- United States

- /

- Banks

- /

- NasdaqGS:CATY

Cathay General Bancorp (NASDAQ:CATY) Is Due To Pay A Dividend Of $0.34

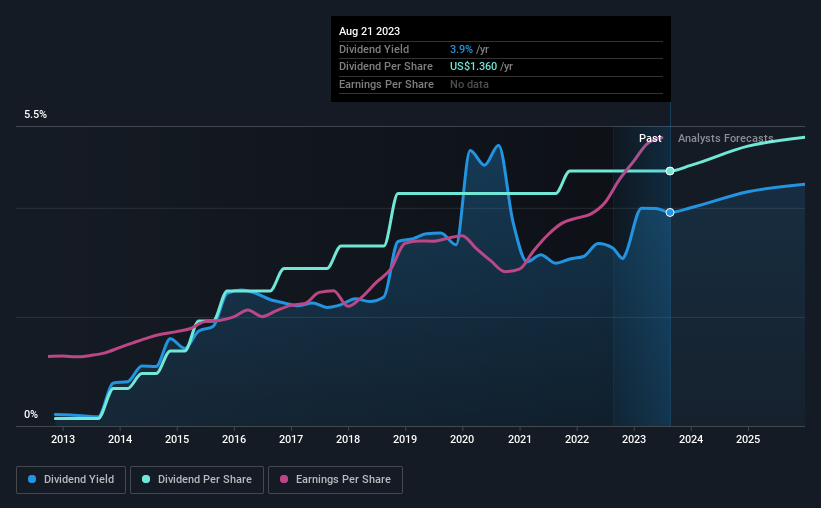

Cathay General Bancorp (NASDAQ:CATY) will pay a dividend of $0.34 on the 11th of September. This means the dividend yield will be fairly typical at 3.9%.

View our latest analysis for Cathay General Bancorp

Cathay General Bancorp's Dividend Forecasted To Be Well Covered By Earnings

While it is always good to see a solid dividend yield, we should also consider whether the payment is feasible.

Cathay General Bancorp has established itself as a dividend paying company with over 10 years history of distributing earnings to shareholders. While past records don't necessarily translate into future results, the company's payout ratio of 13% also shows that Cathay General Bancorp is able to comfortably pay dividends.

The next 3 years are set to see EPS grow by 2.2%. The future payout ratio could be 31% over that time period, according to analyst estimates, which is a good look for the future of the dividend.

Cathay General Bancorp Has A Solid Track Record

The company has been paying a dividend for a long time, and it has been quite stable which gives us confidence in the future dividend potential. Since 2013, the dividend has gone from $0.04 total annually to $1.36. This implies that the company grew its distributions at a yearly rate of about 42% over that duration. It is good to see that there has been strong dividend growth, and that there haven't been any cuts for a long time.

The Dividend Looks Likely To Grow

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. It's encouraging to see that Cathay General Bancorp has been growing its earnings per share at 15% a year over the past five years. Cathay General Bancorp definitely has the potential to grow its dividend in the future with earnings on an uptrend and a low payout ratio.

Cathay General Bancorp Looks Like A Great Dividend Stock

Overall, we think that this is a great income investment, and we think that maintaining the dividend this year may have been a conservative choice. The company is easily earning enough to cover its dividend payments and it is great to see that these earnings are being translated into cash flow. Taking this all into consideration, this looks like it could be a good dividend opportunity.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For instance, we've picked out 1 warning sign for Cathay General Bancorp that investors should take into consideration. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CATY

Cathay General Bancorp

Operates as the holding company for Cathay Bank that offers various commercial banking products and services to individuals, professionals, and small to medium-sized businesses in the United States.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success