- United States

- /

- Banks

- /

- NasdaqCM:FCCO

First Community (FCCO) Profit Margin Surge Reinforces Long-Term Bullish Narrative

Reviewed by Simply Wall St

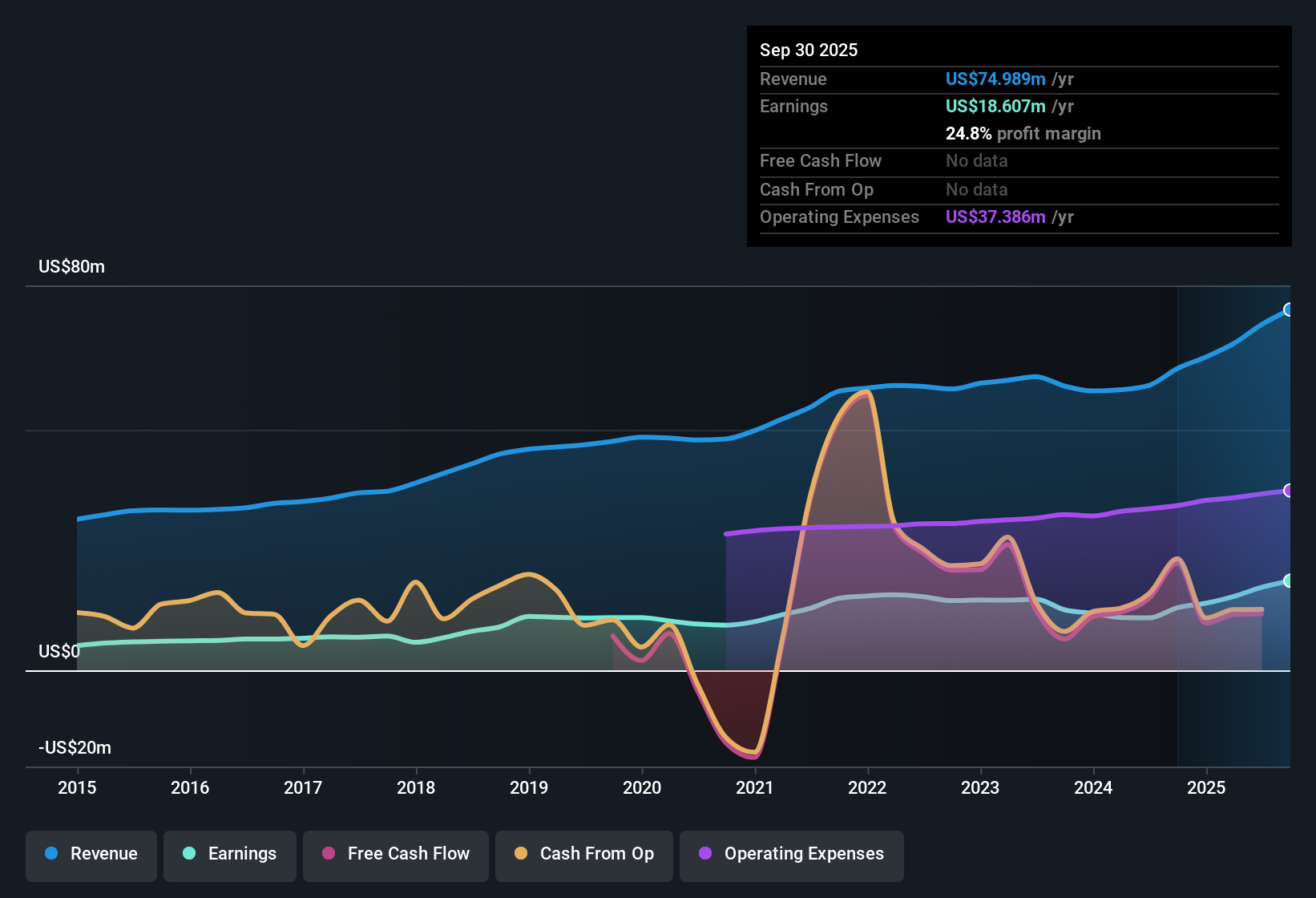

First Community (FCCO) posted average annual earnings growth of 3.4% over the past five years, with net profit margins rising to 24% from 18.4% last year. Most recently, earnings surged by 58.3%, signaling a sharp acceleration in the company’s upward trend and highlighting high-quality profits that may have staying power. Investors are now weighing the appeal of ongoing growth in profits and dividends, as well as a price that suggests value relative to both direct peers and FCCO’s intrinsic worth.

See our full analysis for First Community.The next step is to see how this fresh performance matches up against the major narratives around FCCO. Where do the numbers back up the story, and where might the consensus be challenged?

Curious how numbers become stories that shape markets? Explore Community Narratives

Margin Expansion Lifts Profit Quality

- Net profit margin rose to 24% this year, up from 18.4% previously. This marked improvement highlights profitability exceeding typical sector dynamics.

- The recent margin strength heavily supports the view that FCCO’s strong operational discipline is translating into better earnings durability.

- Recent filings emphasize that these margins are not only high but regarded as “high quality” by management. This suggests the core business is driving structurally sound profits.

- Given that regional banks often face narrow spreads, this elevated margin level gives FCCO extra flexibility to weather industry shifts or cost pressures.

Dividend Yield and Valuation Leverage

- With a price-to-earnings ratio of 12.4x, lower than direct peers at 13.5x but above the banks industry at 11.2x, shares currently trade not only at a peer discount but also well below their DCF fair value of $43.22.

- What is surprising is how this discount to intrinsic worth enhances FCCO’s appeal for value and income-focused investors.

- Reward factors are clear: ongoing profit growth, a sustainable dividend stream, and a price below modeled fair value all strengthen the argument for holding FCCO through multiple cycles.

- Despite an uptick in share price with recent results, investors still have a substantial margin of safety based on the latest DCF estimate. This reinforces patience among long-term holders.

Peer Discount Persists Despite Surging Profits

- FCCO’s share price of $27.91 is trading at a meaningful discount to its DCF fair value of $43.22 and is priced below its direct peer average valuation multiples.

- This spread is notable, as the prevailing view is that FCCO’s accelerating profit growth and enhanced margin profile have yet to be fully reflected in the stock.

- Industry commentary points out that while sector peers are navigating volatility, FCCO’s steady profile and clear valuation gap could make it stand out as a “safe haven” play.

- Yet the market has not closed this valuation gap, perhaps reflecting broader caution around smaller banks, despite company-specific momentum on margins and net income.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on First Community's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

Despite rapid profit growth, FCCO’s valuation discount persists. This is likely due to lingering skepticism about long-term earnings stability and consistent performance across cycles.

If you want to focus on companies delivering reliable results year after year, use our stable growth stocks screener (2094 results) to discover stocks that have consistently expanded revenue and earnings, offering greater peace of mind for long-term investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:FCCO

First Community

Operates as the bank holding company for First Community Bank that provides various commercial and retail banking products and services to small-to-medium sized businesses, professionals, and individuals.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives