- United States

- /

- Banks

- /

- NasdaqCM:CZNC

Citizens & Northern (NASDAQ:CZNC) Is Due To Pay A Dividend Of $0.28

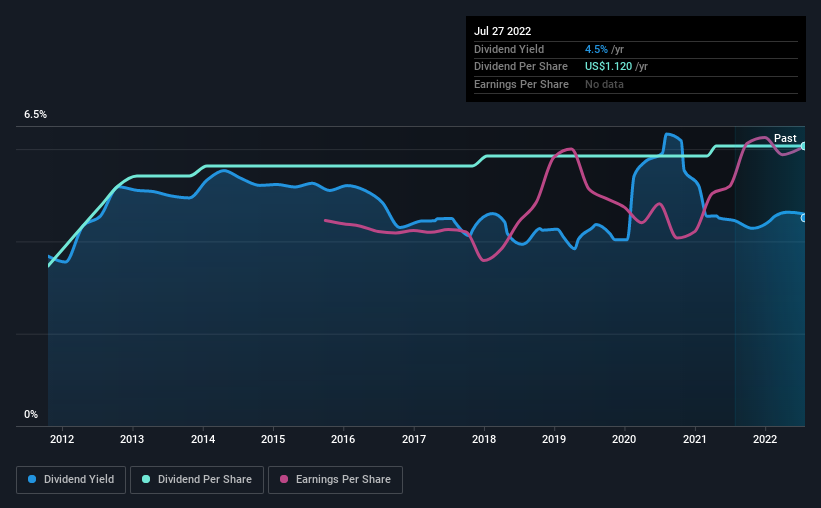

Citizens & Northern Corporation (NASDAQ:CZNC) will pay a dividend of $0.28 on the 12th of August. The dividend yield will be 4.5% based on this payment which is still above the industry average.

See our latest analysis for Citizens & Northern

Citizens & Northern's Payment Expected To Have Solid Earnings Coverage

If the payments aren't sustainable, a high yield for a few years won't matter that much.

Citizens & Northern has established itself as a dividend paying company with over 10 years history of distributing earnings to shareholders. Past distributions do not necessarily guarantee future ones, but Citizens & Northern's payout ratio of 61% is a good sign as this means that earnings decently cover dividends.

Over the next year, EPS could expand by 7.3% if recent trends continue. If the dividend continues on this path, the future payout ratio could be 57% by next year, which we think can be pretty sustainable going forward.

Citizens & Northern Has A Solid Track Record

Even over a long history of paying dividends, the company's distributions have been remarkably stable. The dividend has gone from an annual total of $0.64 in 2012 to the most recent total annual payment of $1.12. This implies that the company grew its distributions at a yearly rate of about 5.8% over that duration. Dividends have grown at a reasonable rate over this period, and without any major cuts in the payment over time, we think this is an attractive combination as it provides a nice boost to shareholder returns.

The Dividend Has Growth Potential

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. It's encouraging to see that Citizens & Northern has been growing its earnings per share at 7.3% a year over the past five years. Earnings are on the uptrend, and it is only paying a small portion of those earnings to shareholders.

Citizens & Northern Looks Like A Great Dividend Stock

Overall, we like to see the dividend staying consistent, and we think Citizens & Northern might even raise payments in the future. Distributions are quite easily covered by earnings, which are also being converted to cash flows. All of these factors considered, we think this has solid potential as a dividend stock.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. You can also discover whether shareholders are aligned with insider interests by checking our visualisation of insider shareholdings and trades in Citizens & Northern stock. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:CZNC

Citizens & Northern

Operates as the bank holding company for Citizens & Northern Bank that provides various banking and related services to individual and corporate customers.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives