- United States

- /

- Banks

- /

- NasdaqGS:BSVN

Discovering Undiscovered Gems with Promising Potential This October 2024

Reviewed by Simply Wall St

The United States market has shown a robust performance, rising 1.5% over the last week and climbing 33% in the past year, with earnings projected to grow by 16% annually. In such a thriving environment, identifying stocks with strong fundamentals and unique growth opportunities can be crucial for uncovering hidden gems that may offer promising potential.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Teekay | NA | -6.48% | 55.79% | ★★★★★★ |

| Mission Bancorp | 25.37% | 16.23% | 20.16% | ★★★★★★ |

| Omega Flex | NA | 1.31% | 3.88% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.12% | 10.04% | ★★★★★★ |

| Associated Capital Group | NA | -7.78% | 8.48% | ★★★★★★ |

| Banco Latinoamericano de Comercio Exterior S. A | 311.64% | 21.07% | 24.77% | ★★★★★☆ |

| Valhi | 38.71% | 2.57% | -19.76% | ★★★★★☆ |

| Chain Bridge Bancorp | 10.64% | 41.34% | 18.53% | ★★★★☆☆ |

| FRMO | 0.17% | 12.99% | 23.62% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

MVB Financial (NasdaqCM:MVBF)

Simply Wall St Value Rating: ★★★★★☆

Overview: MVB Financial Corp. is a bank holding company for MVB Bank, Inc., offering financial services to individuals and corporate clients, with a market capitalization of $250.41 million.

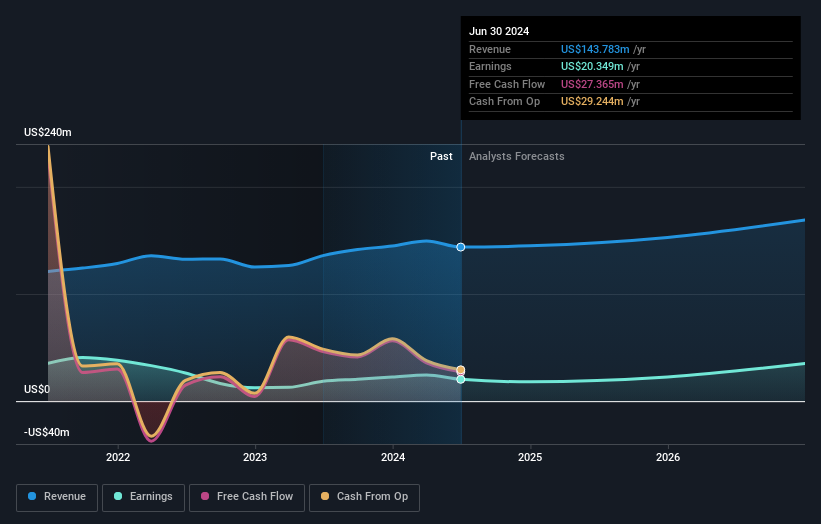

Operations: MVB Financial generates revenue primarily from its Core Banking segment, which contributed $144.88 million. The company also derives income from its Financial Holding Company segment amounting to $6.10 million.

With total assets of US$3.3 billion and equity of US$296.7 million, MVB Financial boasts a solid foundation with deposits at US$2.9 billion and loans at US$2.2 billion, though its allowance for bad loans is low at 1%. Despite this, the company shows resilience with earnings growth of 9.8% over the past year, outpacing the industry average by a significant margin while trading below estimated fair value by 53%.

- Dive into the specifics of MVB Financial here with our thorough health report.

Review our historical performance report to gain insights into MVB Financial's's past performance.

Bank7 (NasdaqGS:BSVN)

Simply Wall St Value Rating: ★★★★★★

Overview: Bank7 Corp. is a bank holding company for Bank7, offering banking and financial services to individual and corporate customers, with a market cap of $373.74 million.

Operations: Bank7 Corp. generates revenue primarily through its banking segment, which reported $85.88 million in revenue.

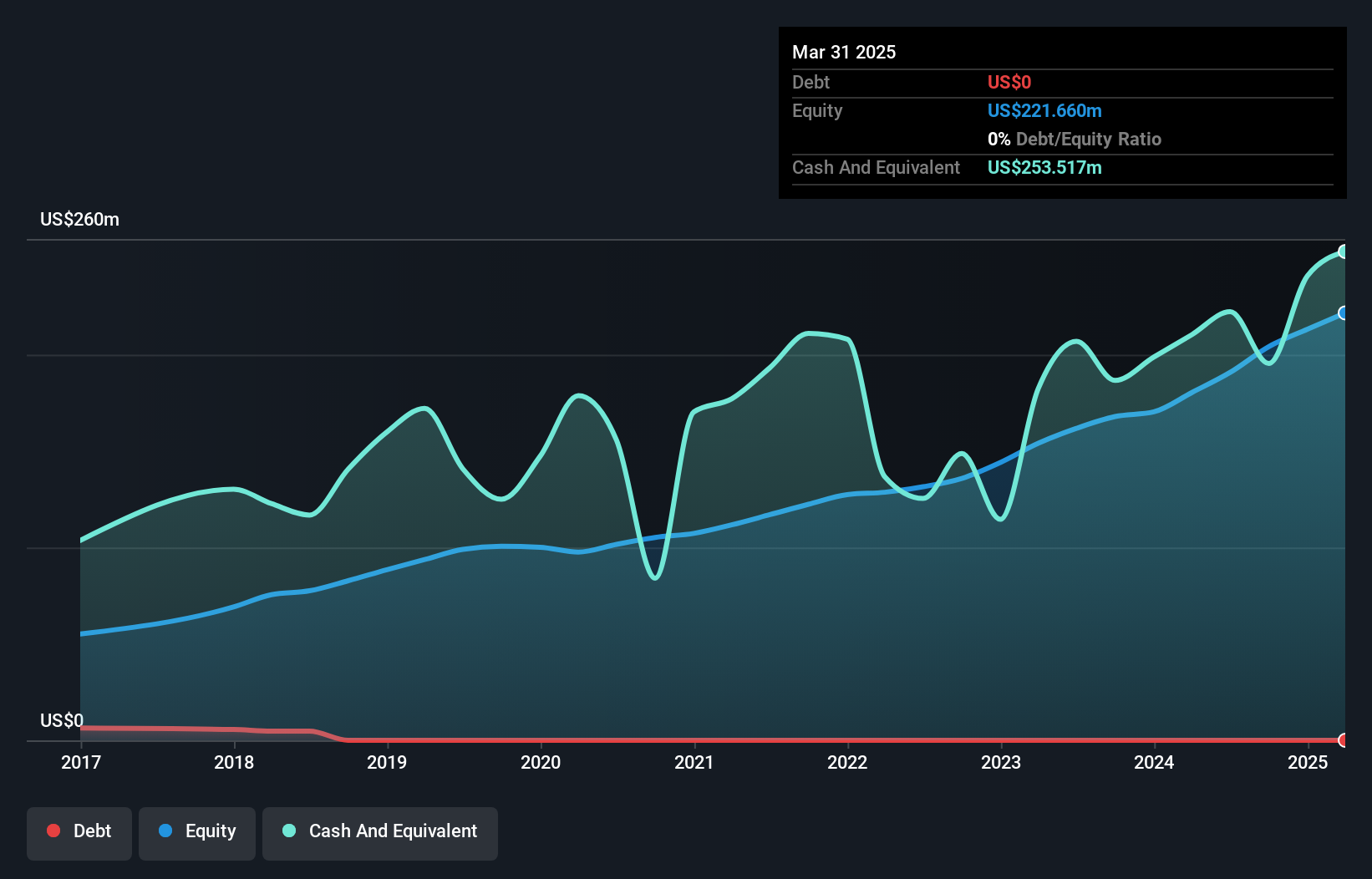

Bank7, with assets totaling US$1.7 billion and equity of US$204.2 million, operates with a strong financial footing. The bank's bad loans are at a low 0.5% of total loans, supported by an ample allowance for bad loans at 264%. Total deposits stand at US$1.5 billion against total loans of US$1.4 billion, indicating solid liquidity management. Despite recent shareholder dilution, earnings grew by 0.2%, outpacing the industry average decline of -15.6%. Bank7 also increased its quarterly dividend to $0.24 per share, marking the fifth consecutive annual increase and reflecting confidence in its ongoing profitability and growth prospects.

- Take a closer look at Bank7's potential here in our health report.

Gain insights into Bank7's historical performance by reviewing our past performance report.

IDT (NYSE:IDT)

Simply Wall St Value Rating: ★★★★★★

Overview: IDT Corporation offers communications and payment services across the United States, the United Kingdom, and internationally, with a market capitalization of approximately $1.21 billion.

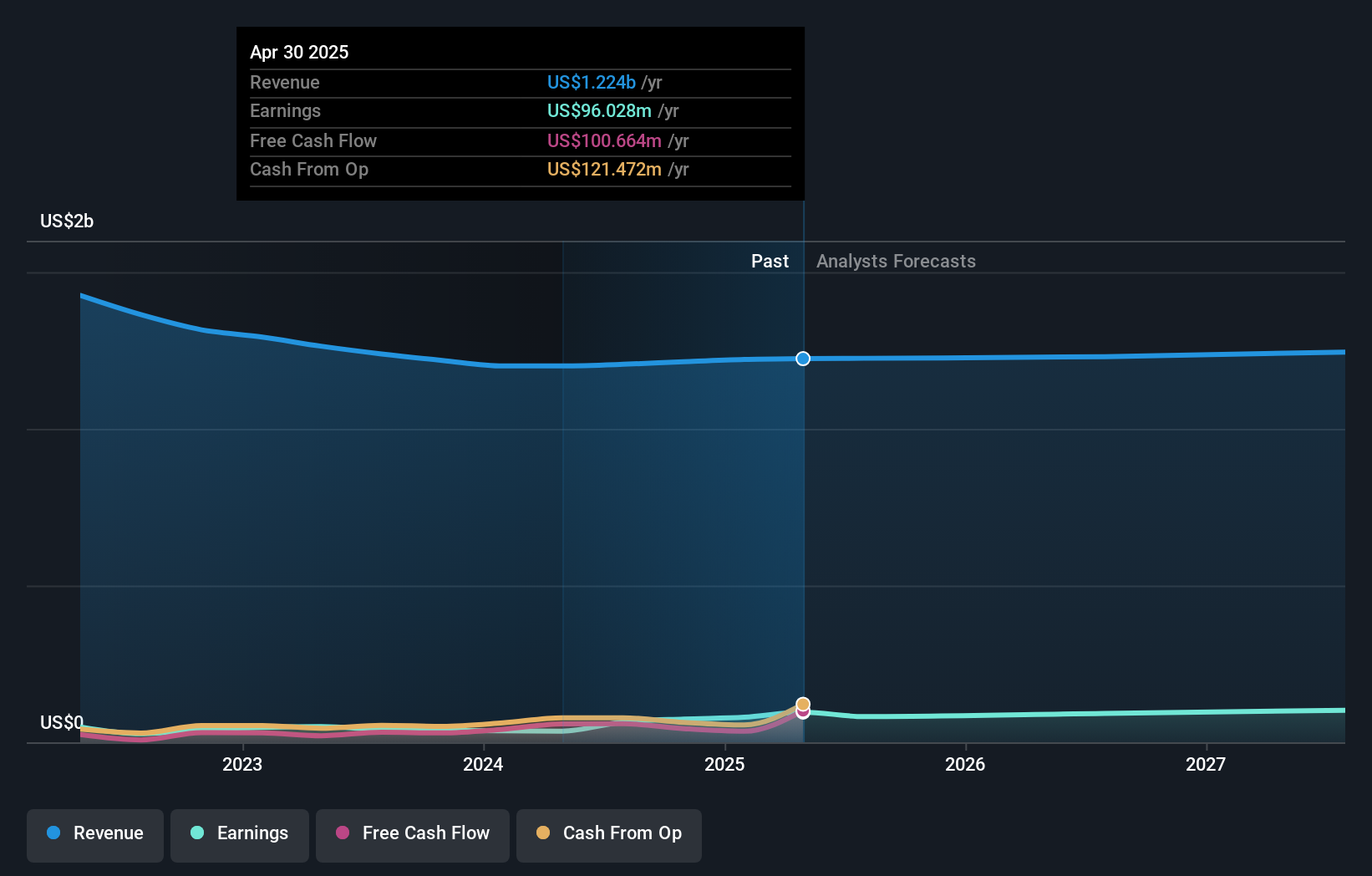

Operations: IDT Corporation's revenue is primarily driven by its Traditional Communications segment, generating $899.60 million, followed by Fintech at $120.70 million. The Net2phone and National Retail Solutions (NRS) segments contribute $82.30 million and $103.10 million, respectively, to the overall revenue stream.

IDT stands out with a significant earnings surge of 59.2% over the past year, outperforming the Telecom industry's -18.2%. Despite sales dipping to US$1.21 billion from US$1.24 billion, net income rose to US$64.45 million from US$40.49 million, highlighting robust profitability and high-quality earnings. Trading at 72.7% below estimated fair value indicates potential undervaluation, although recent insider selling raises some cautionary flags amidst a completed buyback of 3,596,214 shares for $48.52 million since 2016.

- Unlock comprehensive insights into our analysis of IDT stock in this health report.

Assess IDT's past performance with our detailed historical performance reports.

Next Steps

- Click through to start exploring the rest of the 216 US Undiscovered Gems With Strong Fundamentals now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank7 might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BSVN

Bank7

Operates as a bank holding company for Bank7 that provides banking and financial services to individual and corporate customers.

Flawless balance sheet and good value.