- United States

- /

- Banks

- /

- NasdaqGS:COLB

Columbia Banking System (COLB): Assessing Valuation as Loan Quality Concerns Grow Among Regional Banks

Reviewed by Kshitija Bhandaru

Recent updates from regional lenders stirred anxiety across the sector, as disclosures of large loan charge-offs and collateral concerns at Zions Bancorp and Western Alliance sparked renewed scrutiny of Columbia Banking System (COLB).

See our latest analysis for Columbia Banking System.

Columbia Banking System’s share price has seen notable swings this year as industry-wide worries about loan quality have been counterbalanced by occasional rebounds tied to positive signals from the Fed and strong quarterly results from major banks. After a solid stretch, momentum has faded, with a year-to-date share price return of -9.5%. This echoes investor nerves about risks in regional lending even as the longer-term, five-year total shareholder return remains a healthy 43%.

If financial shake-ups have you curious about what else is out there, now’s a smart time to broaden your search and discover fast growing stocks with high insider ownership

With Columbia Banking System’s shares trading at a sizable discount to analyst targets, investors are left to wonder: does this mark a compelling entry point, or has the market already priced in all of the company’s future upside?

Most Popular Narrative: 16.8% Undervalued

Columbia Banking System’s latest close sits significantly below the most widely tracked fair value estimate, suggesting notable expectations for upside if narrative assumptions are met. The fair value in focus is grounded in projections for expansion, innovation, and margin improvement over the next several years.

"Continued investment in AI, digital banking platforms, and embedded financial products is expected to drive greater customer engagement, acquisition, and retention, particularly as more consumers and businesses shift to digital channels, supporting higher fee income and reduced operating costs, thus improving net margins and earnings."

Want to know which financial forecast underpins this optimism? There is a bold growth plan at the heart of the valuation, with expectations for record revenue jumps, margin expansion, and a significant focus on next-generation banking strategy. Curious what is fueling analysts’ high conviction? Start exploring the full story and the assumptions that could shift the share price trajectory.

Result: Fair Value of $29.23 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing integration challenges and continued reliance on volatile Western markets could quickly shift the outlook if growth or credit conditions falter.

Find out about the key risks to this Columbia Banking System narrative.

Another View: Is the Market Telling a Different Story?

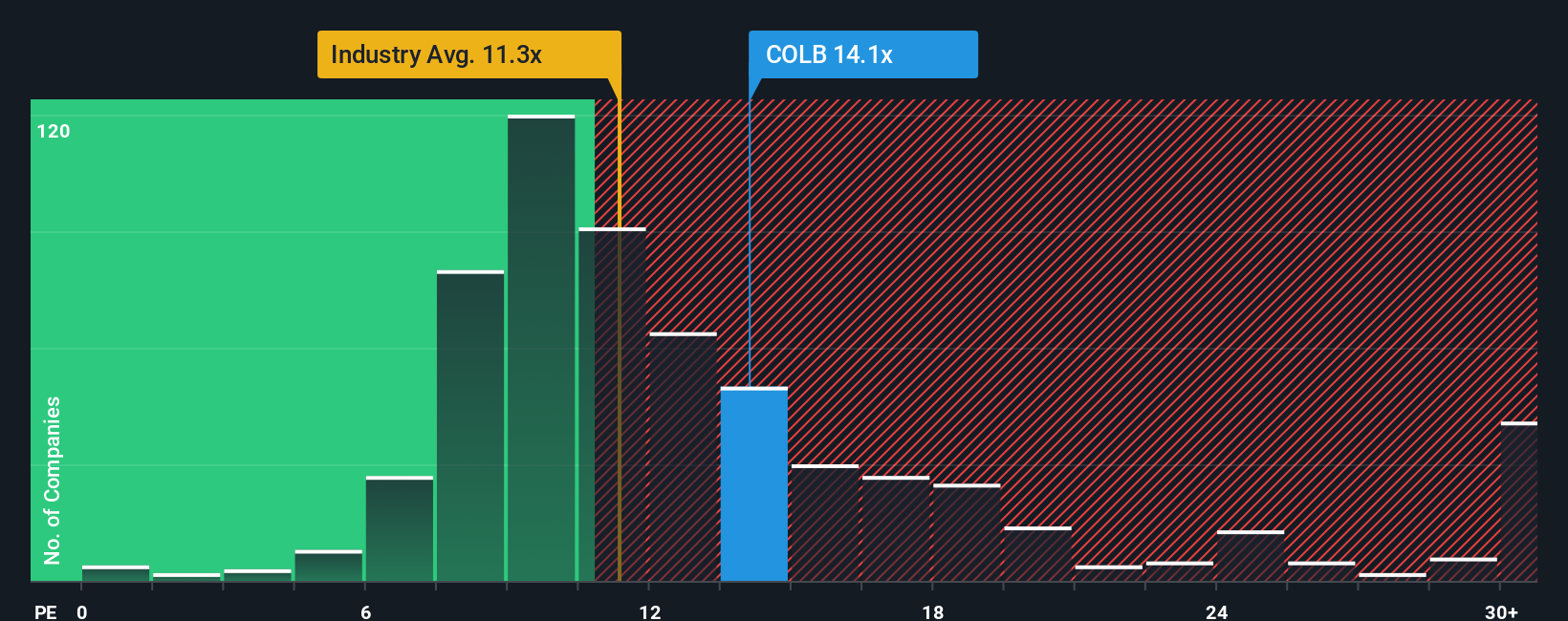

Looking at how the company is valued by the market, its price-to-earnings ratio stands at 13.8 times. This is higher than both the industry average of 11.2 and the peer group average of -7.1. However, its fair ratio is 17.8, suggesting there could still be room for price moves. Does this gap present a hidden risk, or is it actually an opportunity for investors willing to hold on through uncertainty?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Columbia Banking System Narrative

If you have your own perspective or want to dig deeper into the numbers, you can craft a narrative from fresh data in just a couple of minutes, and Do it your way.

A great starting point for your Columbia Banking System research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Paths?

Seize the chance to find your next high-potential winner by seeing which stocks are standing out right now. Don’t let opportunities pass you by when smarter ideas are just a click away.

- Unlock stocks with explosive growth potential by checking out these 3596 penny stocks with strong financials offering strong financial momentum and unique market niches.

- Strengthen your passive income strategy by reviewing these 18 dividend stocks with yields > 3% yielding over 3 percent for sustainable, robust returns that help power long-term portfolios.

- Capitalize on the future of healthcare innovation and technology by scanning these 33 healthcare AI stocks at the forefront of medical AI breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COLB

Columbia Banking System

Operates as the Bank holding company of Columbia Bank that provides banking, private banking, mortgage, and other financial services in the United States.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives