- United States

- /

- Banks

- /

- NasdaqGS:DCOM

Dime Community Bancshares (NASDAQ:DCOM) Will Pay A Dividend Of $0.25

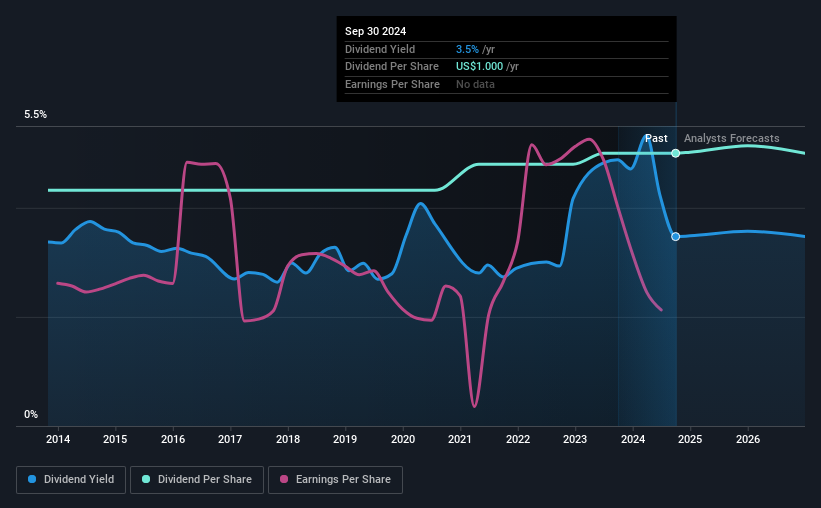

Dime Community Bancshares, Inc. (NASDAQ:DCOM) will pay a dividend of $0.25 on the 24th of October. Based on this payment, the dividend yield will be 3.5%, which is fairly typical for the industry.

While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. Investors will be pleased to see that Dime Community Bancshares' stock price has increased by 39% in the last 3 months, which is good for shareholders and can also explain a decrease in the dividend yield.

View our latest analysis for Dime Community Bancshares

Dime Community Bancshares' Earnings Will Easily Cover The Distributions

Unless the payments are sustainable, the dividend yield doesn't mean too much.

Having distributed dividends for at least 10 years, Dime Community Bancshares has a long history of paying out a part of its earnings to shareholders. Taking data from its last earnings report, calculating for the company's payout ratio shows 65%, which means that Dime Community Bancshares would be able to pay its last dividend without pressure on the balance sheet.

Over the next 3 years, EPS is forecast to expand by 158.2%. Analysts estimate the future payout ratio will be 30% over the same time period, which is in the range that makes us comfortable with the sustainability of the dividend.

Dime Community Bancshares Has A Solid Track Record

The company has a sustained record of paying dividends with very little fluctuation. The annual payment during the last 10 years was $0.864 in 2014, and the most recent fiscal year payment was $1.00. This works out to be a compound annual growth rate (CAGR) of approximately 1.5% a year over that time. Although we can't deny that the dividend has been remarkably stable in the past, the growth has been pretty muted.

Dividend Growth May Be Hard To Come By

Investors could be attracted to the stock based on the quality of its payment history. However, things aren't all that rosy. Over the past five years, it looks as though Dime Community Bancshares' EPS has declined at around 6.1% a year. A modest decline in earnings isn't great, and it makes it quite unlikely that the dividend will grow in the future unless that trend can be reversed. Earnings are forecast to grow over the next 12 months and if that happens we could still be a little bit cautious until it becomes a pattern.

In Summary

Overall, a consistent dividend is a good thing, and we think that Dime Community Bancshares has the ability to continue this into the future. While the payments look sustainable for now, earnings have been shrinking so the dividend could come under pressure in the future. The dividend looks okay, but there have been some issues in the past, so we would be a little bit cautious.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. For instance, we've picked out 1 warning sign for Dime Community Bancshares that investors should take into consideration. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:DCOM

Dime Community Bancshares

Operates as the holding company for Dime Community Bank that engages in the provision of various commercial banking and financial services.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success