- United States

- /

- Banks

- /

- NasdaqCM:BSBK

Is Now The Time To Put Bogota Financial (NASDAQ:BSBK) On Your Watchlist?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

So if you're like me, you might be more interested in profitable, growing companies, like Bogota Financial (NASDAQ:BSBK). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

View our latest analysis for Bogota Financial

How Fast Is Bogota Financial Growing Its Earnings Per Share?

Even with very modest growth rates, a company will usually do well if it improves earnings per share (EPS) year after year. So EPS growth can certainly encourage an investor to take note of a stock. You can imagine, then, that it almost knocked my socks off when I realized that Bogota Financial grew its EPS from US$0.058 to US$0.50, in one short year. Even though that growth rate is unlikely to be repeated, that looks like a breakout improvement. Could this be a sign that the business has reached an inflection point?

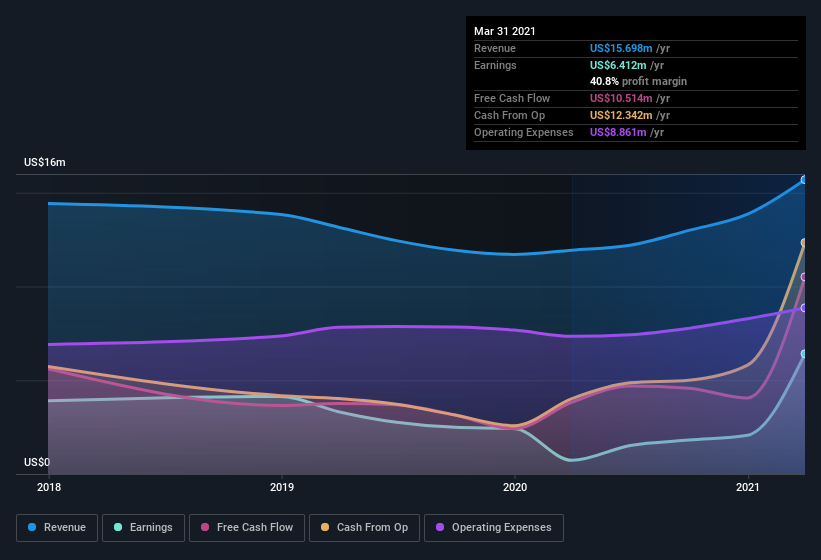

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. I note that Bogota Financial's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. Bogota Financial maintained stable EBIT margins over the last year, all while growing revenue 32% to US$16m. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Since Bogota Financial is no giant, with a market capitalization of US$141m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Bogota Financial Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Not only did Bogota Financial insiders refrain from selling stock during the year, but they also spent US$98k buying it. That's nice to see, because it suggests insiders are optimistic. It is also worth noting that it was Independent Director John Masterson who made the biggest single purchase, worth US$43k, paying US$7.22 per share.

Should You Add Bogota Financial To Your Watchlist?

Bogota Financial's earnings have taken off like any random crypto-currency did, back in 2017. If you're like me, you'll find it hard to ignore that sort of explosive EPS growth. And indeed, it could be a sign that the business is at an inflection point. For me, this situation certainly piques my interest. We don't want to rain on the parade too much, but we did also find 3 warning signs for Bogota Financial (1 is a bit concerning!) that you need to be mindful of.

As a growth investor I do like to see insider buying. But Bogota Financial isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade Bogota Financial, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Bogota Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:BSBK

Bogota Financial

Operates as the bank holding company for Bogota Savings Bank that provides banking products and services in the United States.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives