- United States

- /

- Banks

- /

- NasdaqGM:SMBC

US Undiscovered Gems With Strong Fundamentals November 2025

Reviewed by Simply Wall St

As the U.S. stock market experiences a notable upswing, with major indices like the Dow surging over 650 points, investors are turning their attention to small-cap stocks that often go unnoticed amidst larger market movements. In this dynamic environment, identifying stocks with strong fundamentals becomes crucial for those looking to uncover potential opportunities in less-explored corners of the market.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| First Bancorp | 57.63% | 1.47% | -2.43% | ★★★★★★ |

| Tri-County Financial Group | 102.20% | -2.69% | -15.63% | ★★★★★★ |

| Sound Financial Bancorp | 34.24% | 1.40% | -12.55% | ★★★★★★ |

| Franklin Financial Services | 127.01% | 5.48% | -4.56% | ★★★★★★ |

| Affinity Bancshares | 43.06% | 2.84% | 3.44% | ★★★★★★ |

| Metalpha Technology Holding | NA | 75.66% | 28.60% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 13.18% | 16.77% | ★★★★★☆ |

| Seneca Foods | 41.64% | 2.31% | -23.77% | ★★★★★☆ |

| Pure Cycle | 4.76% | 6.42% | -1.58% | ★★★★★☆ |

| Union Bankshares | 369.65% | 1.12% | -7.45% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Bridgewater Bancshares (BWB)

Simply Wall St Value Rating: ★★★★★★

Overview: Bridgewater Bancshares, Inc. is the bank holding company for Bridgewater Bank, offering a range of banking products and services across the United States, with a market capitalization of approximately $466.46 million.

Operations: Bridgewater Bancshares generates revenue primarily from its banking segment, amounting to $127.24 million.

Bridgewater Bancshares, with assets of US$5.4 billion and equity of US$497.5 million, is making waves in the banking sector. It boasts a robust allowance for bad loans at 564% and maintains low-risk funding sources for 88% of its liabilities, primarily through customer deposits. The bank's net charge-offs have decreased to US$275,000 from US$931,000 a year ago, reflecting improved credit management. Despite significant insider selling recently, earnings grew by 25% over the past year and are projected to grow annually by 22%. Trading below estimated fair value by 23%, it presents potential upside for investors seeking growth opportunities in regional banks.

Southern Missouri Bancorp (SMBC)

Simply Wall St Value Rating: ★★★★★★

Overview: Southern Missouri Bancorp, Inc. is the bank holding company for Southern Bank, offering banking and financial services to individuals and corporate customers in the United States, with a market cap of $619.37 million.

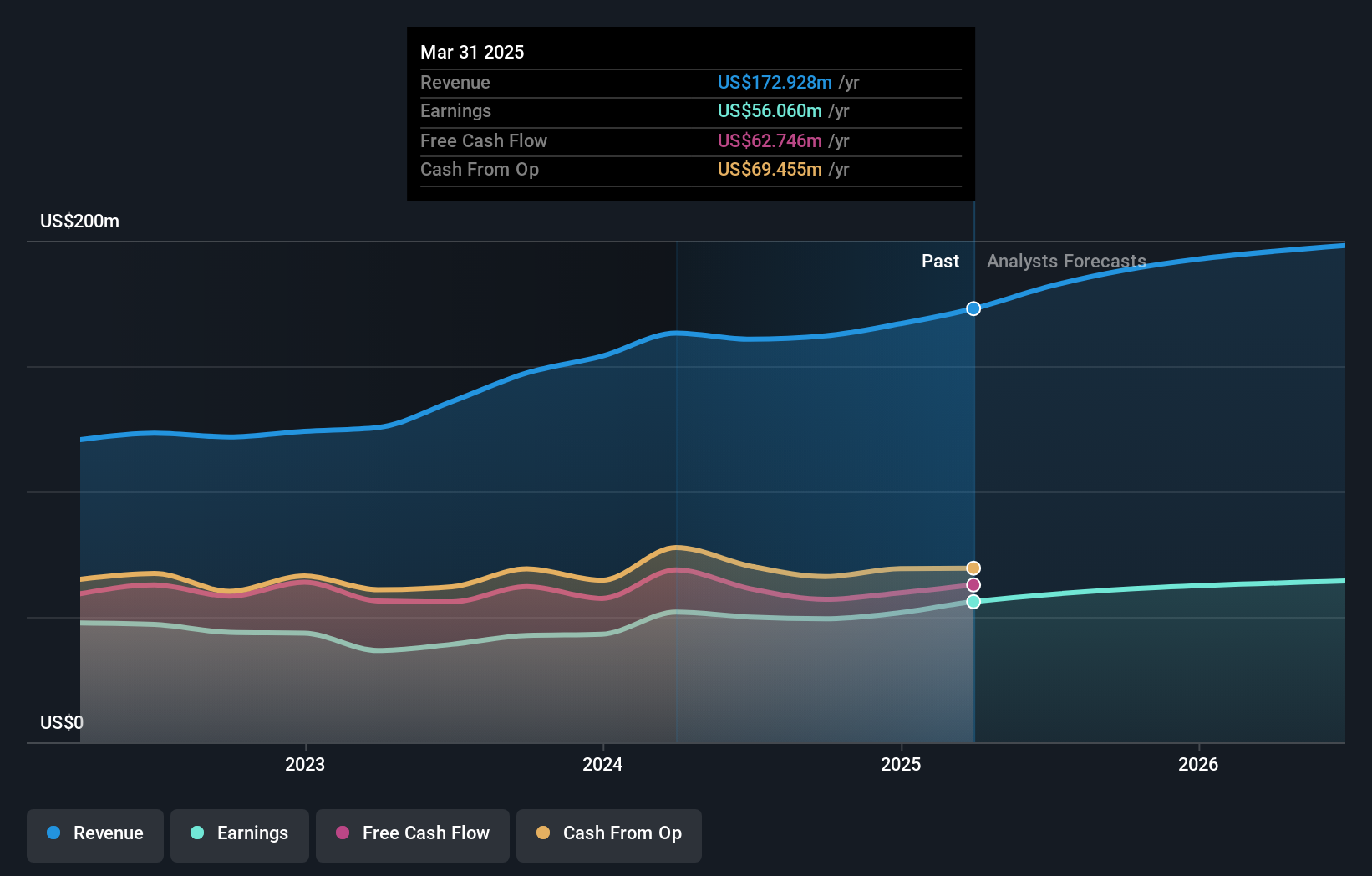

Operations: Southern Missouri Bancorp generates revenue primarily through its thrift and savings loan institutions, amounting to $178.89 million.

Southern Missouri Bancorp, with assets totaling US$5 billion and equity of US$560.2 million, is trading at a good value compared to its peers. The bank's liabilities are 96% funded by low-risk customer deposits, reducing external borrowing risks. With total deposits of US$4.3 billion and loans of US$4.1 billion, it maintains a sufficient allowance for bad loans at 0.6%. Earnings grew by 24.9% last year, surpassing the industry average of 18.1%, highlighting strong performance in community banking services driven by favorable demographic shifts in the Midwest and South regions.

ATRenew (RERE)

Simply Wall St Value Rating: ★★★★★★

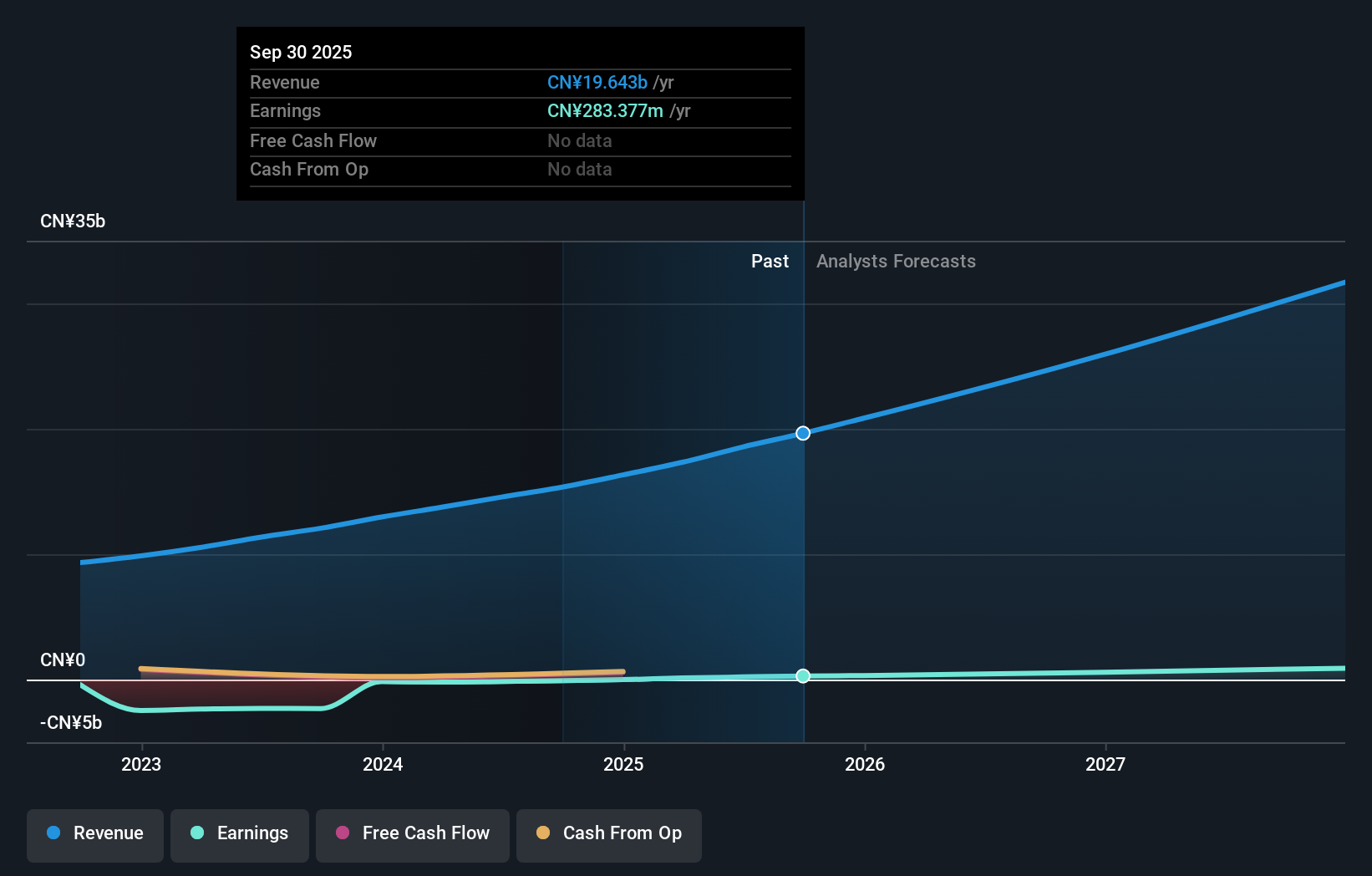

Overview: ATRenew Inc., with a market cap of approximately $917.81 million, operates a platform for pre-owned consumer electronics transactions and services in the People’s Republic of China.

Operations: ATRenew generates revenue primarily from its retail electronics segment, which reported CN¥19.64 billion. The company's gross profit margin is 25%, reflecting the efficiency of its operations in managing costs relative to sales.

ATRenew has shown impressive financial growth, turning a net income of CNY 90.82 million in Q3 2025, compared to just CNY 17.88 million the previous year. Its basic earnings per share rose from CNY 0.0733 to CNY 0.3733 over the same period, highlighting its profitability strides. The company also repurchased shares worth $2.1 million, indicating confidence in its valuation and future prospects. Despite trading at US$4.67 per share—well below its estimated fair value—ATRenew's debt-to-equity ratio has improved significantly from 14.7% to 3.9% over five years, showcasing prudent financial management amidst rapid expansion challenges and competitive pressures in the recommerce sector.

Turning Ideas Into Actions

- Dive into all 297 of the US Undiscovered Gems With Strong Fundamentals we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SMBC

Southern Missouri Bancorp

Operates as the bank holding company for Southern Bank that provides banking and financial services to individuals and corporate customers in the United States.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success