- United States

- /

- Banks

- /

- NasdaqGS:CCBG

Capital City Bank Group (CCBG) Margin Growth Reinforces Bullish Narratives Despite Revenue Lag

Reviewed by Simply Wall St

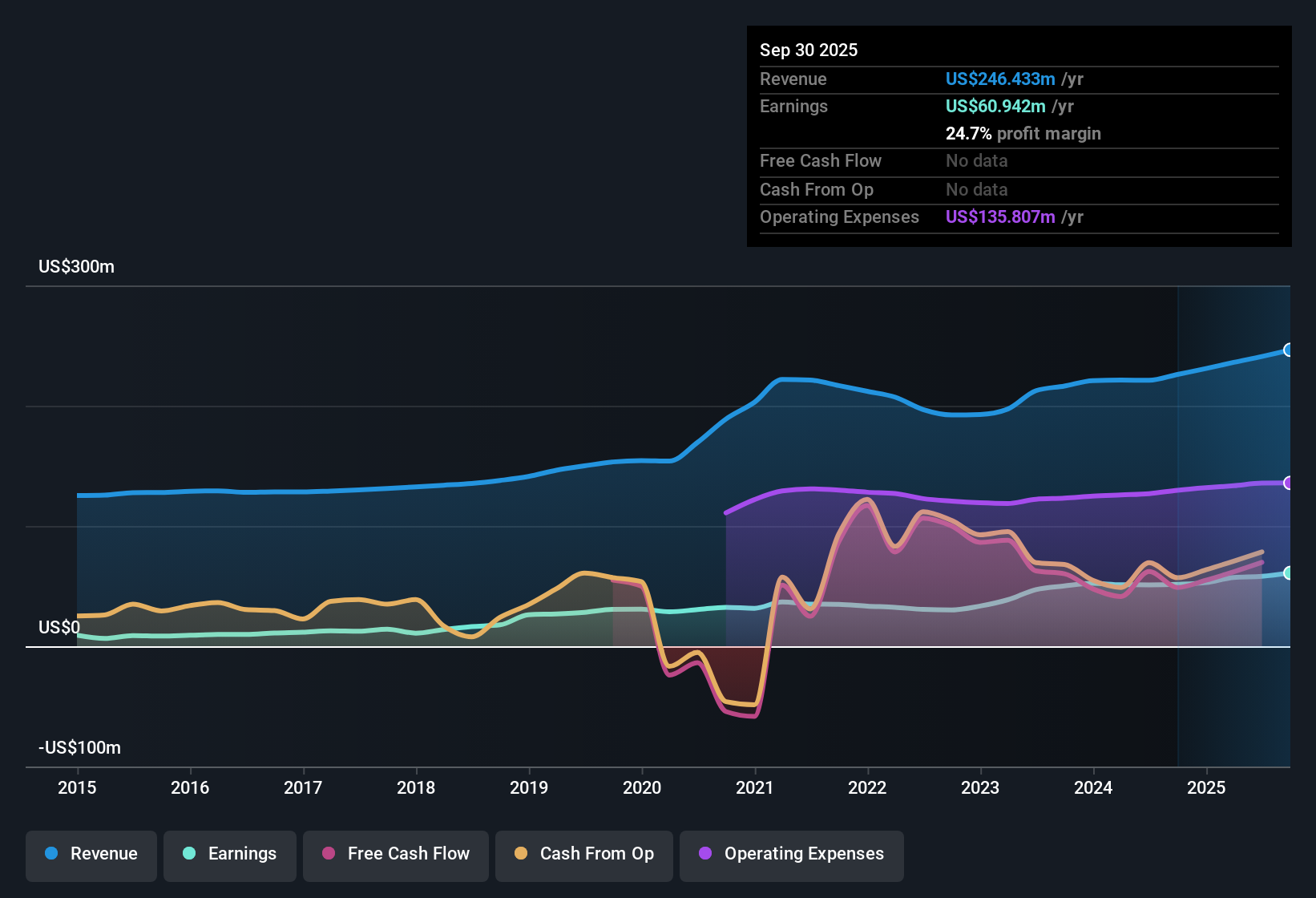

Capital City Bank Group (CCBG) posted another solid performance, with EPS climbing for the fifth straight year and annual earnings growth accelerating to 18.2%. Net profit margins also pushed higher, reaching 24.7% from 22.8% a year earlier. While revenue is projected to rise at just 4% annually versus the broader US market’s 10.1% outlook, the recent jump in profitability and steady historical growth keep investors interested, particularly with shares currently trading below the company’s estimated fair value.

See our full analysis for Capital City Bank Group.Next up, we’ll see how these numbers stack up against the most widely followed narratives among market-watchers, highlighting where the consensus holds and where it gets put to the test.

Curious how numbers become stories that shape markets? Explore Community Narratives

Five-Year Profit Growth Outpaces Peers

- Annual earnings grew at 14.5% over the past five years, higher than most regional banks in the US sector and reflecting management’s focus on sustainable profitability beyond headline revenue trends.

- What’s striking is that, despite guidance for a 2.7% annual earnings drop over the next three years, momentum from robust historical profit growth supports investor interest.

- Critics highlight that the earnings trend is at odds with the slowing 4% revenue outlook, emphasizing the gap between past strength and outlook-driven caution.

- Strong profit margins of 24.7% challenge the view that softer revenue growth alone should define the earnings power story.

Margins Edge Up as Revenue Lags Market

- Net profit margins reached 24.7%, up from 22.8% last year, while sector revenue growth runs more than twice as fast at 10.1% compared to CCBG’s 4% forecast.

- In the prevailing market view, the margin expansion heavily supports the notion that operational discipline is paying off, even as top-line growth falls short of industry averages.

- Margins at these levels challenge worries about looming pressures from softer revenue performance and show the business model’s resilience within its niche.

- At the same time, the revenue gap explains why forecasts have turned more cautious despite stable profitability metrics.

Value Appealing Against Sector, But Not All Peers

- Based on the current share price of $40.17, the stock trades below its internal DCF fair value of $69.78. This implies a notable upside gap, but the stock remains somewhat expensive compared to immediate peer valuations.

- The prevailing market perspective sees this discount to fair value as a clear positive for longer-term investors.

- Yet, some investors may remain cautious in light of CCBG’s relative premium to similar banks, especially with near-term earnings growth expected to reverse.

- The valuation narrative is shaped by a tug-of-war: historical strength and fair value support versus peer-level headwinds and tempered future guidance.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Capital City Bank Group's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite CCBG’s resilient margins and long-term profit gains, its projected revenue and earnings growth now trail the broader market and key peers.

If you want steadier performance and less uncertainty, use stable growth stocks screener (2087 results) to find companies consistently delivering reliable revenue and profit across changing market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CCBG

Capital City Bank Group

Operates as the financial holding company for Capital City Bank that provides a range of banking services to individual and corporate clients.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives