- United States

- /

- Banks

- /

- NasdaqGS:FBNC

A Fresh Look at First Bancorp (FBNC) Valuation Following Chief Risk Officer Succession

Reviewed by Simply Wall St

First Bancorp (FBNC) has named Bridget Welborn as its new Chief Risk Officer and Head of Legal, taking over from Peter Seitz ahead of his retirement in early 2026. This leadership transition comes at a time when banks are placing greater emphasis on risk management and regulatory challenges.

See our latest analysis for First Bancorp.

First Bancorp has seen its share price climb 17.2% so far this year, a promising sign that reflects improving market sentiment and confidence in its strategy. While the pace of gains has steadied lately, shareholders have enjoyed a 6.9% total return over the past 12 months. The company’s five-year total return stands out at nearly 71%, which suggests resilience as leadership transitions take place.

If these shifts at First Bancorp have you thinking bigger, it could be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

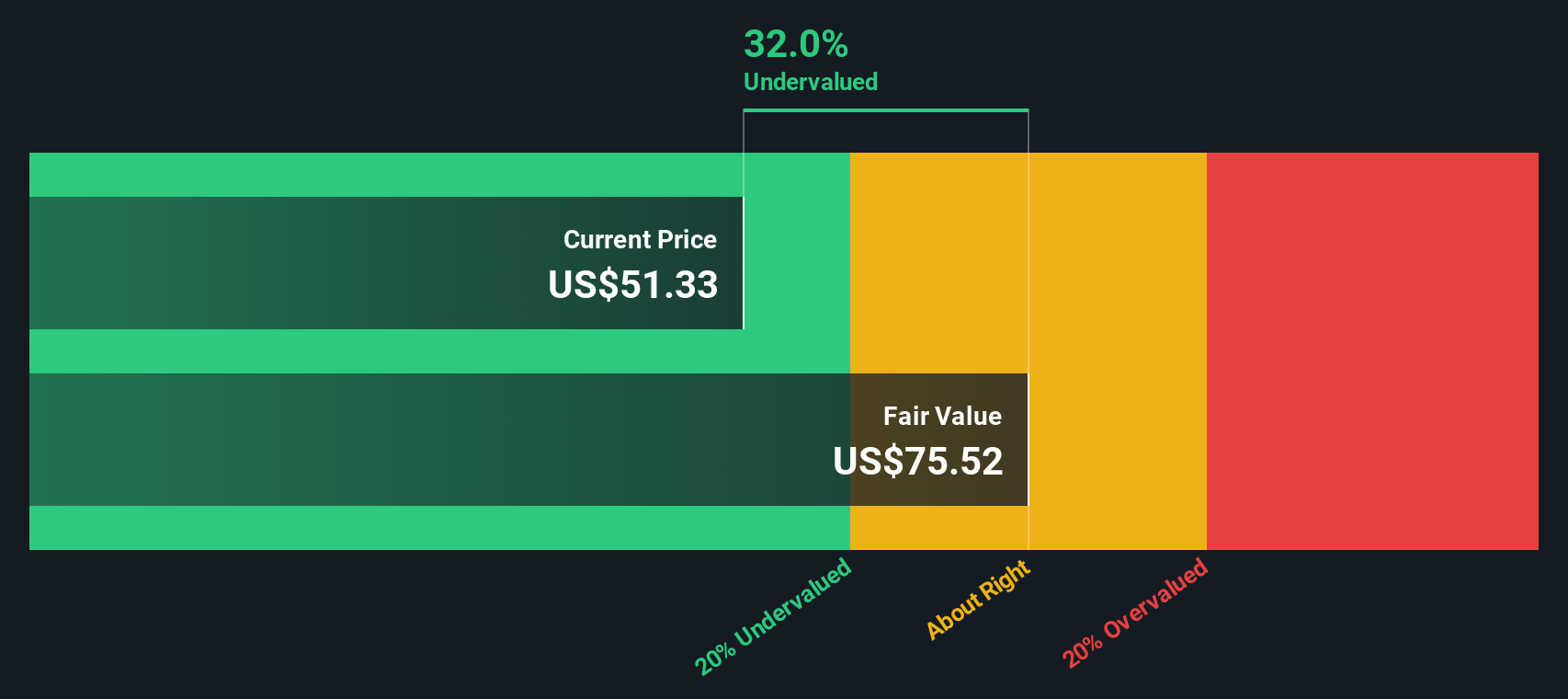

With shares still trading at a notable discount to analyst targets, investors are left to wonder if First Bancorp is undervalued, or if the market is already factoring in the company’s strong growth outlook.

Price-to-Earnings of 21.2x: Is it justified?

First Bancorp currently trades at a price-to-earnings ratio of 21.2x, nearly double the peer average of 10.9x. This points to a premium valuation versus comparable banks. At the last close of $50.40, the stock’s relative expensiveness stands out despite enthusiasm for its growth outlook.

The price-to-earnings (P/E) ratio measures how much investors are willing to pay for each dollar of earnings. For banks, it is often seen as a gauge of expected profit growth, risk, and business stability. A higher multiple can reflect optimism about future earnings growth or unique competitive strengths that set the bank apart.

However, First Bancorp’s premium multiple suggests the market may be pricing in a more robust growth story than current results or peers justify. When compared to the broader U.S. banks industry, where the average P/E is just 11.2x, this premium becomes even more pronounced. The current P/E also sits above what models suggest is the fair price-to-earnings ratio of 15.2x. This is a level the market could move toward if sentiment shifts.

Explore the SWS fair ratio for First Bancorp

Result: Price-to-Earnings of 21.2x (OVERVALUED)

However, slower earnings growth or shifts in the regulatory environment could challenge the current optimism and put pressure on First Bancorp’s premium valuation.

Find out about the key risks to this First Bancorp narrative.

Another View: Discounted Cash Flow Model Weighs In

Looking at First Bancorp through the lens of our SWS DCF model, the picture changes. The DCF suggests shares are trading around 40.8% below their estimated fair value, pointing to significant undervaluation. This is in sharp contrast with the premium signaled by the price-to-earnings ratio, raising an important question for investors: which story better captures the real opportunity?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out First Bancorp for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 926 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own First Bancorp Narrative

If you have a different perspective or simply want to examine the figures firsthand, you can craft your own narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding First Bancorp.

Looking for more investment ideas?

Seize the opportunity to upgrade your investment strategy with handpicked stocks that match your goals. The Simply Wall Street Screener gives you an edge you will not want to miss.

- Capture high-yield opportunities by checking out these 16 dividend stocks with yields > 3% which offers attractive returns above 3% for your income portfolio.

- Spot the next tech breakthrough when you review these 26 AI penny stocks that are powering advances in artificial intelligence and automation.

- Strengthen your portfolio with these 926 undervalued stocks based on cash flows that may offer compelling value based on robust cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FBNC

First Bancorp

Operates as the bank holding company for First Bank that provides banking products and services for individuals and businesses.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives