- United States

- /

- Banks

- /

- NasdaqGS:CHCO

A Look at City Holding’s (CHCO) Valuation Following Record Earnings and a Dividend Increase

Reviewed by Simply Wall St

City Holding (CHCO) saw investor attention this week after the company reported record third quarter results. Net income reached a new high, supported by strong loan growth and higher net interest income.

See our latest analysis for City Holding.

After delivering record quarterly earnings and a 10% dividend boost, City Holding’s shares have held steady, with a year-to-date share price return of 3.8%. Momentum may be modest, but a robust 1-year total shareholder return of 8.6% and 132.9% over five years shows long-term investors are still being rewarded. This reflects ongoing confidence in the company’s fundamentals, despite recent executive changes and stable buyback activity.

If City Holding’s consistency has you thinking about what other opportunities are out there, now’s the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With the stock trading at a modest premium to book value and analysts forecasting further upside, investors may wonder if City Holding is a hidden value play or if the market has already factored in future growth.

Price-to-Earnings of 14x: Is it justified?

City Holding’s shares trade at a price-to-earnings ratio (P/E) of 14x, which places them at a premium compared both to US banks and the fair value benchmark for similar companies.

The price-to-earnings ratio compares a company’s current share price to its per-share earnings. This provides a snapshot of how much investors are willing to pay for each dollar of profit. In banking, it is often used to weigh market expectations for profit growth and balance sheet health.

At 14x, City Holding’s P/E is above the US Banks average (11.2x) and exceeds the peer group average (11.9x). It is also noticeably higher than the estimated fair P/E of 10.5x. This suggests that investors are pricing in more stability and quality than sector norms. With strong historical profit growth and robust dividend payments, the market may be showing confidence. However, the gap between fair and actual multiples could be significant if expectations change.

Explore the SWS fair ratio for City Holding

Result: Price-to-Earnings of 14x (OVERVALUED)

However, a shift in banking sector sentiment or a slowdown in City Holding’s revenue growth could quickly challenge today’s optimistic valuation narrative.

Find out about the key risks to this City Holding narrative.

Another View: Discounted Cash Flow Implies Deep Value

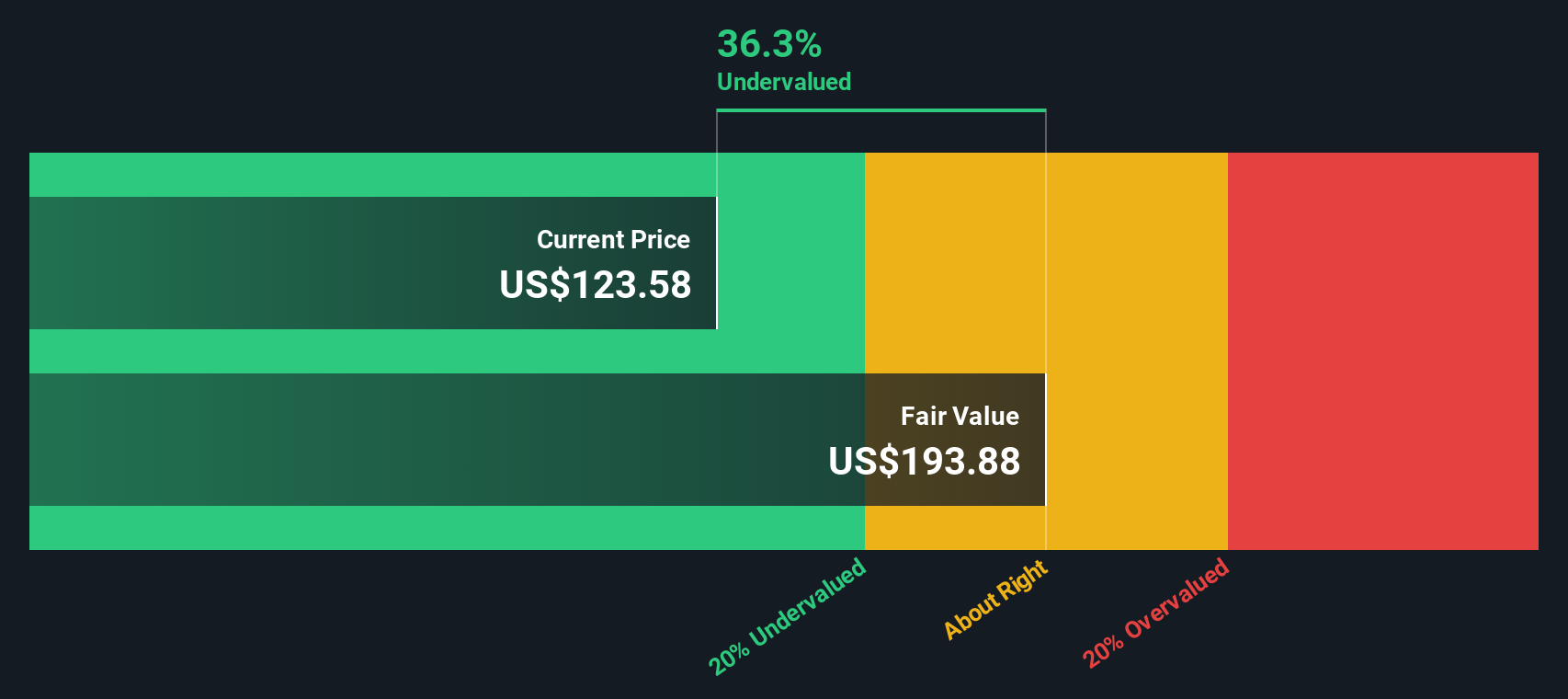

While City Holding appears pricey based on its price-to-earnings ratio, the SWS DCF model provides a very different perspective. This approach values the company’s future cash flows and indicates that shares are trading about 40% below intrinsic value, suggesting a hidden bargain. Is the market overlooking something, or is caution warranted?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out City Holding for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own City Holding Narrative

If you have a different perspective or want to dive deeper into the numbers yourself, why not build your own story and insights in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding City Holding.

Looking for More Investment Ideas?

Smart investors always keep their eye on emerging themes. There are no limits to how you can grow your portfolio, so don’t miss these standout opportunities from our screener:

- Boost your income potential and tap into market resilience by starting with these 17 dividend stocks with yields > 3%, which delivers attractive yields and consistent returns.

- Ride the momentum of next-generation breakthroughs by checking out these 27 AI penny stocks, positioned at the cutting edge of artificial intelligence and automation.

- Capitalize on value gaps with these 877 undervalued stocks based on cash flows, which analysts believe are trading well below their intrinsic worth right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CHCO

City Holding

Operates as a financial holding company for City National Bank of West Virginia that provides banking, trust and investment management, and other financial solutions in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives