- United States

- /

- Banks

- /

- NasdaqGM:BWFG

Bankwell Financial Group (BWFG) Net Profit Margin Decline Reinforces Cautious Investor Narratives

Reviewed by Simply Wall St

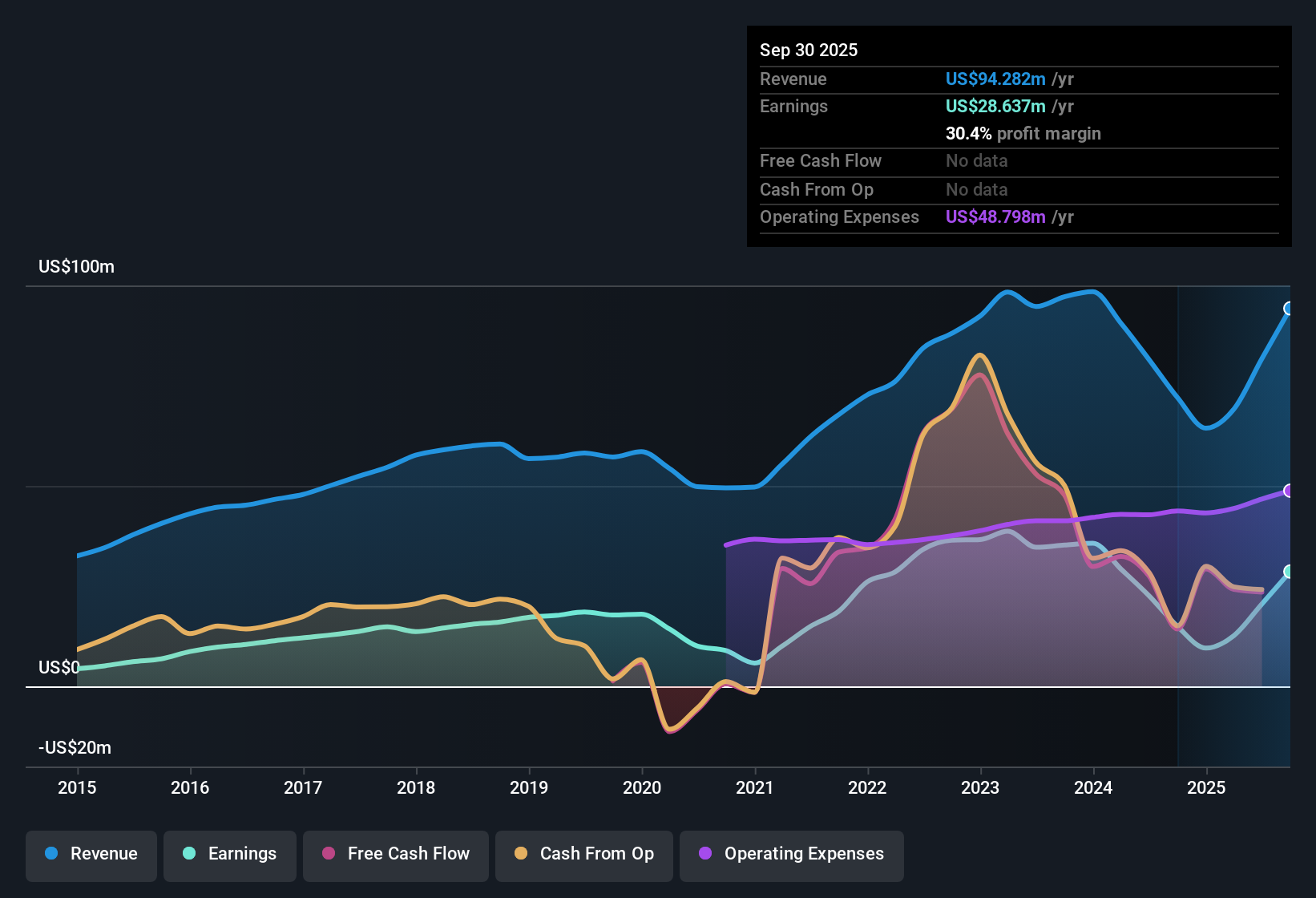

Bankwell Financial Group (BWFG) posted a net profit margin of 25.2%, down from 27.7% last year, signaling a dip in year-over-year profitability. Despite growing earnings at an average annual rate of 5.7% over the past five years, the most recent year saw negative earnings growth, missing the company’s longer-term trend. With high-quality past earnings, a premium valuation compared to industry peers, and a market price of $43.88 well below the estimated fair value of $98.47 per share, investors are focusing on the company’s attractive dividend profile and the potential for valuation upside.

See our full analysis for Bankwell Financial Group.Next, we will see how these key results compare to the widely discussed market narratives and whether the latest numbers confirm or challenge the current investor view.

See what the community is saying about Bankwell Financial Group

Deposit Expansion Drives Lower Funding Costs

- The addition of five private client deposit teams brought in hundreds of millions of dollars in low or no-cost deposits, directly lowering funding costs and broadening the bank’s net interest margin.

- Analysts' consensus view credits these new teams and the bank’s digital onboarding improvements with jump-starting growth and profitability.

- Consensus notes the faster account-opening process and new relationships should drive expanded net interest margin over the next 12 to 24 months.

- Ongoing investments in technology are expected to enhance operational efficiency and help Bankwell capture additional market share across Connecticut’s affluent regions.

- The analysts’ estimates reinforce the story by projecting revenue growth of 28.2% per year over the next three years, paired with expanding projected profit margins from 25.2% to 40.5%, which would be a significant improvement if achieved.

To see what the community thinks about these deposit-led catalysts, check the full consensus narrative for additional perspectives. 📊 Read the full Bankwell Financial Group Consensus Narrative.

SBA Lending and Asset Quality Boost

- The ramp-up of SBA lending, visible in a strong pipeline and an increase in gain-on-sale income, is diversifying Bankwell’s revenue beyond traditional loan spreads.

- Analysts' consensus view argues that strengthening asset quality, with decade-low nonperforming loans and CRE concentrations, supports lower credit costs and reserve releases.

- Population growth and economic stability in Connecticut are expected to drive steady loan demand and customer loyalty.

- This helps to buttress the bank’s long-term revenue and earnings growth, even as the company faces industry competition and regulatory pressures.

Premium Valuation Despite DCF Upside

- With shares trading at $43.88 and a Price-to-Earnings ratio of 16.4x (above the industry average of 11.3x and peer average of 13.2x), the market currently values Bankwell at a premium to other US banks, even as the share price remains materially below the DCF fair value of $98.47.

- According to the analysts' consensus, the modest gap between the current price and the official analyst price target of $45.00 suggests they see the company as fairly valued for now.

- Analysts believe further share price upside will require the projected profit margin expansion to 40.5% and earnings growth to $69.8 million by 2028 to materialize.

- Investors are reminded to sense check these forward estimates against their own expectations and risk tolerance before assuming the future justifies today’s premium.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Bankwell Financial Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do the figures give you a different impression? Craft your own take and share your narrative in just a few minutes. Do it your way

A great starting point for your Bankwell Financial Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

While Bankwell Financial Group shows growth potential, its premium valuation and recent drop in earnings highlight the risk of paying for inconsistent performance.

For those seeking better value and stronger upside, discover our these 876 undervalued stocks based on cash flows to focus on companies offering genuine financial bargains right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bankwell Financial Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:BWFG

Bankwell Financial Group

Operates as the bank holding company for Bankwell Bank that provides various banking services for individual and commercial customers.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives