- United States

- /

- Luxury

- /

- NYSE:CRI

US Dividend Stocks Spotlight Featuring Three Top Picks

Reviewed by Simply Wall St

As the U.S. stock market continues to soar with the S&P 500 and Dow Jones Industrial Average reaching record highs, investors are increasingly looking towards dividend stocks as a stable source of income amidst this bullish trend. In such an environment, selecting dividend stocks that offer consistent payouts and potential for growth can be a prudent strategy for those seeking to benefit from both capital appreciation and regular income streams.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.47% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.46% | ★★★★★★ |

| Columbia Banking System (NasdaqGS:COLB) | 4.55% | ★★★★★★ |

| Isabella Bank (OTCPK:ISBA) | 4.51% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 4.71% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.30% | ★★★★★★ |

| CompX International (NYSEAM:CIX) | 4.34% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 5.47% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.41% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.30% | ★★★★★★ |

Click here to see the full list of 136 stocks from our Top US Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

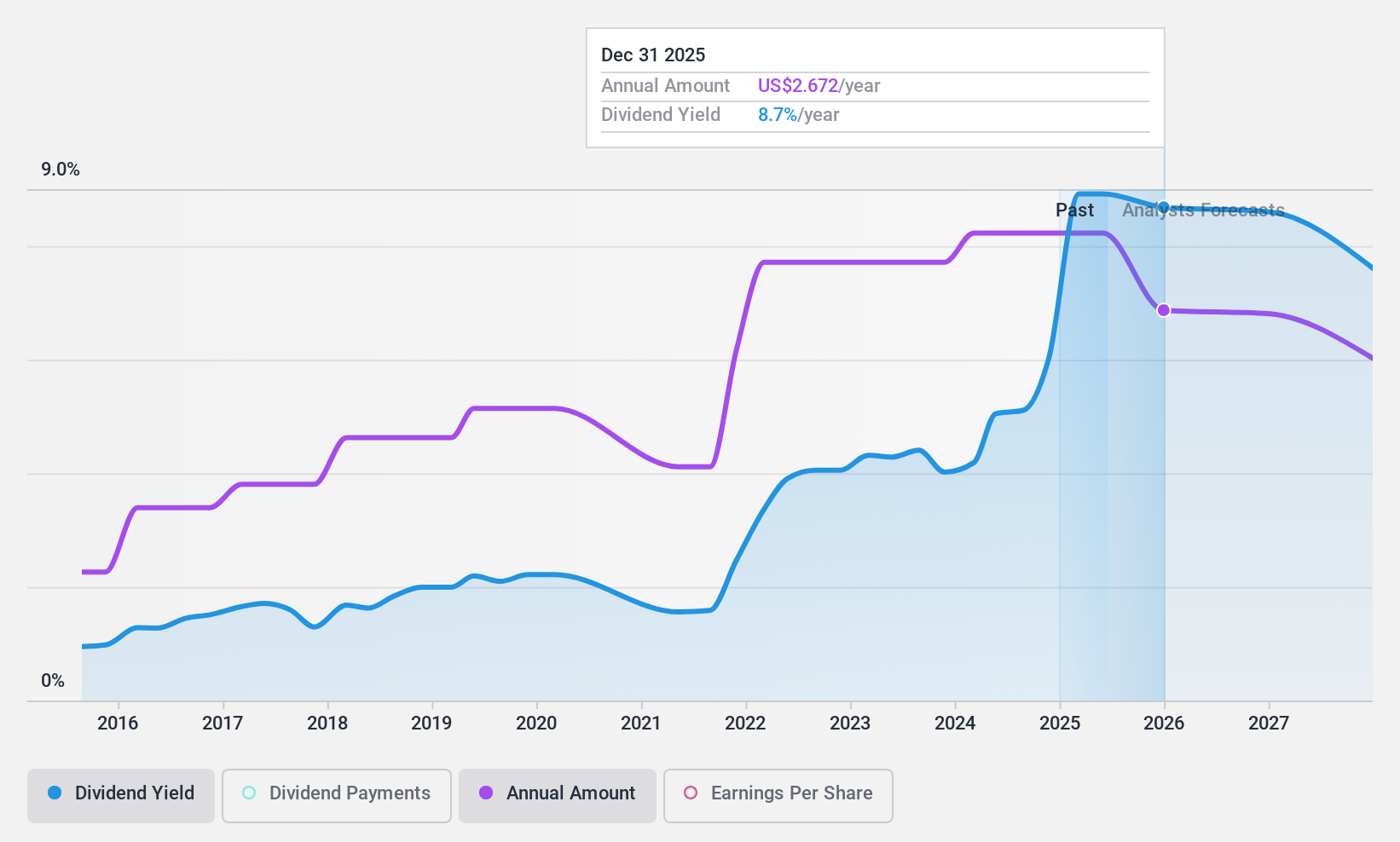

First Busey (NasdaqGS:BUSE)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: First Busey Corporation, with a market cap of approximately $1.55 billion, operates as the bank holding company for Busey Bank, providing retail and commercial banking products and services to individual, corporate, institutional, and governmental customers in the United States.

Operations: First Busey Corporation's revenue segments include Banking at $385.10 million, Firs Tech at $23.54 million, and Wealth Management at $61.82 million.

Dividend Yield: 3.5%

First Busey offers a stable dividend history with payments reliably increasing over the past decade, supported by a manageable payout ratio of 48.5%. The company’s recent financial performance shows steady net interest income growth, though overall net income has decreased year-to-date. Despite shareholder dilution last year, First Busey completed a significant share buyback program and declared consistent quarterly dividends. While its current yield of 3.52% is below top-tier levels, it remains an attractive option for dividend stability.

- Dive into the specifics of First Busey here with our thorough dividend report.

- Our expertly prepared valuation report First Busey implies its share price may be lower than expected.

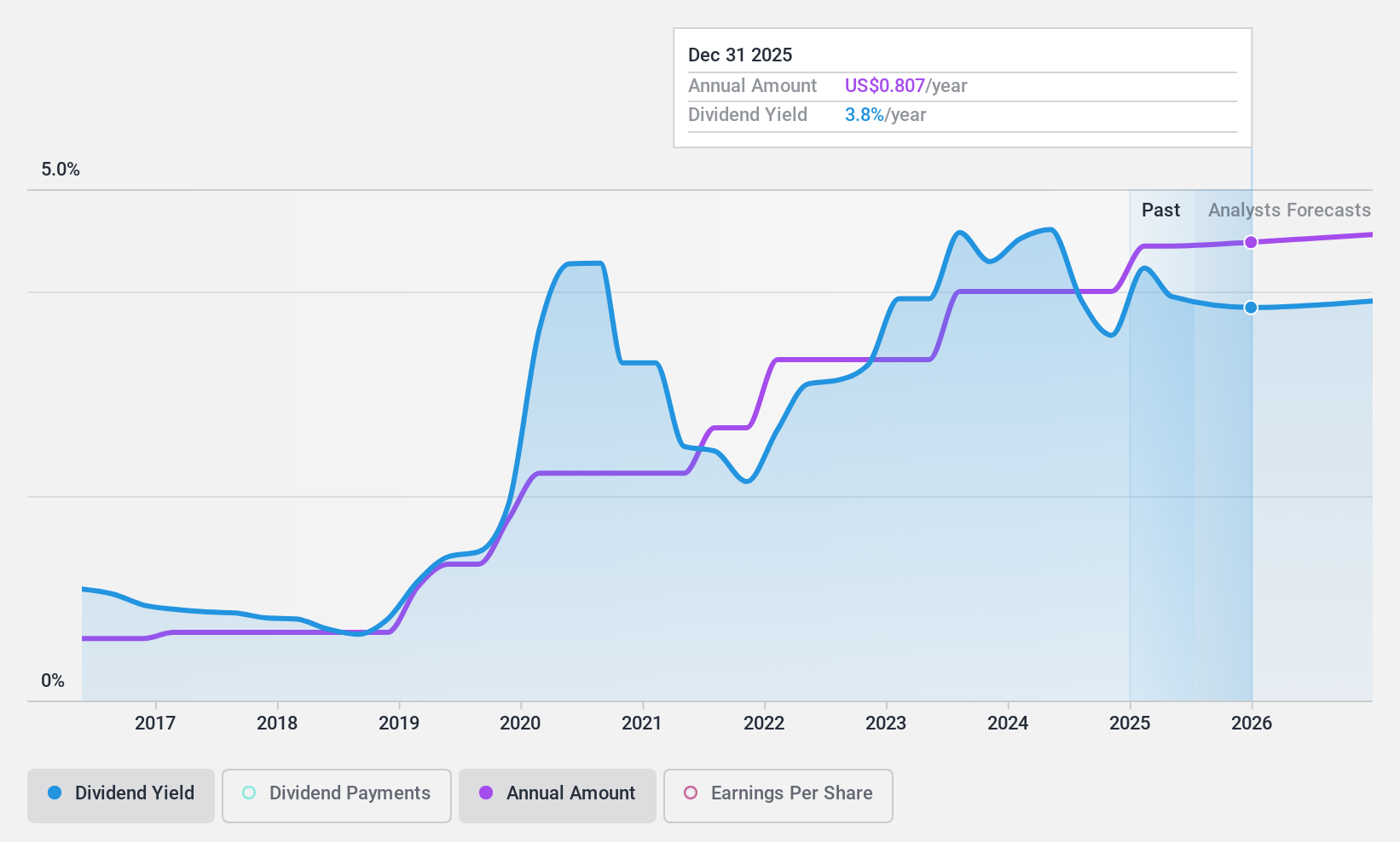

PCB Bancorp (NasdaqGS:PCB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: PCB Bancorp is the bank holding company for PCB Bank, offering a range of banking products and services to small to medium-sized businesses, individuals, and professionals in Southern California, with a market cap of $305.47 million.

Operations: PCB Bancorp generates its revenue primarily from the banking industry, amounting to $94.83 million.

Dividend Yield: 3.4%

PCB Bancorp's recent financials show stable net interest income and a slight increase in quarterly net income, though year-to-date figures have declined. The company declared a quarterly dividend of US$0.18 per share, maintaining its reliable dividend history over the past decade with well-covered payments due to a low payout ratio of 42.4%. Despite not repurchasing shares recently, PCB's dividends remain sustainable and forecasted to be covered by earnings in three years.

- Navigate through the intricacies of PCB Bancorp with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that PCB Bancorp is priced lower than what may be justified by its financials.

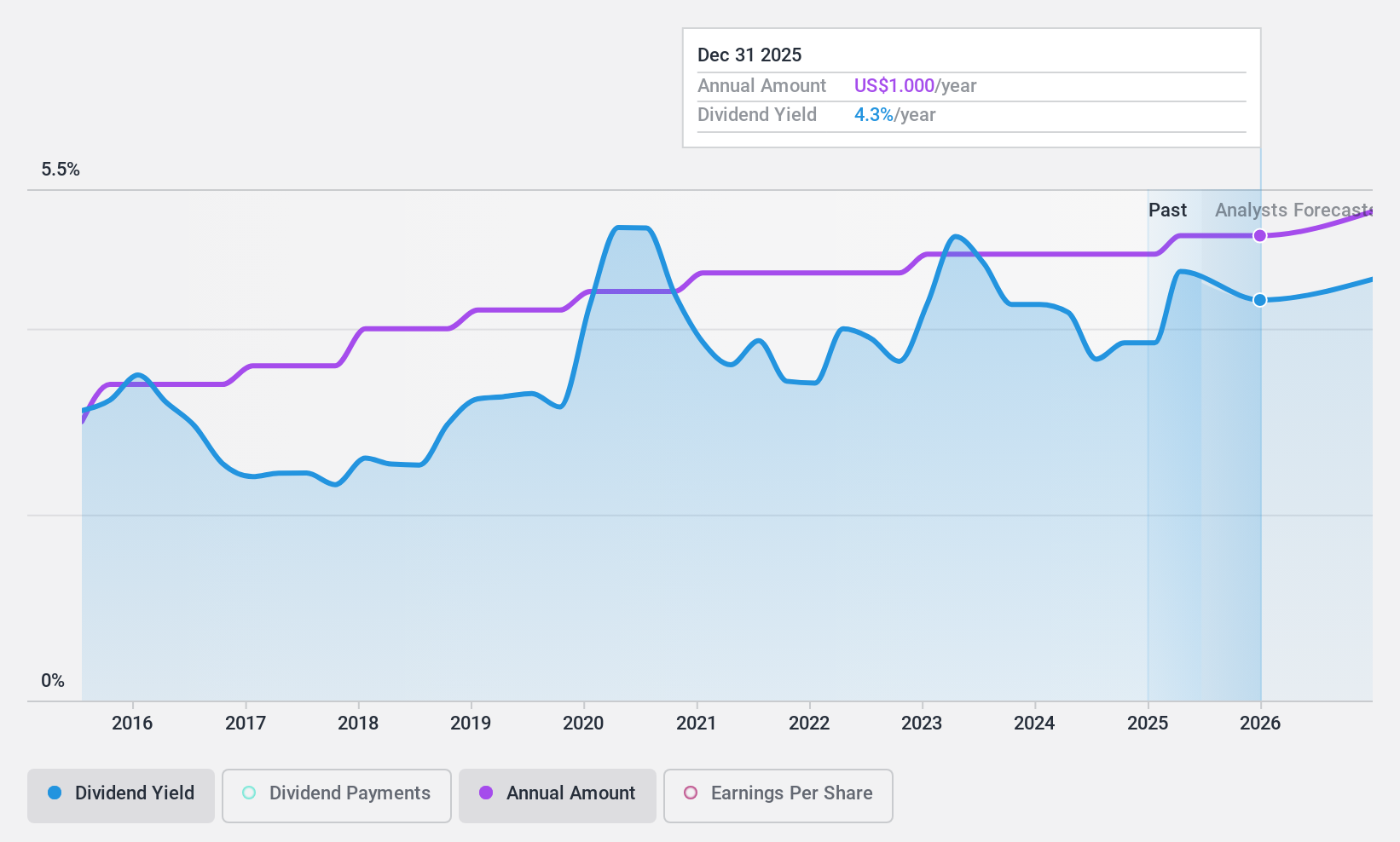

Carter's (NYSE:CRI)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Carter's, Inc. designs, sources, and markets branded childrenswear under various brands both in the United States and internationally, with a market cap of approximately $1.95 billion.

Operations: Carter's revenue is primarily derived from three segments: U.S. Retail ($1.43 billion), International ($408.17 million), and U.S. Wholesale ($1 billion).

Dividend Yield: 5.9%

Carter's offers a competitive dividend yield in the top 25% of US payers, with recent affirmations of a US$0.80 per share quarterly dividend. Despite its dividends being well-covered by earnings and cash flows, Carter's has an unstable dividend track record due to past volatility. The company's price-to-earnings ratio suggests good value relative to the market, but declining sales and earnings forecasts indicate potential challenges ahead for sustaining growth in dividends.

- Click here to discover the nuances of Carter's with our detailed analytical dividend report.

- Our valuation report here indicates Carter's may be undervalued.

Taking Advantage

- Click here to access our complete index of 136 Top US Dividend Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRI

Carter's

Designs, sources, and markets branded childrenswear under the Carter's, OshKosh, Skip Hop, Child of Mine, Just One You, Simple Joys, Little Planet, and other brands in the United States and internationally.

Flawless balance sheet with solid track record and pays a dividend.