- United States

- /

- Banks

- /

- OTCPK:BKSC

Here's Why I Think Bank of South Carolina (NASDAQ:BKSC) Is An Interesting Stock

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

So if you're like me, you might be more interested in profitable, growing companies, like Bank of South Carolina (NASDAQ:BKSC). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

View our latest analysis for Bank of South Carolina

How Quickly Is Bank of South Carolina Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. That makes EPS growth an attractive quality for any company. Bank of South Carolina managed to grow EPS by 12% per year, over three years. That's a good rate of growth, if it can be sustained.

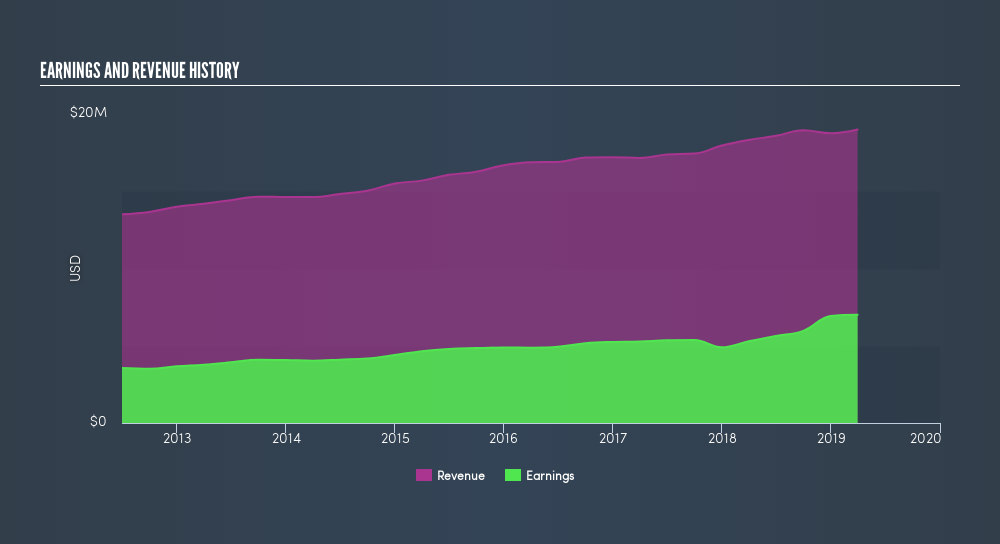

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. I note that Bank of South Carolina's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. Bank of South Carolina maintained stable EBIT margins over the last year, all while growing revenue 3.7% to US$19m. That's a real positive.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

Bank of South Carolina isn't a huge company, given its market capitalization of US$108m. That makes it extra important to check on its balance sheet strength.

Are Bank of South Carolina Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We do note that, in the last year, insiders sold -US$38.5k worth of shares. But that's far less than the US$1.2m insiders spend purchasing stock. I find this encouraging because it suggests they are optimistic about the Bank of South Carolina's future. Zooming in, we can see that the biggest insider purchase was by Executive VP Eugene Walpole for US$189k worth of shares, at about US$18.92 per share.

The good news, alongside the insider buying, for Bank of South Carolina bulls is that insiders (collectively) have a meaningful investment in the stock. To be specific, they have US$21m worth of shares. That's a lot of money, and no small incentive to work hard. That amounts to 20% of the company, demonstrating a degree of high-level alignment with shareholders.

While insiders are apparently happy to hold and accumulate shares, that is just part of the pretty picture. That's because on our analysis the CEO, Fleetwood Hassell, is paid less than the median for similar sized companies. I discovered that the median total compensation for the CEOs of companies like Bank of South Carolina with market caps under US$200m is about US$430k.

The Bank of South Carolina CEO received US$314k in compensation for the year ending December 2018. That comes in below the average for similar sized companies, and seems pretty reasonable to me. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Should You Add Bank of South Carolina To Your Watchlist?

One positive for Bank of South Carolina is that it is growing EPS. That's nice to see. Better yet, insiders are significant shareholders, and have been buying more shares. To me, that all makes it well worth a spot on your watchlist, as well as continuing research. If you think Bank of South Carolina might suit your style as an investor, you could go straight to its annual report, or you could first check our discounted cash flow (DCF) valuation for the company.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Bank of South Carolina, you'll probably love this freelist of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdictionWe aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About OTCPK:BKSC

Bank of South Carolina

Operates as a bank holding company for The Bank of South Carolina that provides financial products and services primarily in Charleston, Berkeley, and Dorchester counties of South Carolina.

Established dividend payer with proven track record.

Market Insights

Community Narratives