- United States

- /

- Banks

- /

- NasdaqGS:ESSA

Here's Why I Think ESSA Bancorp (NASDAQ:ESSA) Might Deserve Your Attention Today

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In contrast to all that, I prefer to spend time on companies like ESSA Bancorp (NASDAQ:ESSA), which has not only revenues, but also profits. While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

Check out our latest analysis for ESSA Bancorp

How Fast Is ESSA Bancorp Growing Its Earnings Per Share?

Over the last three years, ESSA Bancorp has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. Thus, it makes sense to focus on more recent growth rates, instead. It's good to see that ESSA Bancorp's EPS have grown from US$1.23 to US$1.48 over twelve months. I doubt many would complain about that 20% gain.

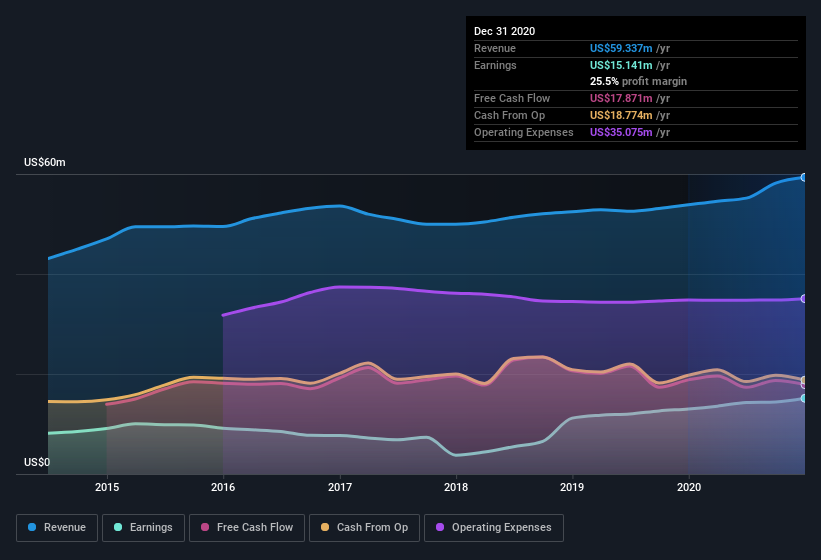

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). I note that ESSA Bancorp's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. ESSA Bancorp maintained stable EBIT margins over the last year, all while growing revenue 10% to US$59m. That's progress.

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

ESSA Bancorp isn't a huge company, given its market capitalization of US$157m. That makes it extra important to check on its balance sheet strength.

Are ESSA Bancorp Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

In twelve months, insiders sold -US$14k worth of ESSA Bancorp shares. On the other hand, Executive VP & Chief Banking Officer Peter Gray paid US$34k for shares, at a price of about US$13.42 per share. So, on balance, that's positive.

Along with the insider buying, another encouraging sign for ESSA Bancorp is that insiders, as a group, have a considerable shareholding. Indeed, they hold US$14m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. Those holdings account for over 8.6% of the company; visible skin in the game.

Is ESSA Bancorp Worth Keeping An Eye On?

As I already mentioned, ESSA Bancorp is a growing business, which is what I like to see. On top of that, we've seen insiders buying shares even though they already own plenty. That makes the company a prime candidate for my watchlist - and arguably a research priority. We should say that we've discovered 1 warning sign for ESSA Bancorp that you should be aware of before investing here.

As a growth investor I do like to see insider buying. But ESSA Bancorp isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade ESSA Bancorp, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if ESSA Bancorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:ESSA

ESSA Bancorp

Operates as a bank holding company for ESSA Bank & Trust that provides a range of financial services to individuals, families, and businesses in Pennsylvania.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives