- United States

- /

- Banks

- /

- NasdaqCM:CFBK

CF Bankshares (CFBK) 36% Earnings Growth Challenges Bearish Narratives on Profitability Turnaround

Reviewed by Simply Wall St

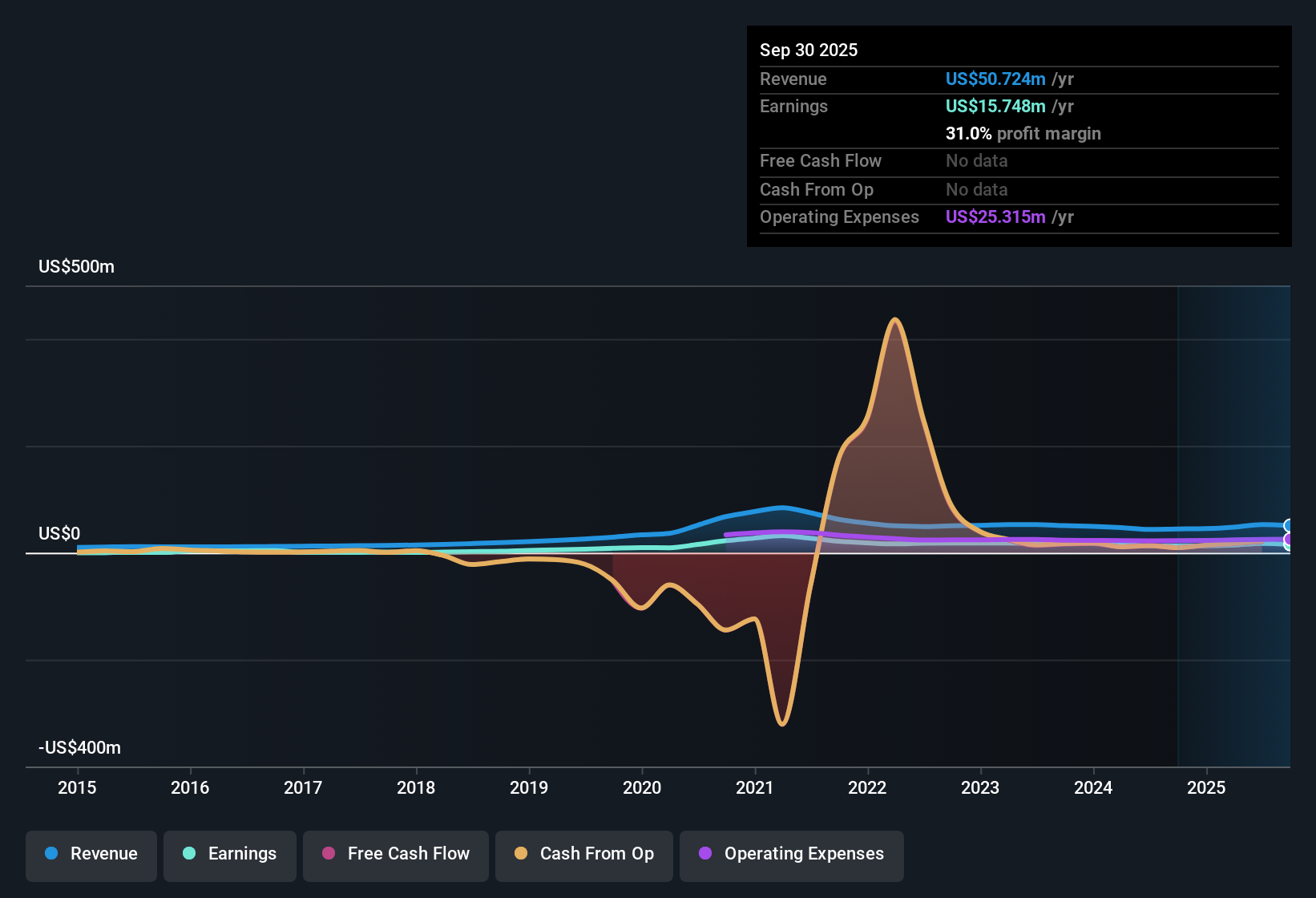

CF Bankshares (CFBK) delivered standout results this year, reversing its five-year average annual earnings decline of 11.7% with a robust 36% earnings growth and expanding net profit margins to 33.3%, up from 29.6% a year ago. The stock trades at $23.35 per share, which is notably below its estimated fair value of $46.49. It presents a price-to-earnings ratio of 8.6x, lower than both its industry and peer averages. With no material risks identified and several rewards in view, including solid profit growth and relative value, investors may see the company as attractively positioned for further gains.

See our full analysis for CF Bankshares.The real test is how these numbers stack up against the prevailing market narratives, which may reinforce some investor views while challenging others.

Curious how numbers become stories that shape markets? Explore Community Narratives

Revenue Forecast Jumps Past Market Pace

- Revenue is projected to grow at a rate of 16.1% annually for CF Bankshares, outpacing the broader US market’s forecasted 10.5% annual growth.

- What is striking is how the company’s future revenue outlook strongly supports the view that regional banks can still outgrow the industry average, especially when management guides to 16.1% annual expansion.

- This momentum builds on the recent 36% earnings increase, which lends credibility to projections for continued profit acceleration.

- In the context of average sector earnings growth at 10.5%, the above-market guidance positions CFBK as not just recovering, but as a regional outlier to watch.

Profit Margins Push Higher Than Peers

- Net profit margins rose to 33.3% this year, an increase from 29.6% a year ago, and stand out among US banks where lower margins are typical.

- The marked margin improvement adds substantial weight to the view that CFBK’s profitability run is more than just a temporary rebound,

- With many regional banks facing pressure on margins from rising costs, CFBK’s rise to 33.3% suggests strong control over its operations and a favorable revenue mix.

- This upward margin trend also signals resilience in the bank’s business model compared to sector peers that have struggled with cost inflation.

DCF Discount Signals Attractive Valuation

- CF Bankshares trades at $23.35, which is roughly half of its DCF fair value of $46.49. The bank’s price-to-earnings ratio of 8.6x is lower than both the US Banks industry average of 11x and the peer average of 15.9x.

- The current valuation gap supports the perspective that, for investors focused on value, CFBK’s shares are pricing in unusually low expectations relative to robust financial performance.

- This disconnect between growth metrics and market pricing offers an uncommon entry point, especially as no material risks are flagged in the latest filings.

- A potential re-rating toward peer multiples could deliver meaningful upside if forecast profit and margin trends persist.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on CF Bankshares's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While CF Bankshares boasts rapid earnings growth and margin expansion, its sharp profit recovery follows several years of inconsistent performance and underwhelming long-term growth.

If steadier gains are your priority, use our stable growth stocks screener (2094 results) to identify companies with proven, reliable expansion through all market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CFBK

CF Bankshares

Operates as the bank holding company for CFBank, National Association that provides various banking products and services.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives