- United States

- /

- Banks

- /

- NasdaqGM:CBFV

CB Financial Services (CBFV) Margin Miss Challenges Bullish Growth Narrative

Reviewed by Simply Wall St

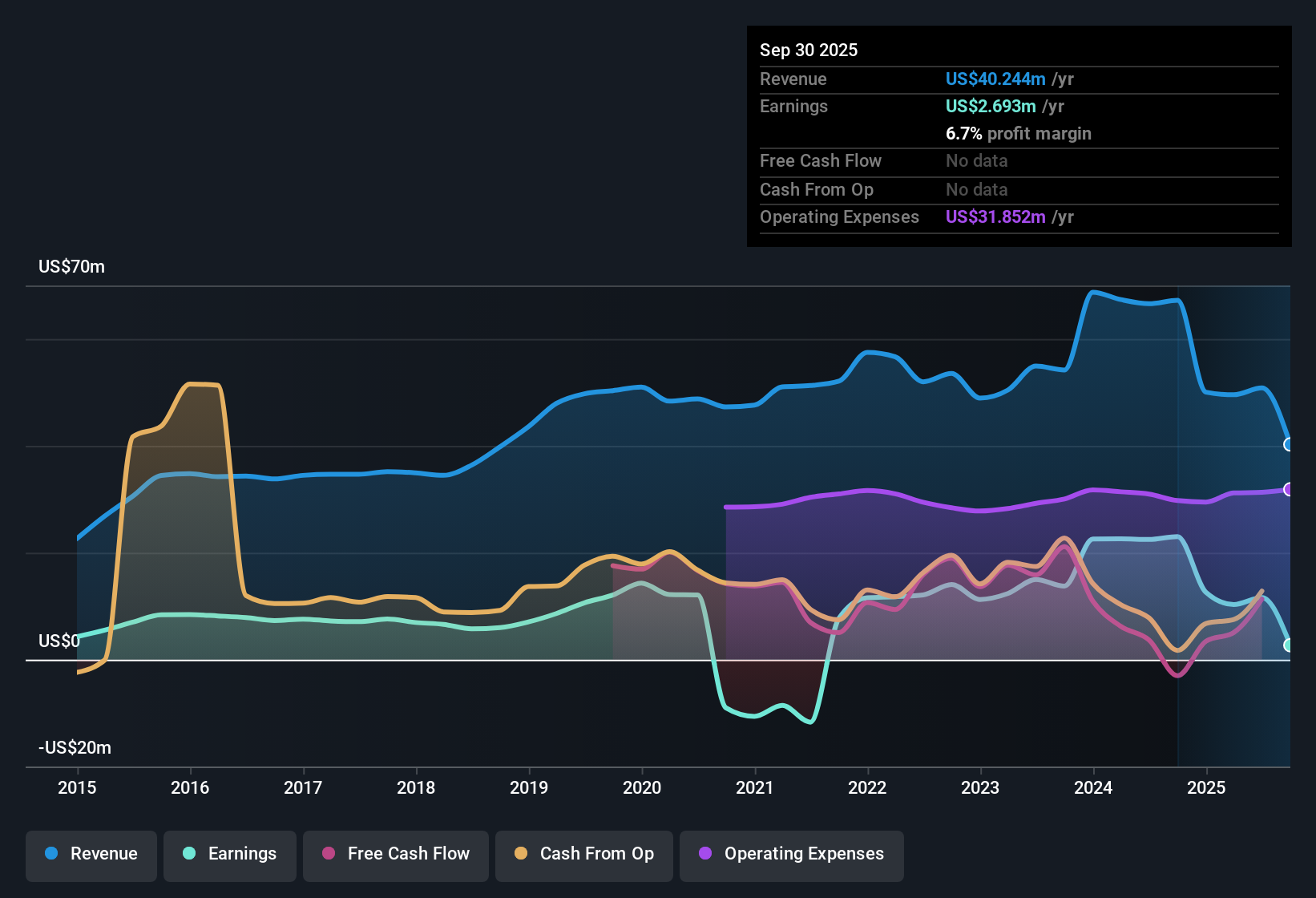

CB Financial Services (CBFV) reported a net profit margin of 6.8%, a steep drop from last year’s 34.3% margin. The latest twelve months included a one-off gain of $915,000 that complicates headline earnings quality. After five years of strong annual earnings growth averaging 33.9%, CBFV posted a negative bottom line this year, breaking from its previous trajectory. With earnings forecast to surge 149.9% per year and revenue predicted to outpace the US market at 27.9% per year, investors see significant growth potential. However, the company’s high P/E of 62.4x and thinner margins introduce a dose of caution.

See our full analysis for CB Financial Services.The next section examines how these results compare to the broader community narratives, highlighting where the numbers reinforce the consensus and where they challenge it.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Pivot Signals New Phase

- Net profit margin dropped sharply to 6.8% from 34.3% last year, reflecting a material contraction even after accounting for a non-recurring gain of $915,000 in the latest twelve months.

- The prevailing market perspective weighs this margin contraction against the company's earnings history and points out the following:

- CB Financial Services averaged 33.9% annual earnings growth for five years but experienced a negative bottom line this year, signaling a break from its historical pattern.

- While sector sentiment remains moderately positive for stable, well-capitalized banks, thinner margins could test that optimism if they persist beyond this period.

High Price-to-Earnings Ratio Raises the Bar

- Shares trade at a price-to-earnings multiple of 62.4x, substantially above peer and industry averages, making future growth expectations more demanding to meet at current valuations.

- From a market analysis perspective, this premium valuation adds both hope and pressure:

- Bulls may highlight the strong forecast of 149.9% annual earnings growth as justification, but the P/E remains elevated despite last year’s negative earnings, which is unusual for the sector.

- If the rapid growth fails to materialize, the share price could be vulnerable to corrections as investors reassess which premium is justified.

Trading Well Below DCF Fair Value

- The current share price of $33.61 sits at a sizable discount to the DCF fair value estimate of $54.24, suggesting long-term upside if profit growth expectations are met.

- Market watchers flag this valuation gap as a potential opportunity but note several important considerations:

- Despite the discount, recent negative earnings and margin compression mean investors must balance upside potential with a watchful eye on sustainable profitability.

- The market’s prevailing view is cautiously optimistic, recognizing both the undervaluation signal and the need for the company to restore its earnings momentum.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on CB Financial Services's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

CB Financial Services faces pressure from weakening margins, recent negative earnings, and a premium valuation that requires exceptional performance to justify its price.

If you want to focus on more consistent performers, use stable growth stocks screener (2099 results) to uncover companies with proven, steady earnings and revenue growth year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:CBFV

CB Financial Services

Operates as the bank holding company for Community Bank that provides various banking products and services for individuals and businesses in southwestern Pennsylvania and West Virginia.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives