- United States

- /

- Banks

- /

- NasdaqGS:BUSE

First Busey (BUSE): Assessing Valuation After Sector Optimism Sparks Share Price Rally

Reviewed by Kshitija Bhandaru

First Busey (BUSE) shares caught a boost as investors responded to upbeat third-quarter results across major banks and hints from the Federal Reserve about winding down its quantitative tightening program. Market sentiment for regional banks improved noticeably.

See our latest analysis for First Busey.

The latest pop in First Busey’s share price comes after upbeat signals from the Federal Reserve and encouraging sector earnings. Both have lifted hopes for a smoother path ahead for regional banks. Despite this recent optimism, First Busey’s 1-year total shareholder return stands at -10.6%, and its 5-year total return remains solidly positive. This shows some long-term resilience even as near-term share price momentum has faded a bit.

If the recent banking sector news has you thinking about your next move, this is a smart time to broaden your search and discover fast growing stocks with high insider ownership

With First Busey shares showing fresh momentum, the key question for investors is whether the recent rally signals an undervalued opportunity or if renewed optimism and future growth are already built into the price.

Price-to-Earnings of 25.9x: Is it justified?

First Busey trades at a price-to-earnings (PE) ratio of 25.9, significantly higher than both its industry peers and the broader US banks sector. With the last close at $22.47, this kind of multiple suggests that the market may be pricing in premium growth or future upside that peers are not assigned.

The price-to-earnings ratio is a fundamental valuation metric reflecting how much investors are willing to pay for every dollar of current earnings. For banks, a high PE ratio often signals expectations of strong growth, improved profitability, or a robust competitive position. However, it can also raise questions if underlying earnings are under pressure.

First Busey’s PE ratio stands well above the US banks industry average of 11.2 and the peer average of 14.7. Versus its estimated “fair” PE ratio of 21.9, the current market price signals a substantial premium. That premium could move closer to the fair ratio as market expectations adjust, or if the company outperforms on future growth and earnings quality.

Explore the SWS fair ratio for First Busey

Result: Price-to-Earnings of 25.9x (OVERVALUED)

However, slower revenue growth or a pullback in net income could temper investor enthusiasm and challenge the case for maintaining a sustained premium valuation.

Find out about the key risks to this First Busey narrative.

Another View: What Does the SWS DCF Model Say?

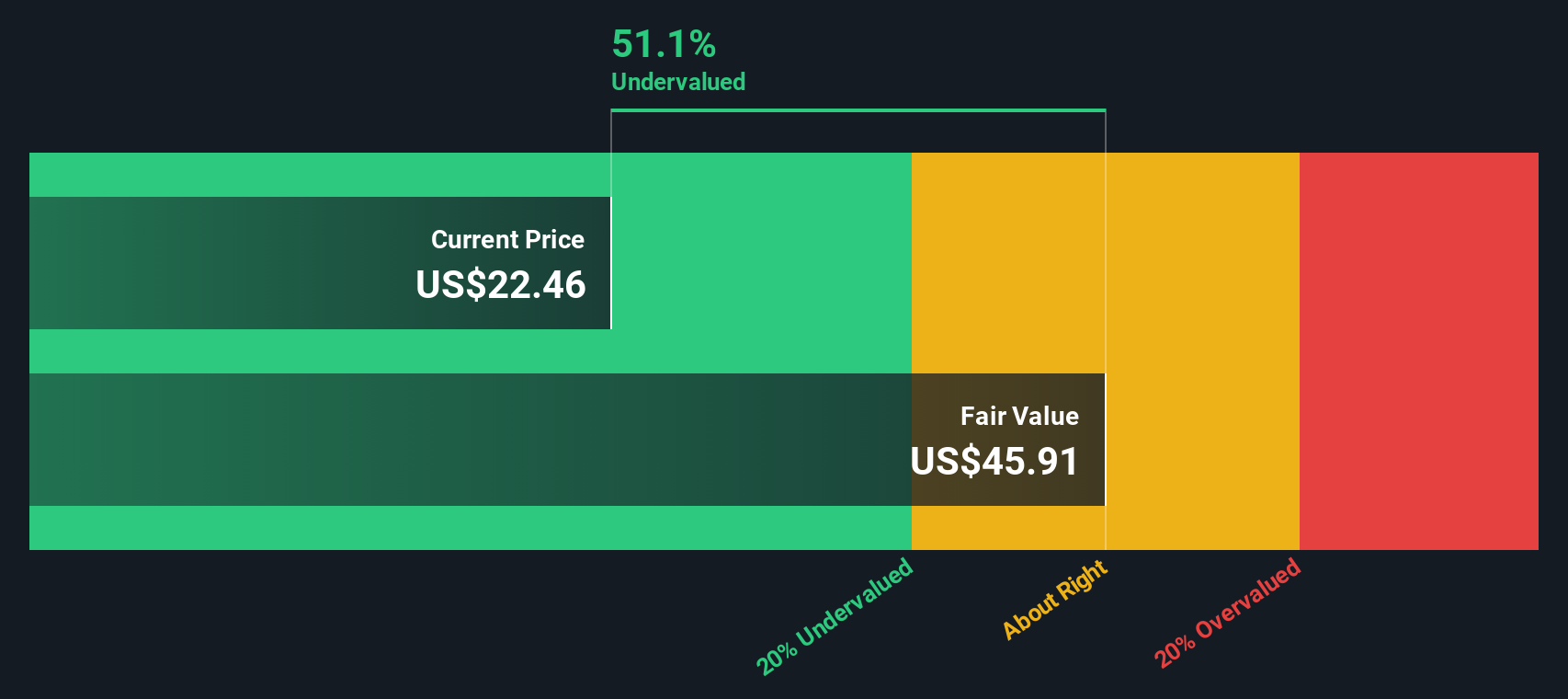

While the market’s price-to-earnings ratio suggests First Busey could be overvalued, our SWS DCF model comes to a very different conclusion. The model estimates a fair value of $45.91, which suggests shares currently trade at a sizable 51.1% discount. How can such a dramatic gap be explained, and what might it mean for investors?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out First Busey for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own First Busey Narrative

If you see the story differently or want to dig into the numbers yourself, you can create your own narrative and weigh the results in just a few minutes. Then Do it your way

A great starting point for your First Busey research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Take your next step with confidence and get ahead of the crowd by checking out new stock themes using the Simply Wall St Screener. Don’t leave smart opportunities on the table. Your next big winner could be just one click away.

- Spot growth potential early by reviewing these 3596 penny stocks with strong financials that have strong fundamentals and the attention of savvy investors.

- Accelerate your financial goals with these 18 dividend stocks with yields > 3% and add high-yielders to your income strategy with ease.

- Position yourself for tomorrow by evaluating these 24 AI penny stocks riding the wave of artificial intelligence breakthroughs shaping countless industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BUSE

First Busey

Operates as the bank holding company for Busey Bank that engages in the provision of retail and commercial banking products and services to individual, corporate, institutional, and governmental customers in the United States.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives