- United States

- /

- Banks

- /

- NasdaqGS:EBC

Strong Q2 Earnings and Dividend From Eastern Bankshares (EBC) Might Change The Case For Investing

Reviewed by Simply Wall St

- Eastern Bankshares recently reported second quarter financial results, announcing net interest income of US$202 million and net income of US$100.2 million, alongside the declaration of a US$0.13 per share quarterly dividend and progress on its share repurchase program.

- The sharp year-over-year rise in earnings, combined with ongoing capital return initiatives, reflects an emphasis on delivering shareholder value and financial strength.

- We’ll now explore how the improved quarterly earnings update could influence Eastern Bankshares’ investment narrative and market positioning.

Eastern Bankshares Investment Narrative Recap

For shareholders, the core thesis behind Eastern Bankshares centers on successful integration of recent acquisitions, the ongoing expansion in its core markets, and resilience in earnings despite current asset quality headwinds. While the significant jump in second quarter net income is positive, potential risks tied to commercial real estate exposures, particularly office loans, remain the most immediate challenge, and this result does not materially reduce concerns around short-term asset quality volatility.

The standout announcement this period is the robust increase in quarterly net interest income and net income compared to last year. This provides further context for evaluating the company's ability to manage credit costs, absorb potential loan losses, and deliver stable returns, given persistent industry concerns about commercial real estate lending.

However, investors should be aware that even with this earnings rebound, the risks surrounding commercial real estate loan reserves could still impact near-term results...

Read the full narrative on Eastern Bankshares (it's free!)

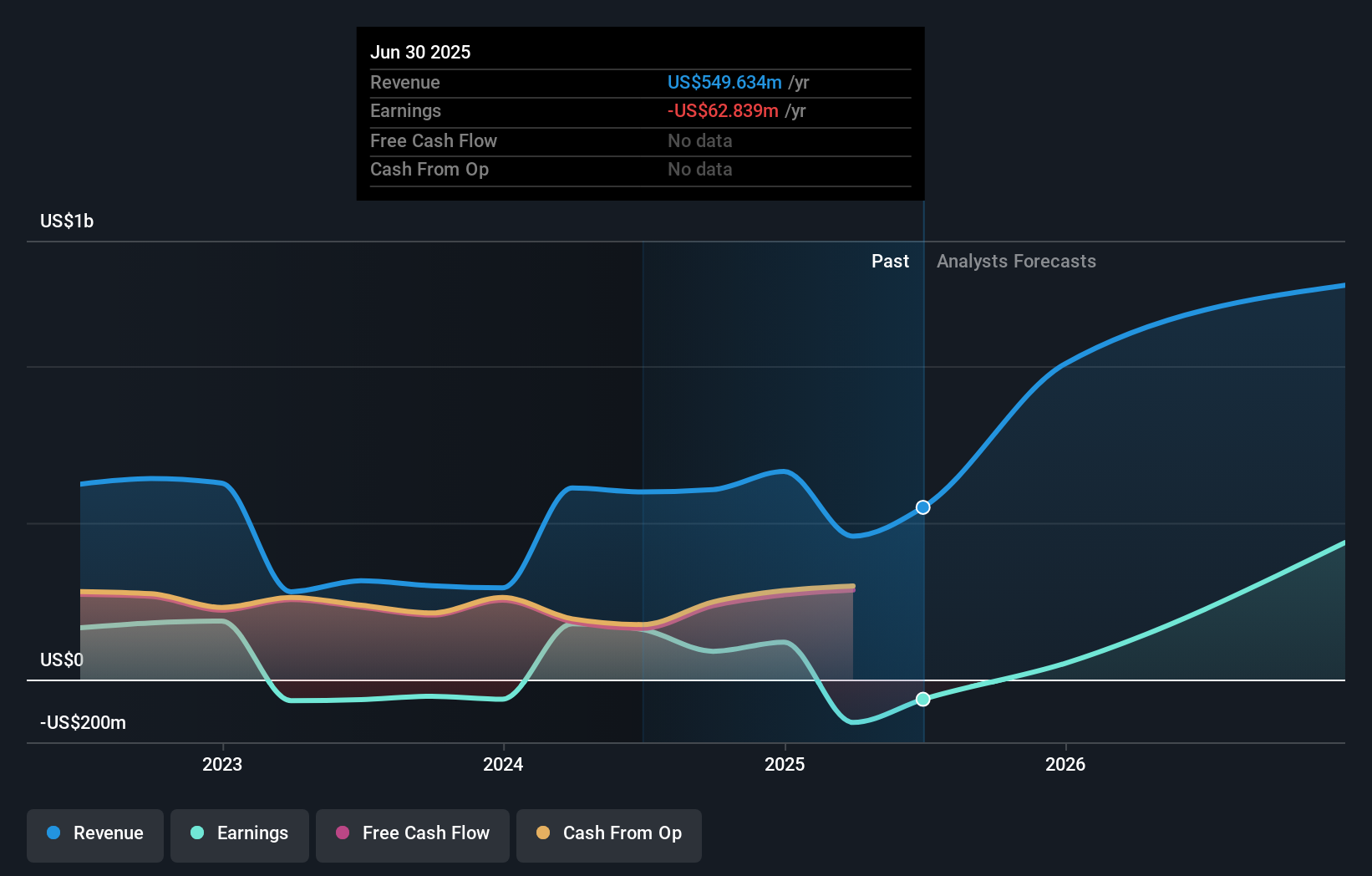

Eastern Bankshares is projected to achieve $1.1 billion in revenue and $434.1 million in earnings by 2028. This outlook assumes an annual revenue growth rate of 21.2%, with earnings rising by $343.8 million from the current $90.3 million.

Exploring Other Perspectives

All one of the Simply Wall St Community fair value estimates place Eastern Bankshares at US$19.00 per share. While optimism rests on integration and earnings growth, concerns about commercial real estate exposure could shape future performance. See how your conclusions compare with other investors’ perspectives.

Build Your Own Eastern Bankshares Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Eastern Bankshares research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Eastern Bankshares research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Eastern Bankshares' overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover the 26 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eastern Bankshares might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EBC

Eastern Bankshares

Operates as the bank holding company for Eastern Bank that provides banking, trust, and investment services to retail, commercial, and small business customers.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives