- United States

- /

- Banks

- /

- NasdaqGS:BSVN

Discovering US Undiscovered Gems This November 2025

Reviewed by Simply Wall St

As we navigate through a turbulent November, marked by significant fluctuations in major indices and the anticipation of potential interest rate cuts, the U.S. market presents both challenges and opportunities for investors. Amidst this backdrop, identifying promising small-cap stocks can be particularly rewarding as these companies often possess unique growth potentials that are not yet fully recognized by the broader market.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 1.99% | 2.14% | 1.63% | ★★★★★★ |

| Southern Michigan Bancorp | 113.59% | 8.48% | 3.73% | ★★★★★★ |

| Tri-County Financial Group | 102.20% | -2.69% | -15.63% | ★★★★★★ |

| Oakworth Capital | 40.91% | 15.96% | 11.47% | ★★★★★★ |

| Senstar Technologies | NA | -18.50% | 29.50% | ★★★★★★ |

| Sound Financial Bancorp | 34.24% | 1.40% | -12.55% | ★★★★★★ |

| Affinity Bancshares | 43.06% | 2.84% | 3.44% | ★★★★★★ |

| FineMark Holdings | 115.37% | 2.22% | -28.34% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 13.18% | 16.77% | ★★★★★☆ |

| FRMO | 0.10% | 35.28% | 40.61% | ★★★★★☆ |

Underneath we present a selection of stocks filtered out by our screen.

Bank7 (BSVN)

Simply Wall St Value Rating: ★★★★★★

Overview: Bank7 Corp. is a bank holding company for Bank7, offering banking and financial services to individual and corporate clients, with a market capitalization of approximately $384.75 million.

Operations: Bank7 generates revenue primarily from its banking segment, amounting to $95.71 million. The company's market capitalization stands at approximately $384.75 million.

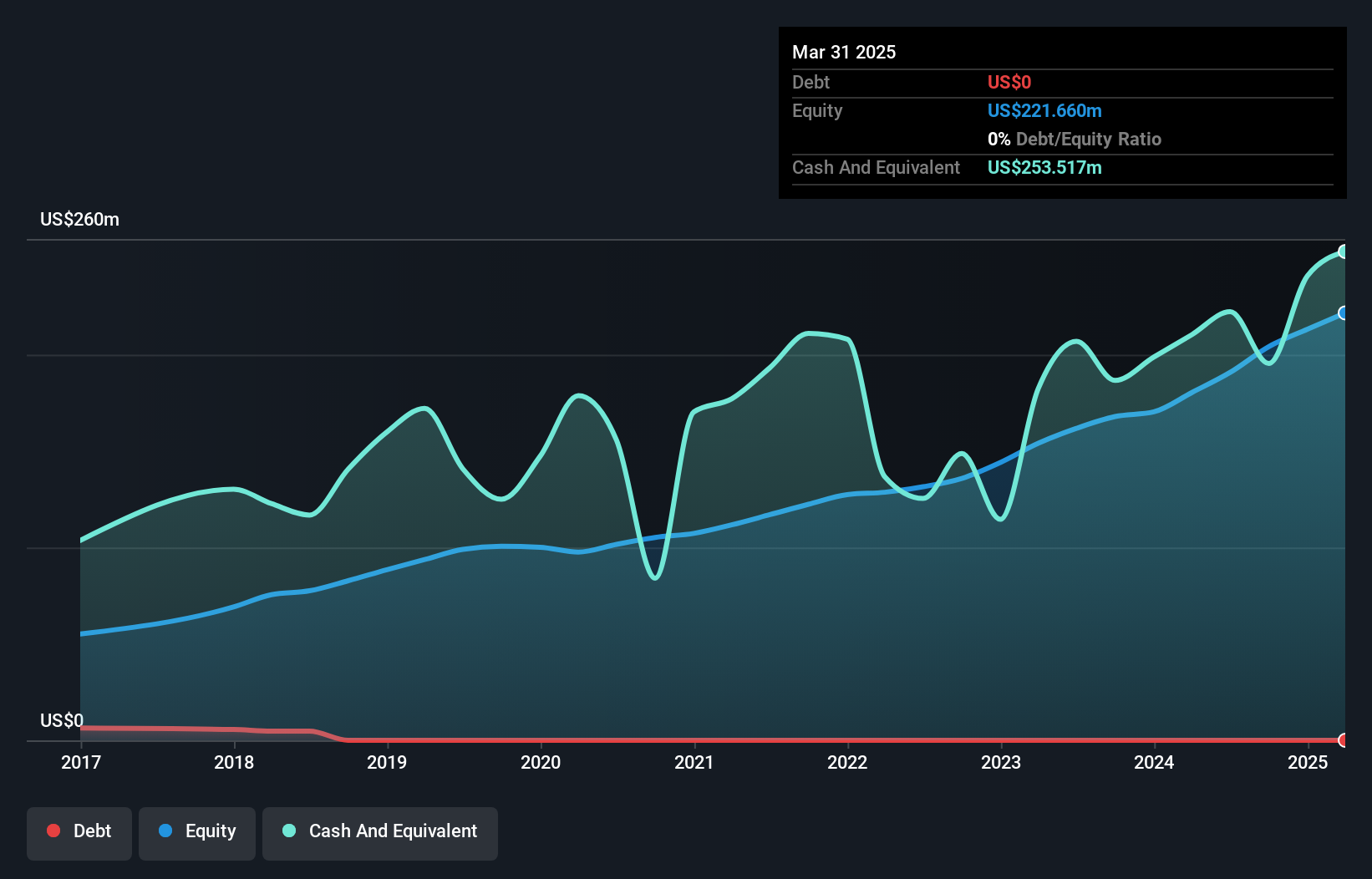

Bank7, a financially sound entity with total assets of US$1.9 billion and equity of US$241.7 million, operates primarily in Oklahoma and Texas. It boasts a net interest margin of 5.1% and maintains an appropriate bad loans level at 0.3% of total loans, showcasing solid credit quality. Despite no recent share repurchases, the company announced a program to buy back up to 750,000 shares over two years for potential corporate uses. Bank7's earnings growth outpaced the industry at 21.7%, while its liabilities are largely low-risk due to customer deposits making up most funding sources.

Northrim BanCorp (NRIM)

Simply Wall St Value Rating: ★★★★★★

Overview: Northrim BanCorp, Inc. is the bank holding company for Northrim Bank, offering commercial banking products and services to businesses and professional individuals, with a market cap of $507.64 million.

Operations: Northrim BanCorp generates revenue primarily from Community Banking, contributing $141.80 million, and Home Mortgage Lending at $36.89 million, with Specialty Finance adding $21.93 million. The company's net profit margin trends provide insight into its financial efficiency over time.

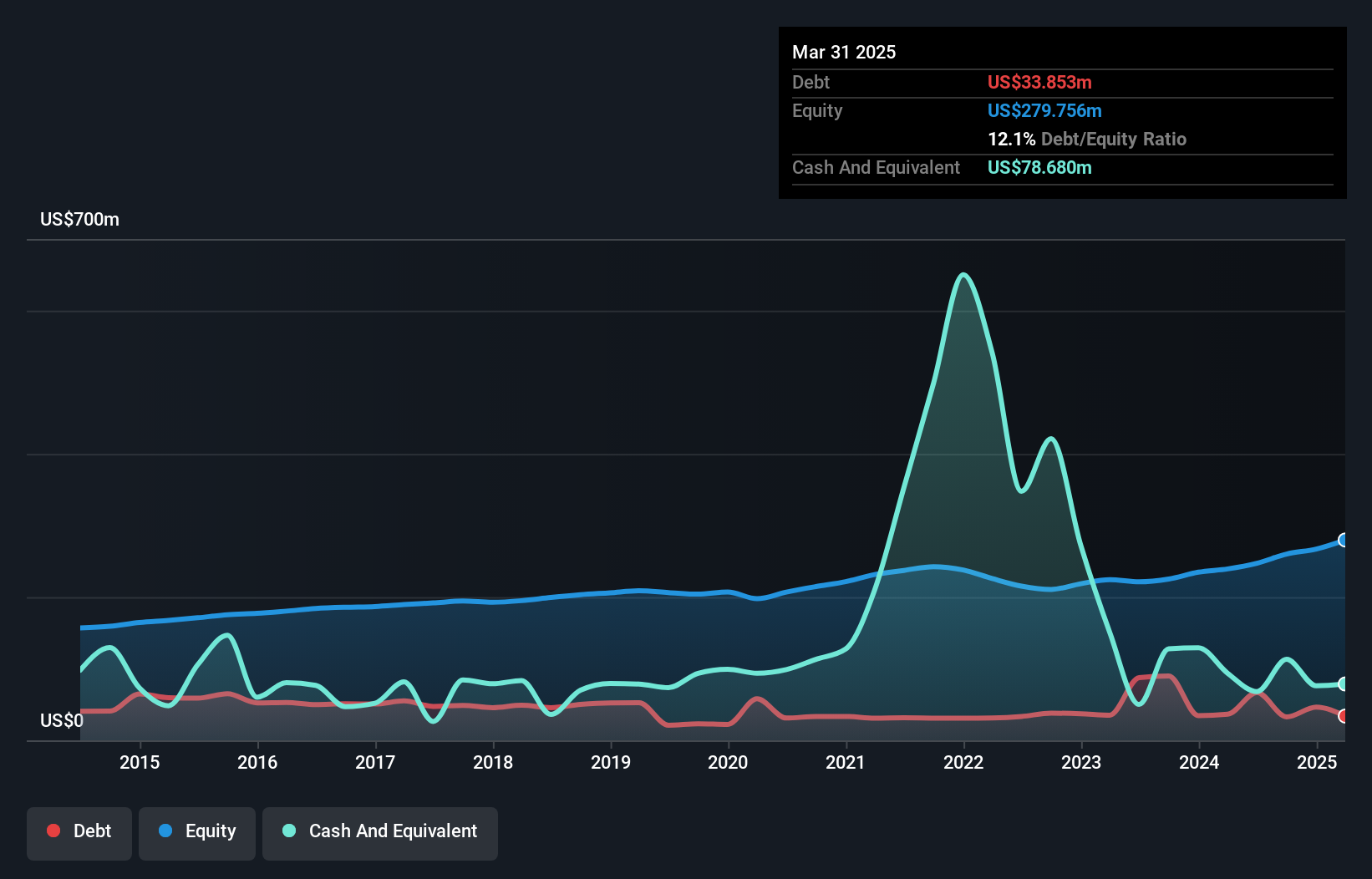

Northrim BanCorp, a financial institution with $3.3 billion in assets and $315.7 million in equity, offers an intriguing prospect given its recent performance and strategic moves. With total deposits of $2.9 billion and loans totaling $2.2 billion, it maintains a net interest margin of 4.3%. The company has an allowance for bad loans at 0.6%, indicating strong risk management practices alongside high-quality earnings growth at 93% over the past year, surpassing industry averages significantly. Notably, Northrim's stock is trading at nearly 27% below estimated fair value, suggesting potential upside for investors seeking undervalued opportunities in the banking sector.

Yalla Group (YALA)

Simply Wall St Value Rating: ★★★★★★

Overview: Yalla Group Limited, along with its subsidiaries, runs a social networking and gaming platform in the Middle East and North Africa region, with a market cap of approximately $1.10 billion.

Operations: Yalla Group generates revenue primarily from its social networking and entertainment platform, amounting to $348.90 million. The company's market cap is approximately $1.10 billion, indicating a significant presence in its operating region.

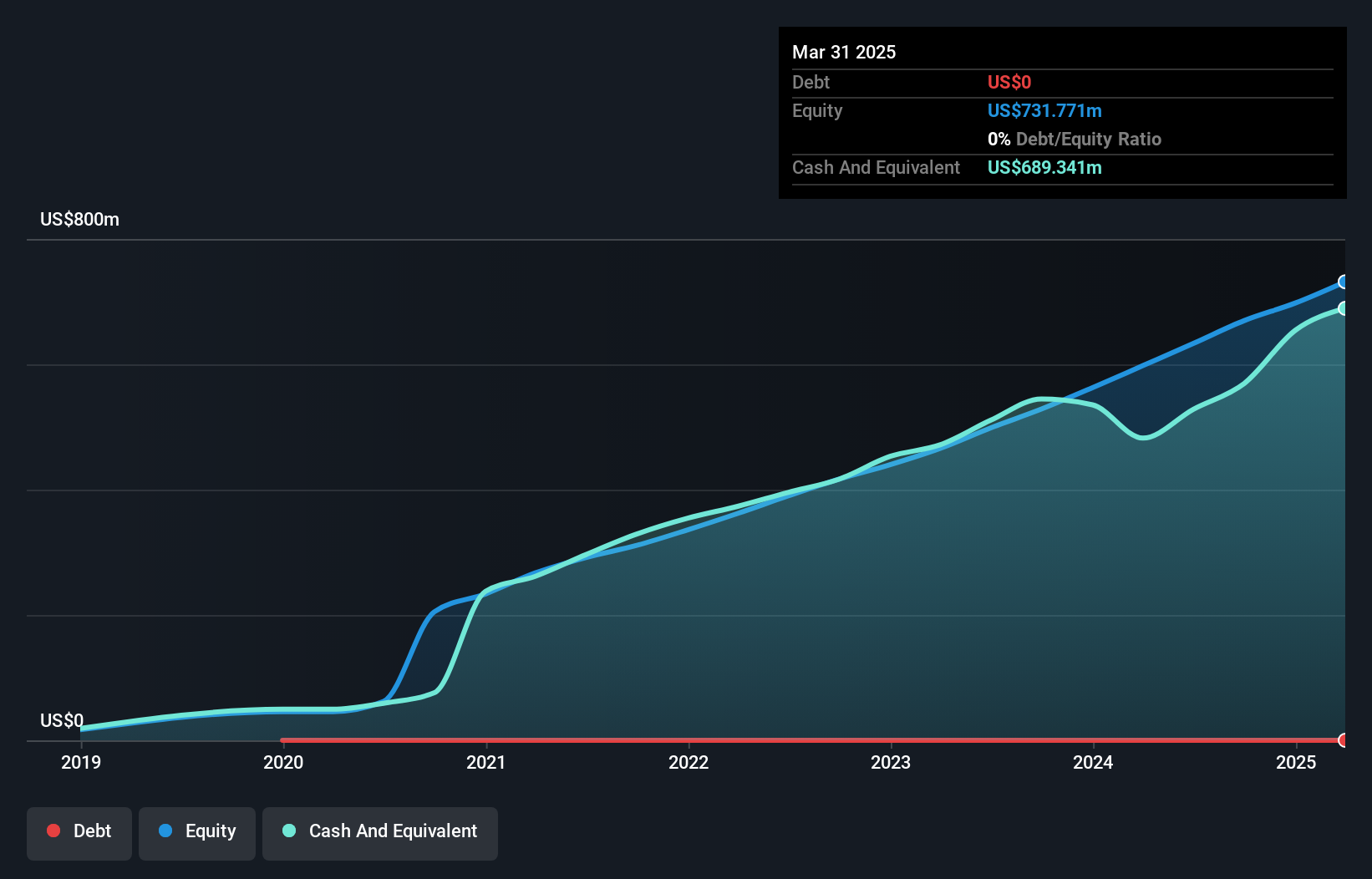

Yalla Group, a player in the MENA region's social networking and gaming scene, is capitalizing on a youthful demographic to fuel digital growth. The company has seen its earnings grow 33.8% annually over five years, although recent growth of 9.9% lagged behind industry peers at 23.3%. Trading at 70.4% below fair value estimates suggests attractive valuation prospects despite potential geopolitical risks and competition in the region. Recent earnings reports show net income rising to US$41 million for Q3 2025 from US$39.85 million last year, with basic EPS increasing to US$0.27 from US$0.25 year-on-year amidst strategic share repurchases totaling $101 million since May 2021.

Seize The Opportunity

- Click through to start exploring the rest of the 291 US Undiscovered Gems With Strong Fundamentals now.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank7 might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BSVN

Bank7

Operates as a bank holding company for Bank7 that provides banking and financial services to individual and corporate customers.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives