- United States

- /

- Banks

- /

- NasdaqCM:BWB

Investors more bullish on Bridgewater Bancshares (NASDAQ:BWB) this week as stock pops 12%, despite earnings trending downwards over past year

It's always best to build a diverse portfolio of shares, since any stock business could lag the broader market. But if you're going to beat the market overall, you need to have individual stocks that outperform. One such company is Bridgewater Bancshares, Inc. (NASDAQ:BWB), which saw its share price increase 25% in the last year, slightly above the market return of around 22% (not including dividends). Unfortunately the longer term returns are not so good, with the stock falling 20% in the last three years.

Since it's been a strong week for Bridgewater Bancshares shareholders, let's have a look at trend of the longer term fundamentals.

View our latest analysis for Bridgewater Bancshares

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Over the last twelve months, Bridgewater Bancshares actually shrank its EPS by 35%.

So we don't think that investors are paying too much attention to EPS. Therefore, it seems likely that investors are putting more weight on metrics other than EPS, at the moment.

Unfortunately Bridgewater Bancshares' fell 16% over twelve months. So using a snapshot of key business metrics doesn't give us a good picture of why the market is bidding up the stock.

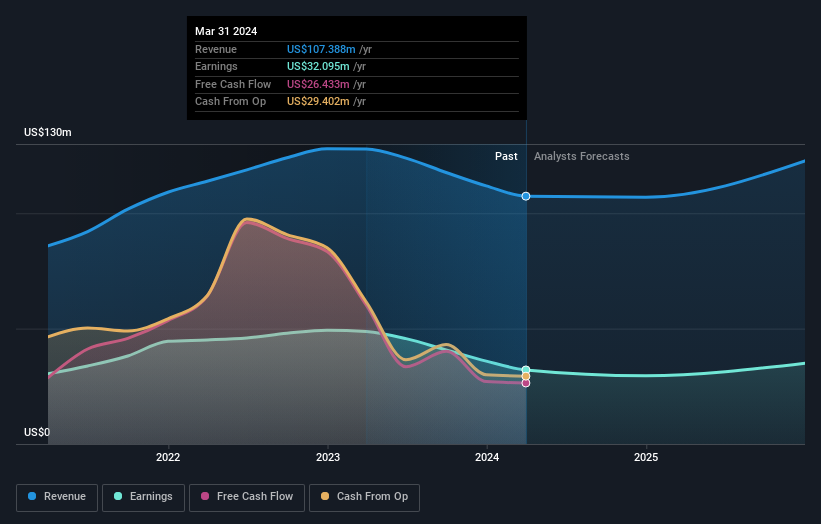

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. If you are thinking of buying or selling Bridgewater Bancshares stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

Bridgewater Bancshares' TSR for the year was broadly in line with the market average, at 25%. That gain looks pretty satisfying, and it is even better than the five-year TSR of 2% per year. Even if the share price growth slows down from here, there's a good chance that this is business worth watching in the long term. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

We will like Bridgewater Bancshares better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Bridgewater Bancshares might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BWB

Bridgewater Bancshares

Operates as the bank holding company for Bridgewater Bank that provides banking products and services to commercial real estate investors, entrepreneurs, business clients, and individuals in the United States.

Flawless balance sheet and good value.