- United States

- /

- Banks

- /

- NasdaqGM:NBN

US Market's Hidden Treasures Featuring Three Undiscovered Gems

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen 1.5% and is up 18% over the last 12 months, with earnings forecasted to grow by 15% annually. In such a dynamic environment, identifying stocks that are not only positioned for growth but also underappreciated by the broader market can offer unique opportunities for investors seeking hidden treasures.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| First Bancorp | 73.89% | 1.93% | -1.42% | ★★★★★★ |

| Southern Michigan Bancorp | 117.38% | 8.87% | 4.89% | ★★★★★★ |

| Oakworth Capital | 87.50% | 15.82% | 9.79% | ★★★★★★ |

| Affinity Bancshares | 43.51% | 4.54% | 8.05% | ★★★★★★ |

| Senstar Technologies | NA | -20.82% | 14.32% | ★★★★★★ |

| Metalpha Technology Holding | NA | 81.88% | -4.97% | ★★★★★★ |

| FRMO | 0.09% | 44.64% | 49.91% | ★★★★★☆ |

| Valhi | 43.01% | 1.55% | -2.64% | ★★★★★☆ |

| China SXT Pharmaceuticals | 64.25% | -29.05% | 10.33% | ★★★★★☆ |

| Rich Sparkle Holdings | 26.73% | -6.13% | 1.75% | ★★★★★☆ |

Let's dive into some prime choices out of from the screener.

Bridgewater Bancshares (BWB)

Simply Wall St Value Rating: ★★★★★★

Overview: Bridgewater Bancshares, Inc. is the bank holding company for Bridgewater Bank, offering a range of banking products and services across the United States with a market capitalization of $442.82 million.

Operations: Bridgewater Bancshares generates revenue primarily from its banking operations, totaling $119.31 million.

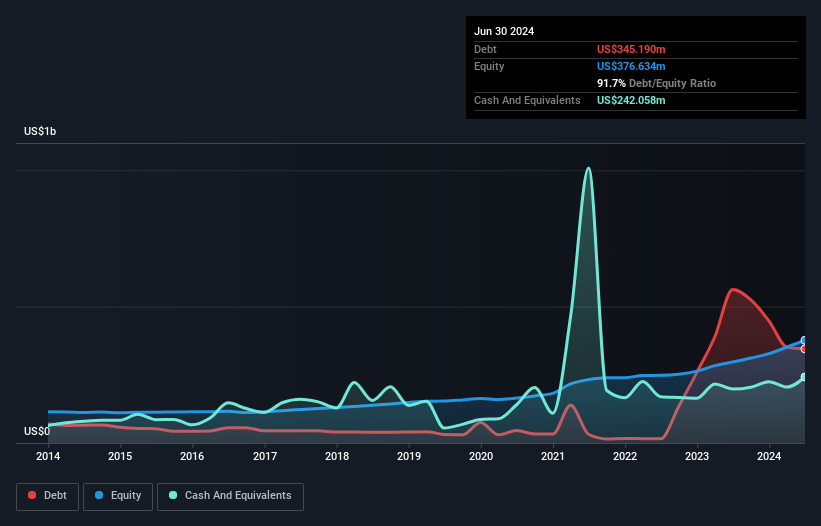

Bridgewater Bancshares, with total assets of US$5.3 billion and equity of US$476.3 million, has demonstrated robust growth potential in the banking sector. The company boasts total deposits of US$4.2 billion against loans totaling US$4.1 billion, while maintaining a net interest margin of 2.3%. It has an allowance for bad loans at 0.2% of total loans, indicating sound risk management practices alongside primarily low-risk funding sources comprising 88% customer deposits. Recent earnings reports reveal a net income increase to US$11.52 million from last year’s US$8.12 million, reflecting strong operational performance amidst economic challenges and competitive pressures.

IRADIMED (IRMD)

Simply Wall St Value Rating: ★★★★★★

Overview: IRADIMED CORPORATION develops, manufactures, markets, and distributes MRI-compatible medical devices and related accessories, disposables, and services in the United States and internationally with a market cap of $716.11 million.

Operations: IRADIMED generates revenue primarily from patient monitoring equipment, totaling $75.15 million. The company's financial performance can be analyzed through its net profit margin, which provides insight into its profitability relative to revenue.

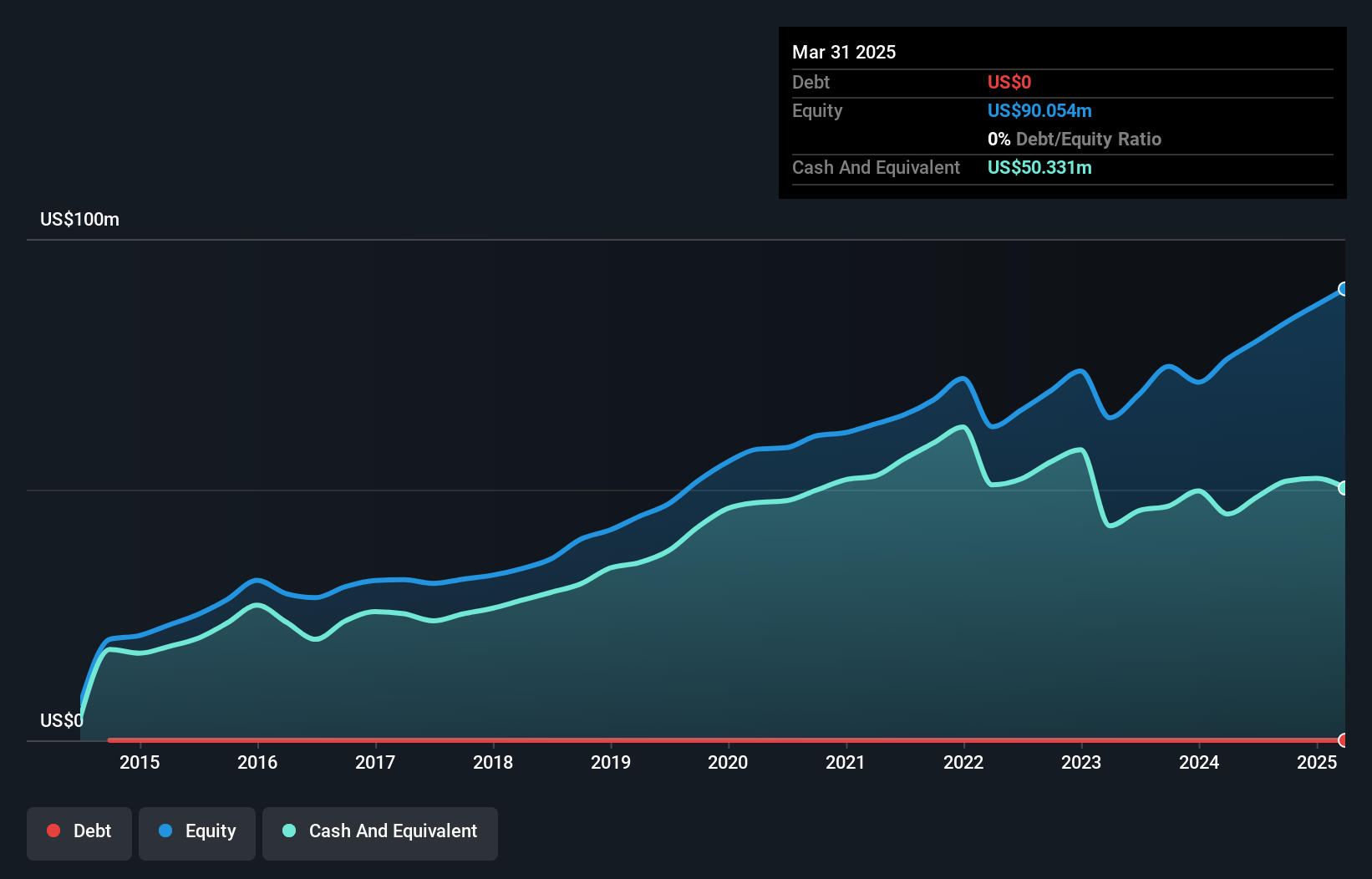

Iradimed, with its niche in MRI-compatible infusion pumps, has been debt-free for the past five years and is trading at 36.9% below estimated fair value. The company's earnings have grown 30.8% annually over five years but recently lagged slightly behind industry growth at 10.4%. Its new MRidium®? 3870 IV Infusion Pump System, cleared by the FDA, is set to bolster revenue from late 2025 onwards. With a focus on domestic sales and an expected profit margin increase from 26.3% to 27.4%, Iradimed faces risks such as U.S.-centric revenue dependency and international sales decline amidst capital expenditure impacts on cash flow.

Northeast Bank (NBN)

Simply Wall St Value Rating: ★★★★★★

Overview: Northeast Bank offers a range of banking services to individual and corporate clients in Maine, with a market capitalization of $817.41 million.

Operations: With a focus on banking services, revenue is primarily derived from the banking segment, amounting to $184.34 million.

Northeast Bank, with total assets of US$4.2 billion and equity of US$467.5 million, stands out for its robust financial health. Its deposits total US$3.3 billion against loans of US$3.7 billion, supported by a net interest margin of 5.2%. The bank's allowance for bad loans is sufficient at 0.8% of total loans, highlighting prudent risk management practices with 88% liabilities sourced from low-risk customer deposits. Recently added to multiple Russell growth indices, Northeast Bank reported a significant earnings increase from the previous year, reflecting its competitive position and potential as an investment opportunity in the financial sector.

Summing It All Up

- Access the full spectrum of 294 US Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northeast Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:NBN

Northeast Bank

Provides various banking services to individual and corporate customers in Maine.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives