- United States

- /

- Banks

- /

- NasdaqGS:NRIM

Exploring Three Undiscovered Gems In The United States Market

Reviewed by Simply Wall St

The United States market has demonstrated robust growth, climbing by 5.1% over the past week and rising 36% over the last year, with earnings forecasted to grow by 15% annually. In such a dynamic environment, identifying stocks that are not only poised for growth but also remain underappreciated can offer unique opportunities for investors seeking to capitalize on emerging potential.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 169.49% | 12.30% | 1.92% | ★★★★★★ |

| Franklin Financial Services | 222.36% | 5.55% | -1.86% | ★★★★★★ |

| Parker Drilling | 46.25% | -0.33% | 53.04% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Nanophase Technologies | 40.87% | 24.19% | -9.71% | ★★★★★☆ |

Here we highlight a subset of our preferred stocks from the screener.

Citizens Financial Services (NasdaqCM:CZFS)

Simply Wall St Value Rating: ★★★★★★

Overview: Citizens Financial Services, Inc., a bank holding company, offers a range of banking products and services to individual, business, governmental, and institutional clients with a market cap of $328.47 million.

Operations: Citizens Financial Services generates revenue primarily through its community banking segment, amounting to $98.20 million. The company's market capitalization is approximately $328.47 million.

Citizens Financial Services, with total assets of US$3 billion and equity of US$298.7 million, stands out for its robust financial health. The bank's earnings growth over the past year hit 50.9%, far surpassing the industry average of -12.2%. It maintains a solid bad loan allowance at 101% and keeps non-performing loans at a manageable 0.9% of total loans, indicating prudent risk management practices. Despite recent volatility in share price, it trades significantly below its estimated fair value by about 52%. With deposits totaling US$2.5 billion and loans at US$2.3 billion, Citizens operates primarily on low-risk funding sources like customer deposits, positioning it well for future stability amidst market fluctuations.

Capital City Bank Group (NasdaqGS:CCBG)

Simply Wall St Value Rating: ★★★★★★

Overview: Capital City Bank Group, Inc. is a financial holding company for Capital City Bank, offering various banking-related services to individual and corporate clients with a market capitalization of $650.50 million.

Operations: Capital City Bank Group generates revenue primarily through its commercial banking segment, which contributes $226.02 million. The company has a market capitalization of approximately $650.50 million.

Capital City Bank Group, a notable player with $4.2 billion in assets and $476.5 million in equity, stands out for its robust financial health. With total deposits at $3.6 billion and loans at $2.7 billion, it maintains a net interest margin of 4.1%. The bank has a solid allowance for bad loans at 0.2%, indicating prudent risk management, while 95% of its liabilities are low-risk customer deposits. Despite earnings growth of 2.8% last year outperforming the industry average, future earnings might see minor declines over the next few years by an average of 0.8% annually.

Northrim BanCorp (NasdaqGS:NRIM)

Simply Wall St Value Rating: ★★★★★★

Overview: Northrim BanCorp, Inc. is a bank holding company for Northrim Bank, offering commercial banking products and services to businesses and professionals, with a market cap of $413.86 million.

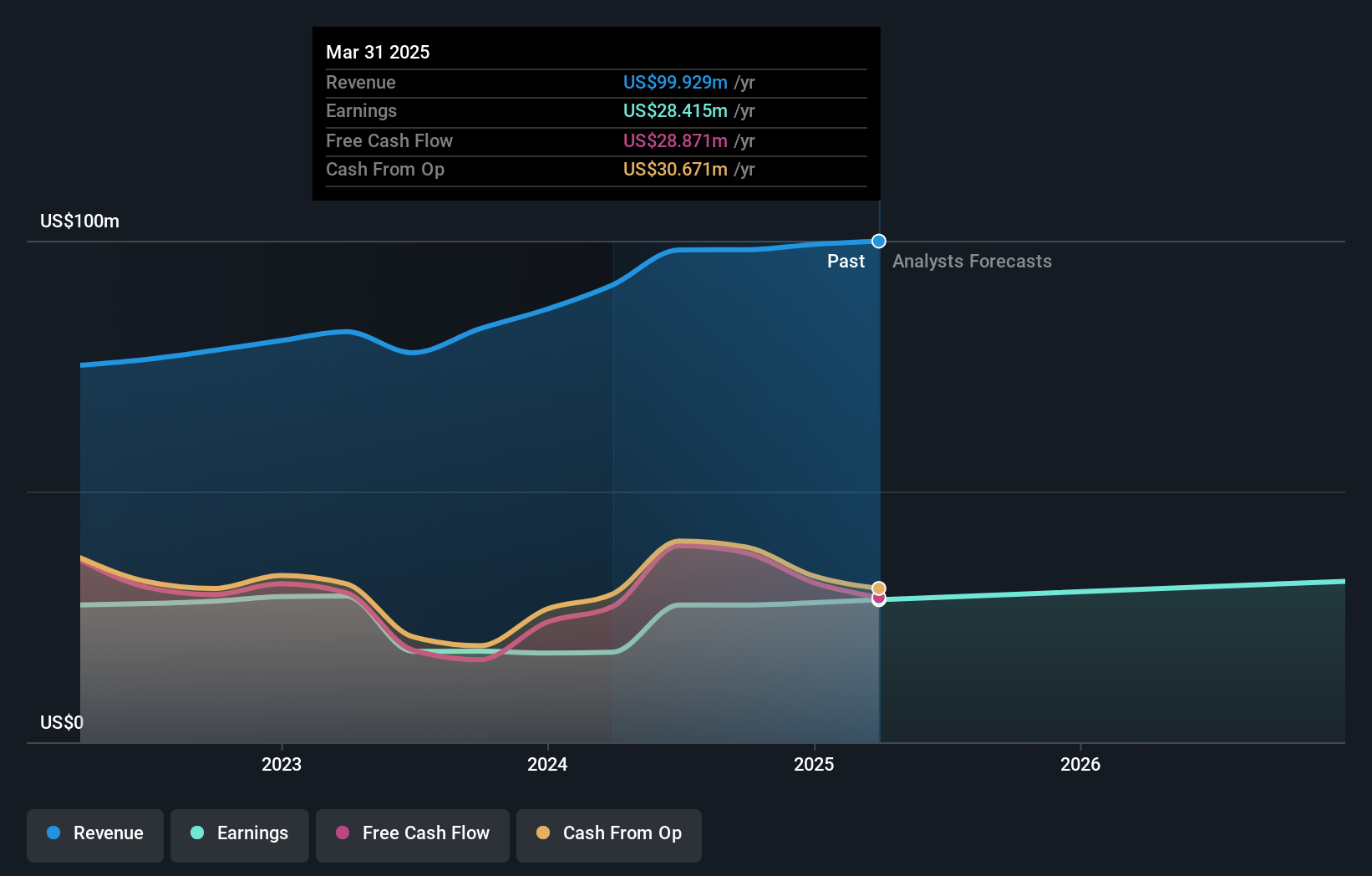

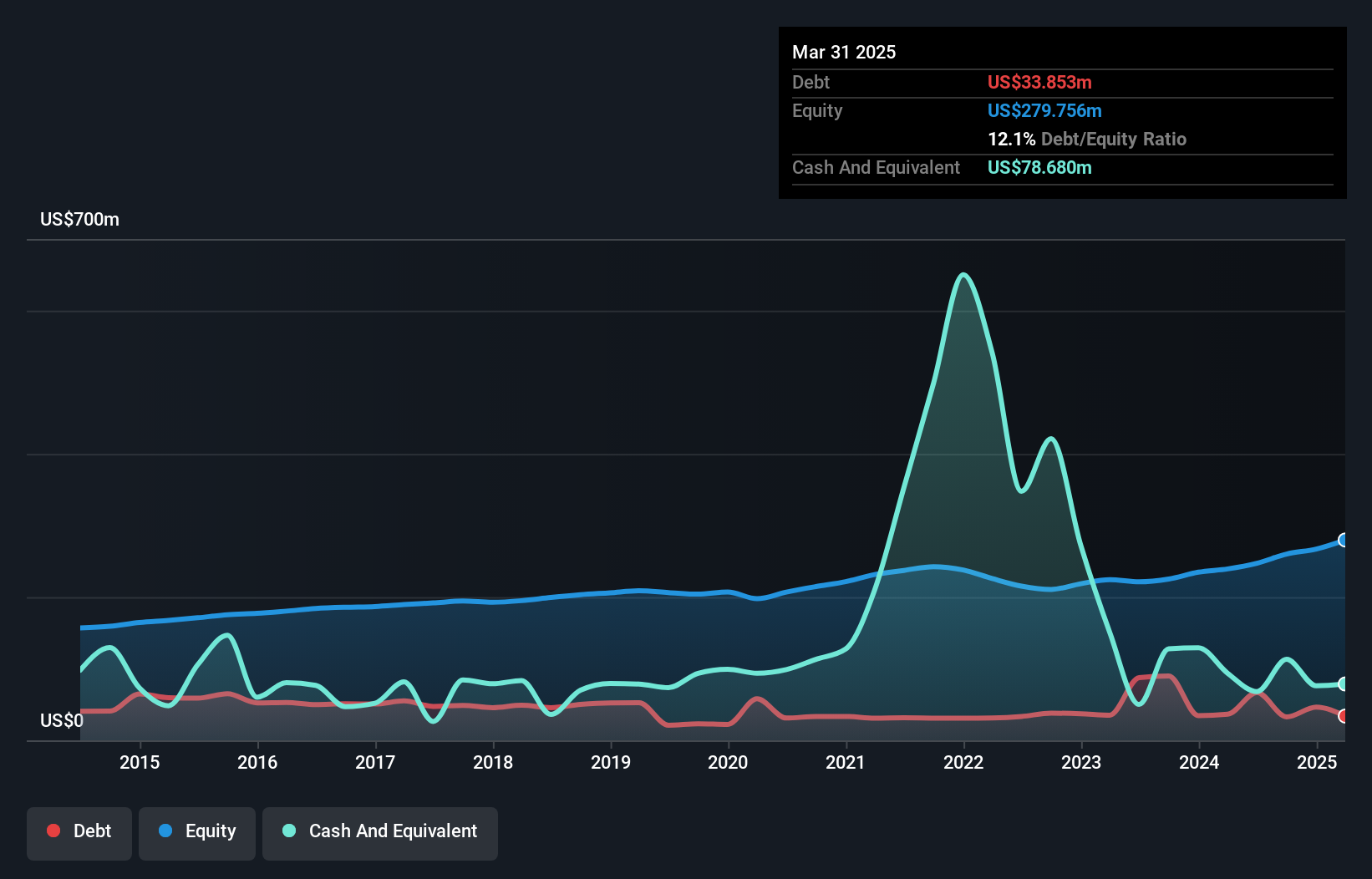

Operations: Northrim BanCorp generates revenue primarily from its Community Banking segment, which accounts for $112.55 million, and its Home Mortgage Lending segment, contributing $29.04 million.

Northrim BanCorp, with total assets of US$3 billion and equity of US$260.1 million, stands out in the banking sector. It boasts a net interest margin of 4.2% and maintains an appropriate level of non-performing loans at 0.2%. Earnings grew by 19.3%, outpacing the industry average, while deposits reached US$2.6 billion against loans totaling US$2 billion. Recent acquisition discussions about Sallyport Commercial Finance highlight strategic growth moves, though no shares were repurchased recently despite prior announcements. The bank's robust bad loan allowance at 394% underscores its financial prudence amidst evolving market dynamics.

Turning Ideas Into Actions

- Dive into all 225 of the US Undiscovered Gems With Strong Fundamentals we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northrim BanCorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NRIM

Northrim BanCorp

Operates as the bank holding company for Northrim Bank that provides commercial banking products and services to businesses and professional individuals.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives