- United States

- /

- Banks

- /

- NasdaqCM:CWBC

Community West Bancshares (NASDAQ:CWBC) Will Pay A Dividend Of $0.12

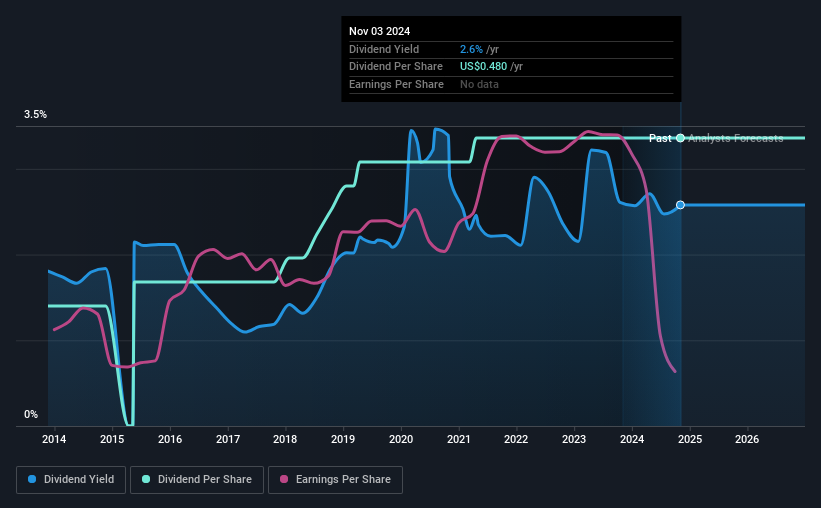

Community West Bancshares' (NASDAQ:CWBC) investors are due to receive a payment of $0.12 per share on 22nd of November. Including this payment, the dividend yield on the stock will be 2.6%, which is a modest boost for shareholders' returns.

See our latest analysis for Community West Bancshares

Community West Bancshares' Payment Expected To Have Solid Earnings Coverage

While yield is important, another factor to consider about a company's dividend is whether the current payout levels are feasible.

Community West Bancshares has established itself as a dividend paying company with over 10 years history of distributing earnings to shareholders. Despite this history however, the company's latest earnings report actually shows that it didn't have enough earnings to cover its dividends. This is an alarming sign for the sustainability of its dividends, as it may mean that Community West Bancsharesis pulling cash from elsewhere to keep its shareholders happy.

Looking forward, earnings per share is forecast by analysts to rise exponentially over the next 3 years. They also expect the future payout ratio to be 22% over the same period, which would make us comfortable with the dividend's sustainability, despite the levels currently being elevated.

Dividend Volatility

The company's dividend history has been marked by instability, with at least one cut in the last 10 years. The dividend has gone from an annual total of $0.20 in 2014 to the most recent total annual payment of $0.48. This means that it has been growing its distributions at 9.1% per annum over that time. We like to see dividends have grown at a reasonable rate, but with at least one substantial cut in the payments, we're not certain this dividend stock would be ideal for someone intending to live on the income.

Dividend Growth Potential Is Shaky

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Community West Bancshares' earnings per share has shrunk at 27% a year over the past five years. Such rapid declines definitely have the potential to constrain dividend payments if the trend continues into the future. Over the next year, however, earnings are actually predicted to rise, but we would still be cautious until a track record of earnings growth can be built.

We should note that Community West Bancshares has issued stock equal to 60% of shares outstanding. Trying to grow the dividend when issuing new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill. Companies that consistently issue new shares are often suboptimal from a dividend perspective.

Community West Bancshares' Dividend Doesn't Look Sustainable

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. The track record isn't great, and the payments are a bit high to be considered sustainable. We would be a touch cautious of relying on this stock primarily for the dividend income.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Just as an example, we've come across 3 warning signs for Community West Bancshares you should be aware of, and 1 of them is significant. Is Community West Bancshares not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:CWBC

Community West Bancshares

Operates as the bank holding company for the Central Valley Community Bank that provides various commercial banking services to small and middle-market businesses and individuals in California.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives