- United States

- /

- Banks

- /

- NasdaqGS:COLB

Columbia Banking System (COLB): Evaluating Valuation After Major Share Buyback and Leadership Changes

Reviewed by Simply Wall St

Columbia Banking System (COLB) announced a $700 million share repurchase program, highlighting management’s confidence in the company’s financial footing. This move arrives in conjunction with leadership changes and recent quarterly results showing mixed performance.

See our latest analysis for Columbia Banking System.

Columbia Banking System’s share price has rebounded by 5.6% over the past month, building some positive momentum after a challenging year that saw a one-year total shareholder return of -7.5%. Recent leadership shifts and the new buyback highlight management’s efforts to adapt to current headwinds and position the company for steadier growth. Net interest income continues to trend upward even as bottom-line results remain mixed.

If you’re curious about which other fast-rising companies are getting noticed, now’s the perfect moment to expand your search and discover fast growing stocks with high insider ownership

With shares trading below analyst targets and the company unveiling major buybacks alongside solid revenue growth, the question for investors is clear: Is Columbia Banking System undervalued right now, or is the market already pricing in its next leg of growth?

Most Popular Narrative: 7.2% Undervalued

With Columbia Banking System's fair value estimated at $29.23 and the latest close at $27.14, the most popular narrative sees shares trading at a meaningful discount, setting up a debate around the path to realizing that upside.

The planned acquisition and integration of Pacific Premier is positioned to significantly expand Columbia's customer base and market reach in high-growth Western U.S. regions, increasing loan and deposit growth as both population and economic activity continue to rise in these areas; this is likely to have a positive impact on revenue and long-term earnings.

What numbers fuel this bullish thesis? The narrative is built on aggressive forecasts: revenue acceleration, fatter profit margins, and an earnings surge that would put Columbia among standouts in the sector. The playbook relies on a future profit multiple that is well below the industry. Want to know just how much growth is baked in? Only the full narrative reveals the high-stakes projections and the bold assumptions behind that fair value.

Result: Fair Value of $29.23 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution risks tied to major integrations and Columbia’s geographic concentration could challenge the bullish outlook if these factors impact earnings or growth momentum.

Find out about the key risks to this Columbia Banking System narrative.

Another View: Multiples Show a Different Story

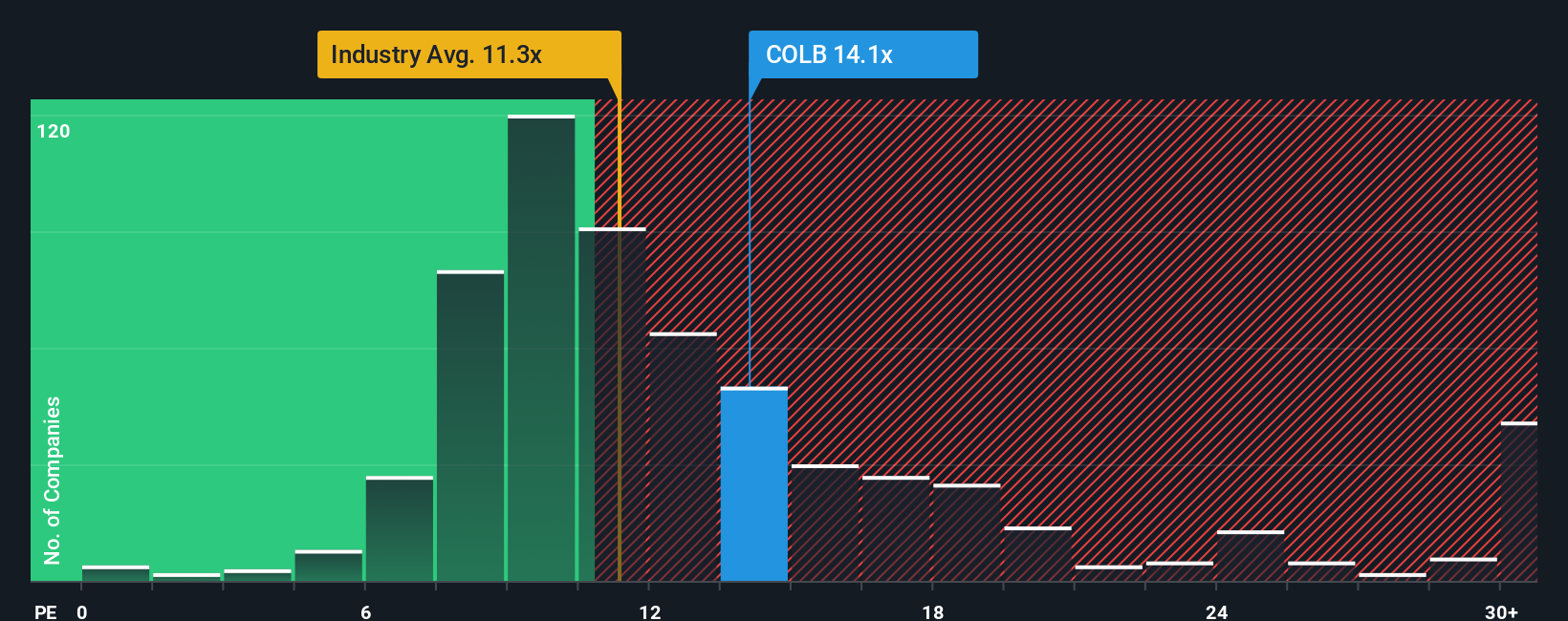

While one method suggests shares are undervalued, comparing Columbia's price-to-earnings ratio of 17x to the industry’s 11.2x and the average peer’s 25.2x paints a mixed picture. The ratio aligns almost perfectly with our estimate of the fair ratio at 17.2x, so there may not be a glaring bargain. Is the market already pricing in what is next, or are investors missing something?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Columbia Banking System Narrative

If you want to test these conclusions or dig into the details yourself, you can analyze the numbers and build your own perspective in just a few minutes, Do it your way

A great starting point for your Columbia Banking System research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don't let the best opportunities pass you by. Use Simply Wall Street’s screeners to find promising stocks that align with your strategy and get ahead of the curve.

- Unlock the chance for high yields by checking out these 14 dividend stocks with yields > 3%, which features companies with strong, reliable payouts.

- Tap into innovative sectors by scanning these 27 quantum computing stocks to spot trailblazers in quantum computing before the crowd catches on.

- Supercharge your search for bargains focused on real cash flow strength with these 882 undervalued stocks based on cash flows to avoid overhyped duds.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COLB

Columbia Banking System

Operates as the Bank holding company of Columbia Bank that provides banking, private banking, mortgage, and other financial services in the United States.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives