- United States

- /

- Banks

- /

- NasdaqGM:PDLB

Discovering US Market's Hidden Gems with 3 Promising Small Caps

Reviewed by Simply Wall St

Amidst a backdrop of optimism for a resolution to the U.S. government shutdown, major stock indices have seen gains, with the tech-heavy Nasdaq and S&P 500 bouncing back from recent declines. In this environment, identifying promising small-cap stocks can be particularly rewarding as they often thrive on market recoveries and investor sentiment shifts; these companies can offer unique growth opportunities when larger caps are under pressure.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| First Bancorp | 57.63% | 1.47% | -2.43% | ★★★★★★ |

| Oakworth Capital | 40.91% | 15.96% | 11.47% | ★★★★★★ |

| Franklin Financial Services | 142.38% | 5.48% | -4.56% | ★★★★★★ |

| Epsilon Energy | NA | 2.43% | -4.36% | ★★★★★★ |

| FineMark Holdings | 115.37% | 2.22% | -28.34% | ★★★★★★ |

| Seneca Foods | 41.64% | 2.31% | -23.77% | ★★★★★☆ |

| FRMO | 0.10% | 35.28% | 40.61% | ★★★★★☆ |

| Pure Cycle | 5.02% | 4.35% | -2.25% | ★★★★★☆ |

| Linkhome Holdings | 7.03% | 215.05% | 239.56% | ★★★★★☆ |

| Solesence | 91.26% | 23.30% | 4.70% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Ponce Financial Group (PDLB)

Simply Wall St Value Rating: ★★★★★★

Overview: Ponce Financial Group, Inc. is the bank holding company for Ponce Bank, offering a range of banking products and services with a market capitalization of approximately $343.82 million.

Operations: The primary revenue stream for Ponce Financial Group comes from its thrift and savings and loan institutions, generating $96.25 million.

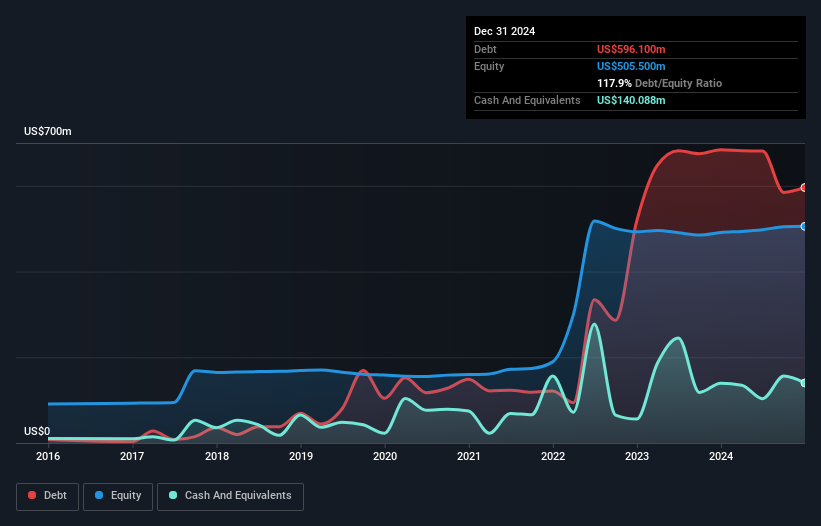

Ponce Financial Group, with total assets of US$3.2 billion and equity of US$529.8 million, is making waves in the community banking space. The bank's focus on low-risk funding is evident as 79% of its liabilities are customer deposits. Its earnings have surged by 148% over the past year, outpacing industry growth significantly. The company has a robust allowance for bad loans at 0.9% of total loans, ensuring financial stability. Recent expansions include a new branch in Upper Manhattan, highlighting its commitment to community engagement and growth across New York City and New Jersey.

- Delve into the full analysis health report here for a deeper understanding of Ponce Financial Group.

Explore historical data to track Ponce Financial Group's performance over time in our Past section.

Pathward Financial (CASH)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Pathward Financial, Inc. is a bank holding company for Pathward, National Association, offering a range of banking products and services in the United States with a market cap of approximately $1.56 billion.

Operations: Pathward Financial generates revenue primarily through interest income from loans and investment securities, and fee income from banking services. The company focuses on managing its cost of funds to optimize net interest margin, which has shown a notable trend over recent periods.

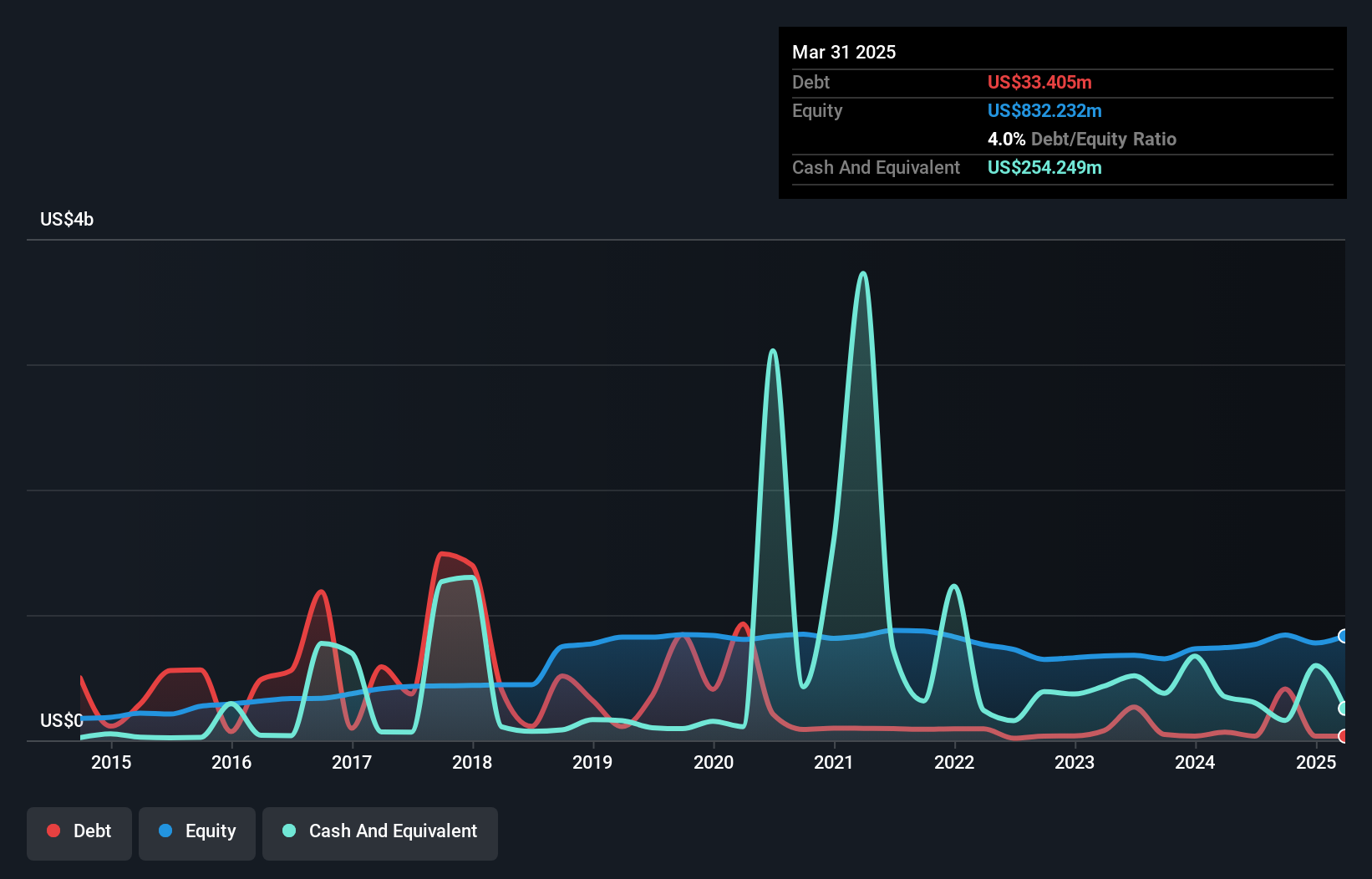

Pathward Financial, with total assets of US$7.2 billion and equity of US$857.5 million, is navigating a complex landscape. Its deposits stand at US$5.9 billion against loans totaling US$4.6 billion, but it has a high level of bad loans at 2.1%. The company trades significantly below its estimated fair value by 61.8%, suggesting potential upside for investors despite challenges like accounting uncertainties and competitive pressures from fintech rivals. Recently, Pathward repurchased over 180,000 shares for nearly US$15 million in the last quarter alone, signaling confidence in its own valuation amidst ongoing strategic shifts towards digital banking solutions.

EVI Industries (EVI)

Simply Wall St Value Rating: ★★★★★☆

Overview: EVI Industries, Inc. operates through its subsidiaries to distribute, sell, rent, and lease commercial and industrial laundry and dry-cleaning equipment with a market capitalization of $352.36 million.

Operations: Revenue for EVI primarily comes from its commercial laundry segment, amounting to $389.83 million.

EVI Industries, with a focus on strategic acquisitions like Girbau North America, is poised to tap into urban and institutional market demands. Its recent performance showcases a net income of US$7.5 million for the year ending June 2025, up from US$5.65 million previously, alongside sales growth to US$389.83 million from US$353.56 million. The company's net debt to equity ratio is satisfactory at 30.8%, while interest payments are well covered by EBIT at 5.1x coverage. Despite its promising growth trajectory and special dividend payout of $0.33 per share reflecting fiscal strength, acquisition-related risks remain a consideration for potential investors.

Where To Now?

- Click here to access our complete index of 296 US Undiscovered Gems With Strong Fundamentals.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:PDLB

Ponce Financial Group

Operates as the bank holding company for Ponce Bank that provides various banking products and services.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives