- United States

- /

- Banks

- /

- NasdaqGS:EFSC

Regional Bank CEOs’ Loan Reassurances Could Be a Game Changer for Enterprise Financial Services (EFSC)

Reviewed by Sasha Jovanovic

- Investor sentiment toward regional banks improved in the past week as CEOs, including those at Enterprise Financial Services, reassured markets about the health of their loan portfolios and helped ease concerns about a potential credit crisis reminiscent of the 2023 turmoil.

- This wave of reassuring commentary from regional bank leaders played a crucial role in stabilizing the sector and restoring confidence after a period of heightened volatility.

- We’ll explore how the renewed confidence in regional bank loan quality shapes the outlook for Enterprise Financial Services’s investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Enterprise Financial Services Investment Narrative Recap

For shareholders in Enterprise Financial Services, a core belief centers on the resilience of its loan book and disciplined credit risk management, factors that underpin the company’s ability to deliver consistent profitability despite regional economic fluctuations. The recent calming of investor sentiment around regional banks has taken some pressure off immediate credit quality concerns, but geographic concentration in the Midwest and Sunbelt remains a key short-term risk to closely monitor, particularly if local economic or real estate conditions soften further. The impact of CEO reassurance appears constructive for sentiment, though not materially shifting these underlying risks and catalysts at this stage.

Among the latest announcements, Enterprise Financial Services has been added to the S&P Banks Select Industry Index, reflecting not only sector recognition, but also the company’s potential to attract greater investor attention just as confidence in loan quality rebounds. This index inclusion could support near-term interest around the stock, especially with ongoing branch expansion and a focus on efficiency likely to remain important drivers for future performance. However, in contrast to these positives, investors should not overlook that...

Read the full narrative on Enterprise Financial Services (it's free!)

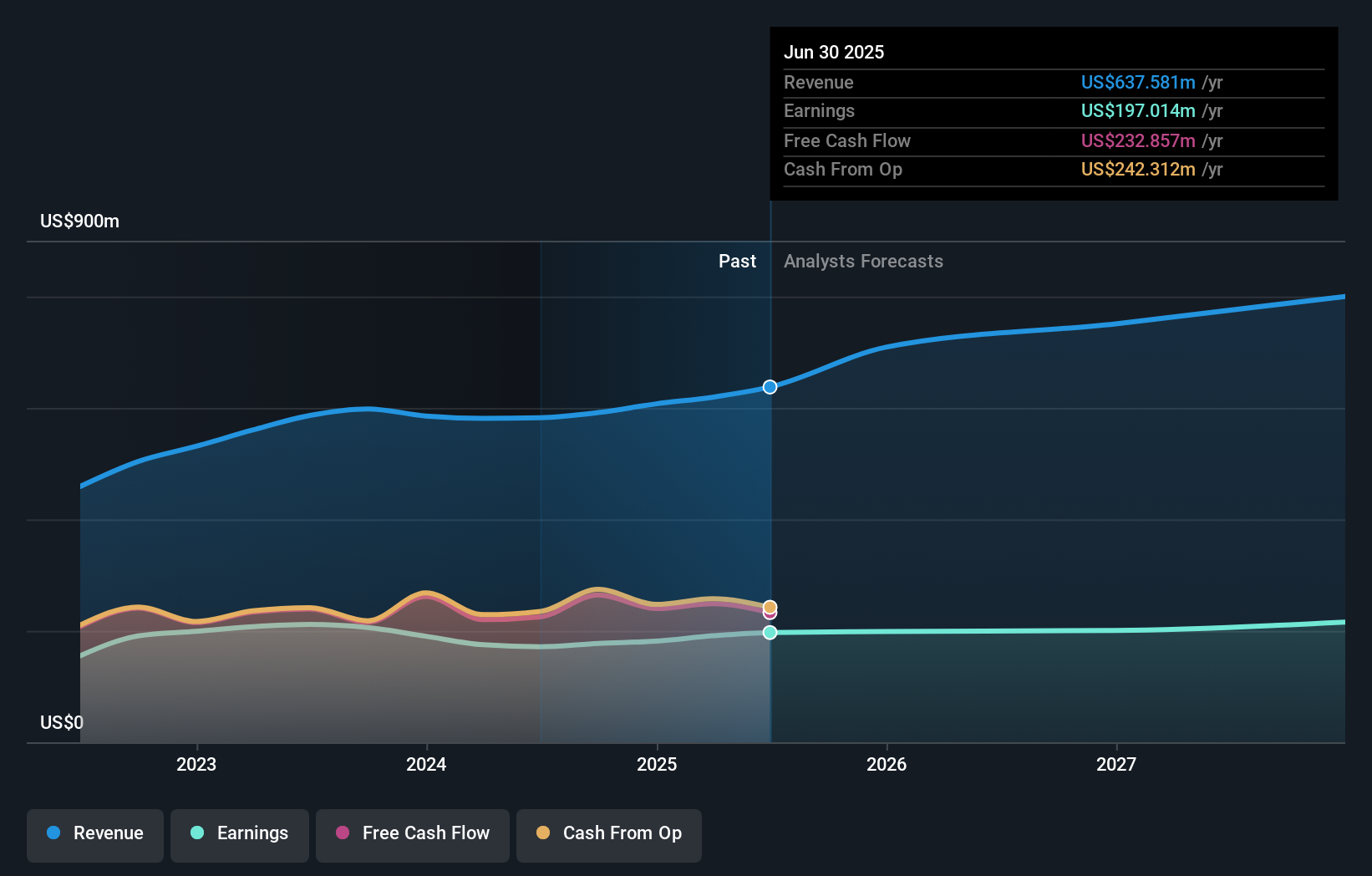

Enterprise Financial Services is projected to reach $850.9 million in revenue and $205.1 million in earnings by 2028. This outlook assumes a 10.1% annual revenue growth rate and an $8.1 million increase in earnings from the current level of $197.0 million.

Uncover how Enterprise Financial Services' forecasts yield a $67.00 fair value, a 21% upside to its current price.

Exploring Other Perspectives

Only one fair value estimate of US$67 appears in the Simply Wall St Community, showing limited diversity among retail investors’ views. While recent CEO commentary has helped stabilize sector sentiment, risks tied to Enterprise Financial Services’ geographic concentration and commercial lending mix highlight the need to explore a range of performance scenarios before drawing conclusions.

Explore another fair value estimate on Enterprise Financial Services - why the stock might be worth as much as 21% more than the current price!

Build Your Own Enterprise Financial Services Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Enterprise Financial Services research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Enterprise Financial Services research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Enterprise Financial Services' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Enterprise Financial Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EFSC

Enterprise Financial Services

Operates as the financial holding company for Enterprise Bank & Trust that offers banking and wealth management services to individuals and corporate customers in Arizona, California, Florida, Kansas, Missouri, Nevada, and New Mexico.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives