor finance agreement to support equipment financing for road construction projects.

- This series of moves highlights the company's focus on expanding its presence in high-net-worth wealth management, diversifying funding sources, and strengthening relationships with commercial equipment clients.

- We’ll explore how the new fixed-income offering could influence First Citizens BancShares’ investment narrative and outlook.

Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

First Citizens BancShares Investment Narrative Recap

To be a shareholder in First Citizens BancShares, you need to have confidence in the company's multi-pronged approach to growth, balancing expansion into high-net-worth wealth management and commercial banking with efforts to diversify funding and strengthen risk controls. The recent fixed-income offering and regional leadership appointments appear directionally positive but are not likely to materially shift the most pressing catalyst for shares, which remains tied to net interest income trends and rate movements; meanwhile, the highest risk still centers around credit exposure from the legacy SVB portfolio and commercial real estate loans, particularly in a volatile macroeconomic environment.

Of the recent developments, the vendor finance partnership with Dynapac North America stands out, as it directly supports First Citizens' push to grow its commercial lending and equipment finance business, an area aligned with management's focus on specialized industry verticals to drive future loan growth, a key current catalyst given tepid interest income guidance and ongoing margin pressures.

On the other hand, investors should be alert to credit loss risks tied to acquired portfolios, especially as...

Read the full narrative on First Citizens BancShares (it's free!)

First Citizens BancShares is projected to reach $9.7 billion in revenue and $2.2 billion in earnings by 2028. This outlook assumes annual revenue growth of 2.6%, but a decrease of $0.1 billion in earnings from current earnings of $2.3 billion.

Uncover how First Citizens BancShares' forecasts yield a $2155 fair value, a 17% upside to its current price.

Exploring Other Perspectives

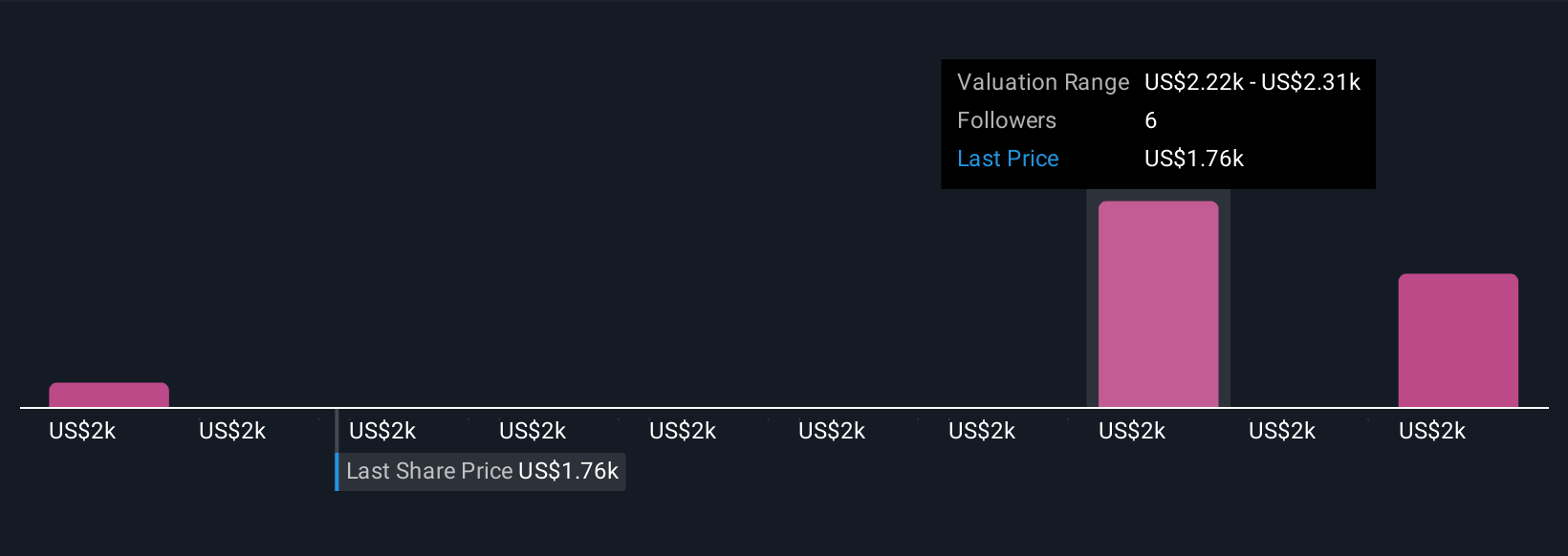

Three individuals in the Simply Wall St Community estimated fair value for First Citizens BancShares between US$1,568 and US$2,538 per share. As you read these varying perspectives, remember current credit concerns and slower net interest income growth could shape your own view of the company’s outlook.

Explore 3 other fair value estimates on First Citizens BancShares - why the stock might be worth as much as 38% more than the current price!

Build Your Own First Citizens BancShares Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your First Citizens BancShares research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free First Citizens BancShares research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate First Citizens BancShares' overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FCNC.A

First Citizens BancShares

Operates as the holding company for First-Citizens Bank & Trust Company that provides retail and commercial banking services to individuals, businesses, and professionals in the United States and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives